The Waterloo Region displayed some concerning trends in venture investment last year, but a new report from briefed.in indicates healthier signs in the first quarter of 2022.

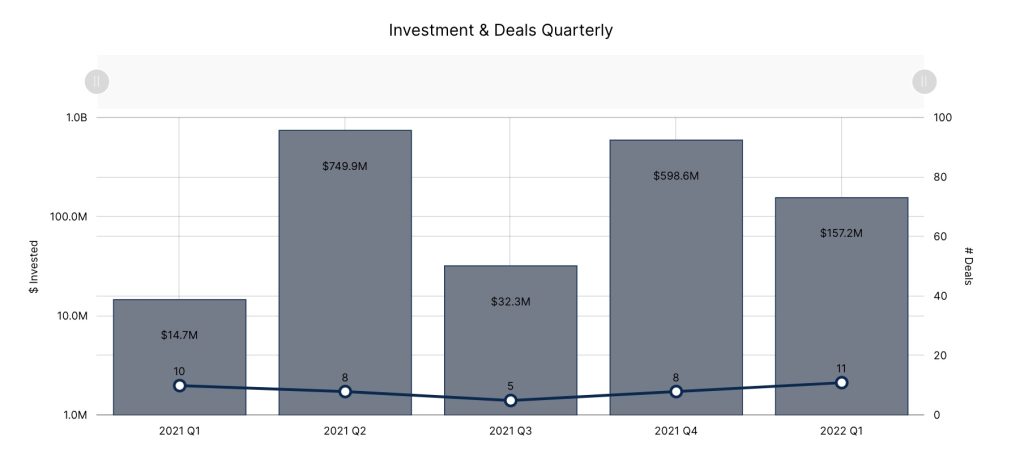

In Q1, the Waterloo Region’s tech startups collectively closed 11 investments totalling $157.2 million. The region saw a 73 percent decrease in total investment quarter-over-quarter, but a 968 percent increase compared to the record low investment raised in Q1 2021.

In Q1 2022, the Waterloo Region saw 11 investments totalling $157.2 million.

In 2021, Waterloo Region tech investment reached a new record of $1.4 billion, but investment levels fluctuated wildly between quarters, reaching over $500 million in the second and fourth quarters and plummeting below $40 million in the first and third quarters of the year.

This see-saw trend can also be observed in Canadian tech ecosystems of similar size to the Waterloo Region. Venture funding in Calgary, for example, has varied wildly from quarter to quarter in the last two years, which local stakeholders say is to be expected for a less mature, smaller sector.

According to briefed.in data, deal volume in the Waterloo Region has trended downwards since 2019, most recently falling from 44 deals in 2020 to just 30 in 2021. This total is nearly half of the 57 deals reported just two years ago.

Yet things looked up in the first quarter of 2022. Deal volume in the Waterloo Region increased by 57 percent compared to last quarter and 10 percent year-over-year. In fact, Q1 2022 represents the most active quarter for the Waterloo Region in the last year. So far, Waterloo Region is 37 percent of the way to match the total deals in 2021 and 11 percent of the way to match in total investment.

According to Evan Clark, executive director of the Waterloo-based Golden Triangle Angel Network (GTAN), the Waterloo Region’s funding activity is “heading in the right direction.”

“While up from last year, with a more historical lens, deal totals are short of our all-time highs,” Clark added.

Early-stage funding on the mend?

