The Canadian Government Scientific Research and Experimental Design (SR&ED) program was created to support and reward investments by businesses in innovation. Yet many businesses aren’t utilizing the program to its full potential, and therefore they miss out on all that SR&ED can offer.

For CFOs, CEOs, and founders, every dollar matters.

The SR&ED program has been providing billions of dollars a year in tax credits to Canadian businesses since 2016, and over 20,000 businesses a year file claims. Usually, technology, hardware, telecommunications companies, and firms in manufacturing, energy, or biomedical can readily identify investments that are SR&ED eligible. That’s because these firms are investing in experimental work where they regularly try to create something new or improve something in a substantial way. But any business may be eligible if they invest in the right areas.

Does your business qualify?

For work to be considered innovative research and development, there must be elements of creating something new, risk of potential failure, and challenges to overcome. A summary from the Canadian Revenue Association (CRA) SR&ED Guidelines states that qualifying work must:

Advance Technology: the work carried out in the experimental development activity must generate information that advances your understanding of underlying technologies and furthers technical knowledge.

Include Technological Uncertainty: these are the technological problems or unknowns that cannot be overcome by applying the techniques, procedures, and data that are generally accessible to competent professionals in the field.

Have Technological Content: the project must have been conducted in an iterative, systematic process with documentation.

The “Why” Requirement: work must be conducted for the advancement of scientific knowledge or for the purpose of achieving technological advancement. The key to both is the generation or discovery of knowledge that advances the understanding of science or technology. Note that success or failure in meeting your objectives is not relevant when assessing whether your work meets the “why” requirement.

The “How” Requirement: work must be a systematic investigation or search that is carried out in a field of science or technology by means of experiment or analysis (contained at the beginning of the definition).

