As more American companies set up shop in Canada to take advantage of talent, one international VC firm is trying to show that it’s getting excited about Canada.

VC firm White Star Capital, which focuses on investments in the east coast of North America and Europe, has released a deep dive on the Canadian VC ecosystem to demonstrate why it’s recently become bullish on Canada. Based on past reports done by NACO, CB Insights, InfoBase, and TracXN, the report is meant to provide an all-encompassing look at Canada’s potential with data already collected.

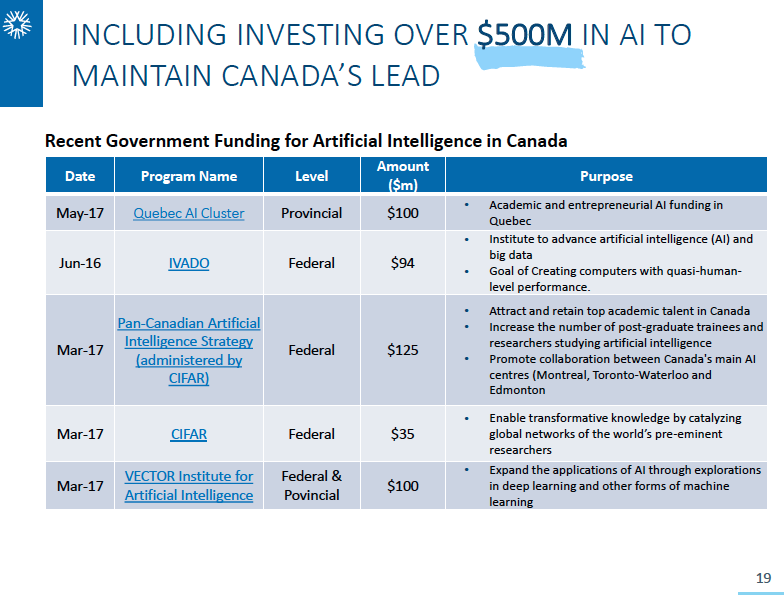

The report outlines specific activity happening in Canda that is setting the foundation for a strong tech ecosystem, including recent exits, active investors, and corporates setting up R&D centres in Canada. White Star called out the public sector’s support of the tech industry through its Innovation Agenda — in particular, its support of the burgeoning AI sector, and initiatives like SR&ED and the Canadian Startup Visa.

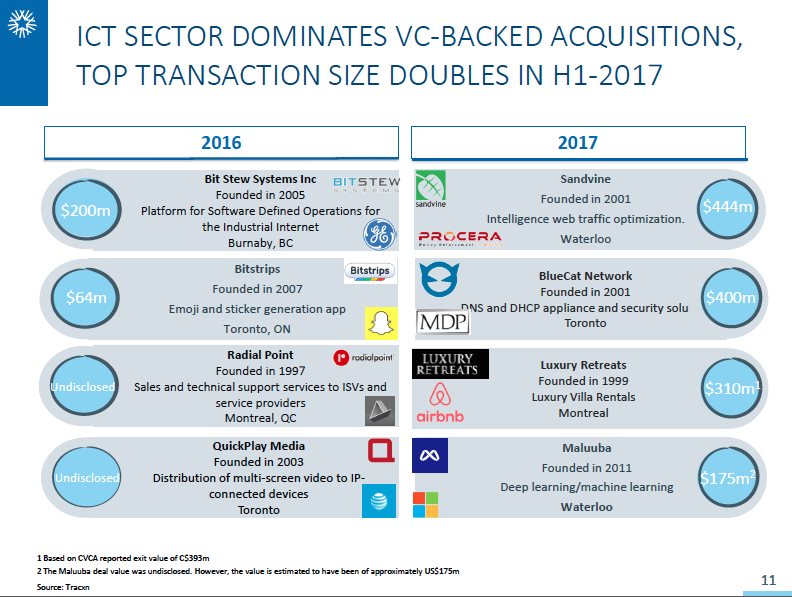

ICT has dominated VC-backed investments in Canada and top transactions have doubled; the report compared Bit Stew’s 2016 $200 million exit — the top exit for that year — against Sandvine’s $444 million exit this year.

The report also named high-potential companies that are leading in emerging fields like ecommerce (Shopify), quantum computing (D-Wave), marketing tech (Hootsuite), and robotics (Thalmic Labs). The report also noted that IPO sizes are increasing, with Shopify topping the list in 2015.

“I say in the report that ‘Canada has it all and nothing can’t be built here,’ which has been true for a while. But the reason why now we see more potential here than ever is due to the strong momentum in exits, large funding rounds involvement from tech giants, and excitement around artificial intelligence,” said Sanjay Zimmerman, White Star’s Montreal associate. A Montreal native, Zimmerman left his hometown eight years ago, spending at least two years at Rothschild in London before returning four months ago to join White Star.

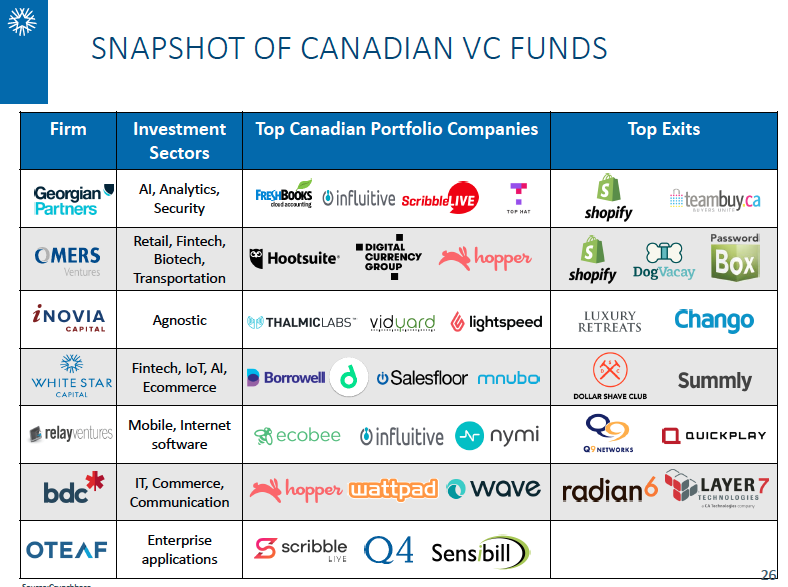

The report also took an opportunity to call out challenges to Canada’s scale, including late-stage funding, a shallow pool of senior talent, and a lack of $1 billion tech companies. However, it overall provides an optimistic view of the Canadian landscape, calling out its strong talent and the country’s most active investors.

“Today, Canada is well positioned in terms of talent, political stability, access to capital and sheer entrepreneurial spirit to have several major successful startups and we want to be there to back them.”

Download and access the full report here.