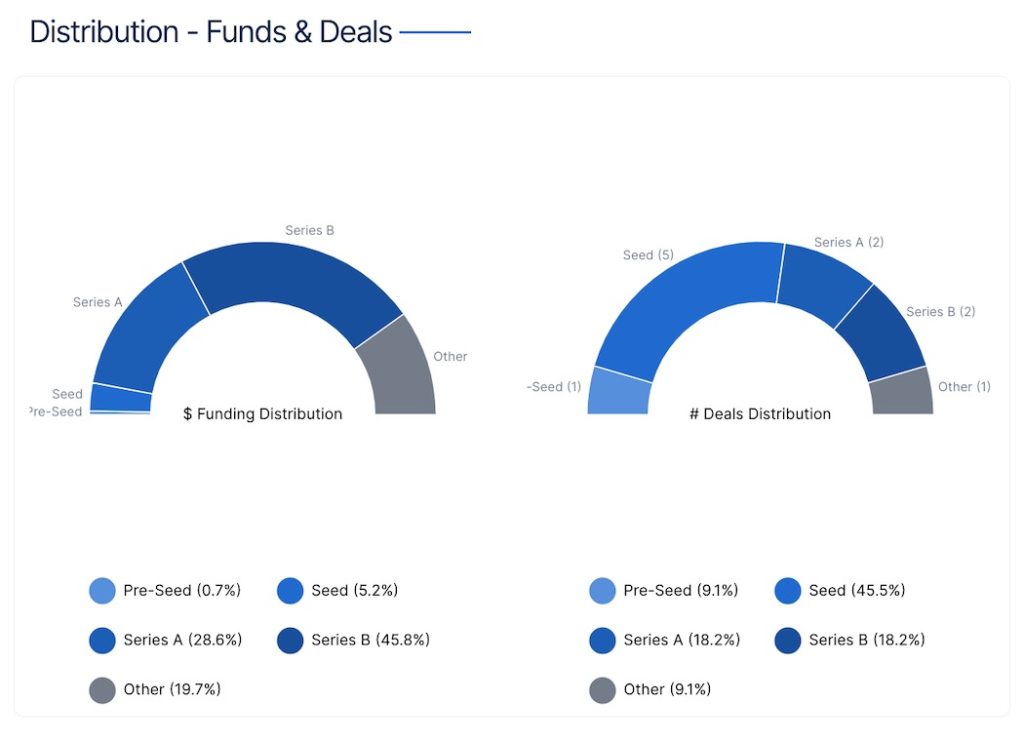

Over 2021, briefed.in tracked a surprising lack of early-stage funding in the Waterloo Region, particularly in the seed stages. Only eight seed-stage deals closed last year, compared to 26 closed in 2019.

It was a concerning sign for a region often celebrated for its strong foundation of early-stage support. Waterloo Region has a heavy presence of incubators and startup hubs, including the Accelerator Centre and Communitech, and a funnel of post-secondary candidates from institutions like the University of Waterloo.

According to briefed.in’s latest report, six deals closed in the pre-seed and seed stages in Q1 2022, including Epoch’s $4.6 million seed funding round, IntelliCulture’s $1.7 million seed funding round, and Hyivy Health’s $1.1 million pre-seed round of funding. Seed deal volume increased from the one deal closed in Q4 2021 and the three closed in Q1 2021.

While these numbers may still seem low, Clark said some early deals from the quarter have yet to be reported. He said GTAN, which invests in the Waterloo Region, is seeing “very strong” early-stage activity in the region. According to Clark, GTAN’s members deployed nearly $2.5 million of local personal capital into over $7 million worth of rounds in Waterloo-based startups in the first quarter of this year.

“Many of our angel members are feeling more confident with the markets and we are seeing, hopefully, the beginning of a rally behind outstanding local founders,” he added.

briefed.in gathers its data on Canadian venture deals from a wide variety of public sources and founders who self-report deal information, which means its findings do not always include information on undisclosed funding rounds.

The strong early-stage activity Clark has observed may follow into Q2. In January, several Ontario angel groups, including GTAN, the National Angel Capital Organization, and Angel Investors Ontario, would receive a cumulative $5.4 million. The funding is aimed to boost angel investment activity by 30 percent and help individual angel groups grow their membership by at least 30 percent.

Late-stage funding no longer just ApplyBoard and Faire

A total of two Series B rounds closed in the Waterloo Region over the first quarter: Axelar’s $44.4 million funding round and DOZR’s $27.5 million funding round. Other significant yet non-venture deals that closed during Q1 2022 included a $414 million financing deal for eSentire.

Aside from Kognitiv’s $31 million raise (the company did not categorize its financing under a specific stage), Axelar and DOZR raised the only two definitive late-stage rounds during the quarter. Together, those rounds accounted for roughly 45 percent of all investment in the region in Q1 2022.

In previous quarters, the vast majority of investment in the Waterloo Region was attributed to a very large deal raised by one of two big names: ApplyBoard or Faire. Faire’s Series F and Series G funding rounds accounted for $814 million, or 58 percent, of all local investment dollars raised in 2021 alone.

However, the rounds closed in the first quarter of 2022 indicate that it’s not just ApplyBoard and Faire attracting late-stage dollars. For a smaller region like Waterloo, Clark said the Series B activity in Q1 is “great to see.”

“If our goal is to see more Series B to those mega-rounds of scaling companies, we require a robust ecosystem supporting all stages of growth,” he added.

BetaKit is a briefed.in Tech Report media partner.