RELATED: How to better leverage SR&ED refunds to accelerate startup growth

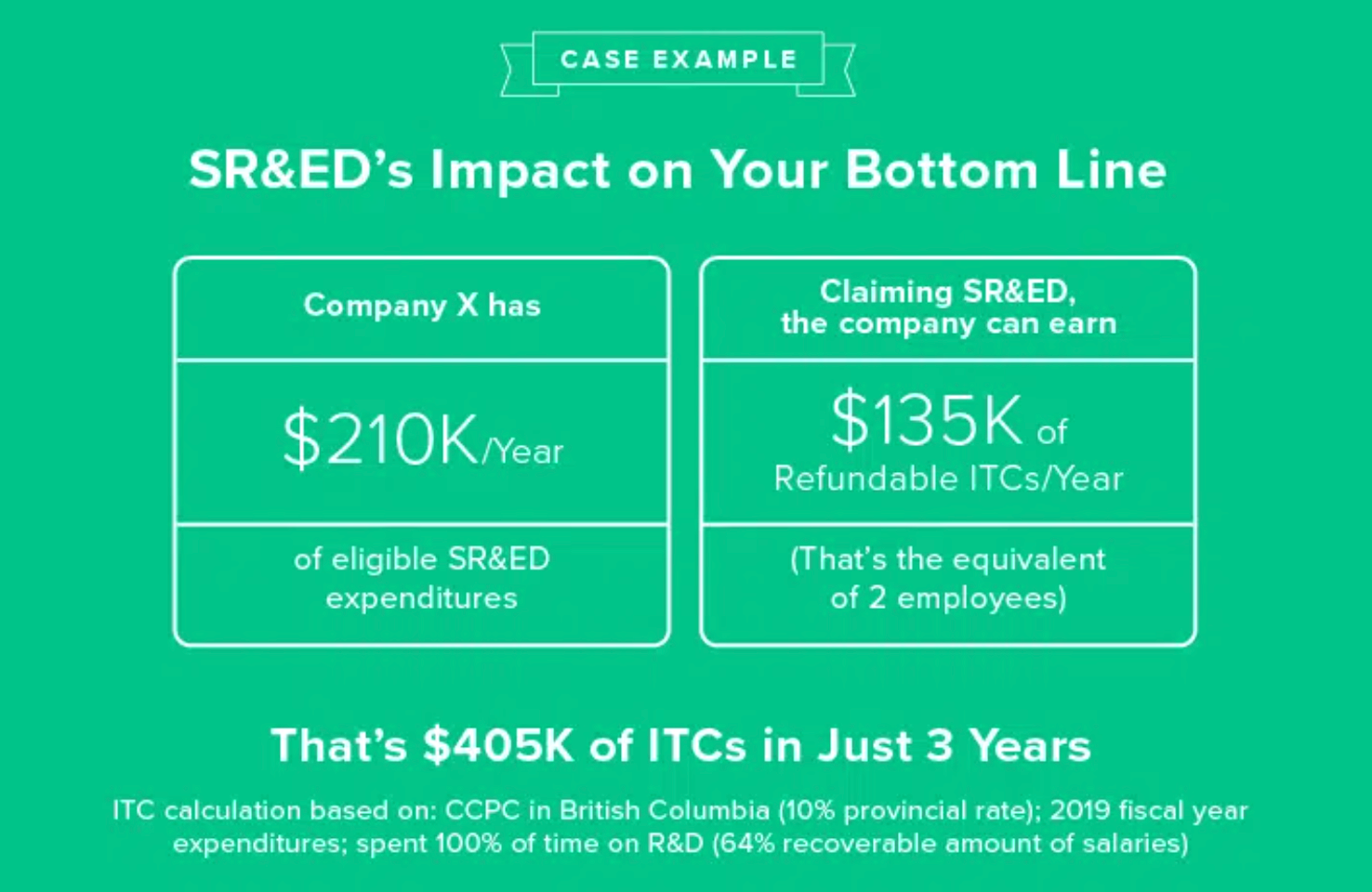

For CFOs, CEOs, and founders, every dollar matters. In fact, getting money back from SR&ED can be highly impactful to growing revenue faster, creating better differentiation from competitors, or providing more financial cushion for bad times or risks that don’t pay off.

The top six SR&ED-related mistakes businesses make

- Self-identifying SR&ED projects incorrectly

- Not claiming because it may be too difficult

- Not claiming because ‘my projects don’t qualify’

- Not thinking about SR&ED strategically and planning throughout the year

- Treating SR&ED as an accounting or tax compliance requirement

- Not utilizing SR&ED as a form of non-dilutive funding

Some businesses want to ‘DIY’ SR&ED. Although possible, it can be like trying to do your own legal work. If you do not have a background in finance and taxes, and if you do not have access to payroll, accounting, and project tracking information, you may want to rethink your SR&ED approach. Mistakes can leave money on the table or trigger a government audit.

Additionally, most accountants that offer SR&ED services do not have the technical knowledge in-house to properly identify eligible work. To overcome this, those accountants ask their clients to identify what work they think is SR&ED-eligible, and they ask clients to write a “draft” technical report that they will “edit with their insights.”

With either scenario, the client ends up having to identify and frame what technical work is eligible, which in almost all cases leads to a claim that is not maximized, poorly defendable, and very likely to get rejected by the CRA in the event of a review.

Some business leaders have tried claiming SR&ED and have said, ‘never again’ because the process can be arduous. But avoiding claiming could mean leaving money—potentially even hundreds of thousands of dollars—unclaimed.

The feeling of ‘never again’ often stems from working with a SR&ED provider that talks a big game, but simply does not know what they are doing. Due to this, they push the work back onto the client and make excuses as to why this is a normal process. If you are working with a quality SR&ED provider, they should take on the bulk of the work.

Ultimately, if you feel SR&ED is too difficult to claim, then you are using the wrong approach to claim. SR&ED claims can be a smooth process. If your experience is not smooth and simple, then look for another SR&ED provider that knows what they are doing.

Many businesses disqualify themselves because they don’t think they are doing the right kind of work. Remember the SR&ED program’s research and development definition is to advance the state of your technology through a systematic approach while overcoming technical challenges.

The SR&ED program considers information readily available in the public domain (search engines, white papers, software patterns, etc.) as well as the context of your company. If you can’t find a solution to your technical problem within the public domain, then this is where your work may qualify for SR&ED.

In fact, certain technological challenges arise from constraints faced by your specific situation due to legacy support issues or legacy equipment used. Overcoming these types of technical challenges in a systematic way could make the work eligible for SR&ED tax credits.

SR&ED should not be an end-of-year project. The opportunity to maximize claims is directly correlated to your ability to accurately identify projects that are eligible and related expenses.

Use the right tracking tools, such as GitHub or Jira for software innovation, to maintain an ongoing record of eligible projects throughout the year. This eliminates the all-too-common need to gather everyone in a meeting and go through projects, costs, and outcomes project-by-project from the start of the year.

Instead, look at SR&ED for what it really is, an effective way to fund more innovation, growth, and differentiation. This involves your development and manufacturing groups, your research department, your testing groups, management, in-country contractors, as well as finance and tax.

SR&ED is submitted via your tax return. But that does not make it a tax exercise to prepare the claim. In fact, it is the exact opposite. SR&ED claim preparation is an engineering and technical endeavor that is submitted via tax means, not the other way around.

If your company’s financial leaders own the SR&ED process, reconsider that ownership. Your company’s technical leaders should own the preparation of the SR&ED claim, and your financial leaders should own the submission of the claim. Without this differentiation, SR&ED will continually be looked at as a tax requirement and not a strategic tool to help grow and maximize product development.

Every business operator, investor, or board member thinks about a business’s financial strategies regularly. Having capital on hand to meet business needs is vital, and any form of funding or cash acceleration is always considered. SR&ED is an optimal way to recoup investment dollars in R&D which can then be used to accelerate additional investments, or, if your SR&ED tax credit is a tax refund, improve your cash position.

“Before our public listing in 2020, our work leveraging SR&ED laid the foundation for Plurilock to successfully file three patents, increasing our competitive moat, which would have been very difficult without [SR&ED] funds,” said Ian L. Paterson, Plurilock CEO. “SR&ED helped us to minimize dilution and was a key component of our financing strategy.”

Planning for SR&ED with your teams throughout the year heightens a positive culture of innovation and keeps teams tracking and reporting on the right items all year.

Photo courtesy of Unsplash.