Montréal’s tech sector managed to break its venture funding record in 2021, exhibiting healthy investment growth year-over-year, according to the BDO-Hockeystick report with data from briefed.in.

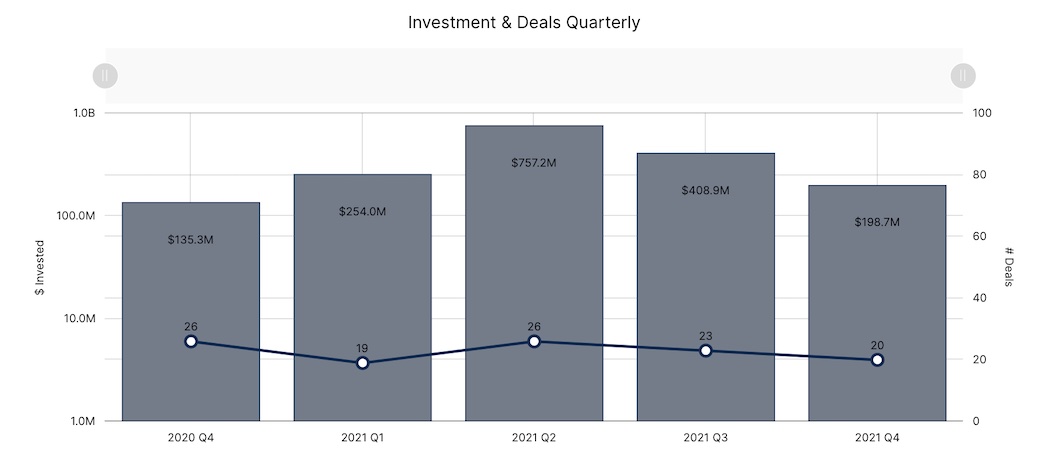

briefed.in found that Montréal tech companies attracted $198.7 million in the fourth quarter of 2021, a 51 percent decrease quarter-over-quarter, but a 47 percent increase compared to the same quarter in 2020. Q4 2021 investment brought Montréal’s total funding for 2021 to $1.6 billion, a new two-year record for the city.

“Our ecosystem experienced a strong growth and development over the past years due to the efforts of all its stakeholders.”

– Olivier Quenneville, Réseau Capital

Overall funding in 2021 increased by roughly 33 percent from the $1.2 billion raised in 2020. Montréal sits third in briefed.in’s ecosystem rankings, behind Toronto and British Columbia, which both tracked remarkable investment growth last year.

Olivier Quenneville, vice president of business intelligence and development at venture capital and private equity association Réseau Capital, said that while 2021 was a banner year in many jurisdictions, he’s happy to see that Montréal is still showing solid growth.

“Ecosystems like the one in Montréal take years to build,” added Hugues Lalancette, recently-promoted partner at Inovia Capital. “We’ve now reached an inflection point driven by larger market opportunities, local talent pools opening up to global players — which is driving a global mindset from the start — combined with an influx of capital.”

Montréal startups raised some significant funding rounds this year, including AlayaCare’s $225 million Series D funding round, Paper’s $122.8 million Series C round of funding, and Hopper’s $175 million Series G financing round. Liette Lamonde, CEO of Bonjour Startup Montréal, a nonprofit startup hub, said the city’s sizeable deals and record-breaking results indicate local initiatives to put Montréal on the map are bearing fruit.

“The multiple efforts and investments of the past (founders’ experience, investors, public funding, programs, accelerators, coaches) are paying off,” Lamonde told BetaKit. “Just like we see everywhere, investors have money to invest, they are eager to do it, and they see that Montréal’s startups are worthy of their interest.”

Deal activity waned in 2021… or did Montréal just go remote?

Per briefed.in data, 88 deals closed in Montréal throughout 2021, a 26 percent decline from the 120 deals in 2020, which also dropped from the 122 deals closed in 2019. However, members of the Montréal ecosystem noted to BetaKit that this is not consistent with what they saw in the region last year.

Quenneville said, according to Réseau Capital’s data, deal volume slowed down in Montréal in 2020, yet last year the city demonstrated “strong growth” in activity, with 106 deals tracked up to the end of the third quarter.

“Looking at the trend for 2021, and based on our preliminary data, we are confident that we will close the year with around 150 deals for a total of more than $2 billion for Montréal,” Quenneville told BetaKit.

It should be noted that briefed.in gathers its data from a wide variety of public sources, as well as founders who self-report deal information. Réseau Capital works with the CVCA to collect data, which has access to information to deals not disclosed to the public.

Lamonde said while she also did not see a decline in interest for Montréal’s companies last year, the result could be attributed to startups seeking alternative forms of financing. Platforms like FrontFundr have allowed many Canadian startups to crowdfund their ventures and skirt traditional financing channels. Montréal-based Hardbacon, for example, raised $1.1 million in equity crowdfunding through FrontFundr last spring.

That being said, Quenneville noted there is still room for improvement when it comes to Montréal’s deal volume, particularly at the later stages, a sentiment echoed by Lamonde.

“The next stage of maturity for the Montréal ecosystem would be to have a better support system for late-stage startups and scale-ups to help them grow stronger and more connected with international opportunities,” Lamonde said. “This can be done in different ways but certainly in collaboration with the venture [and] tech ecosystem.”

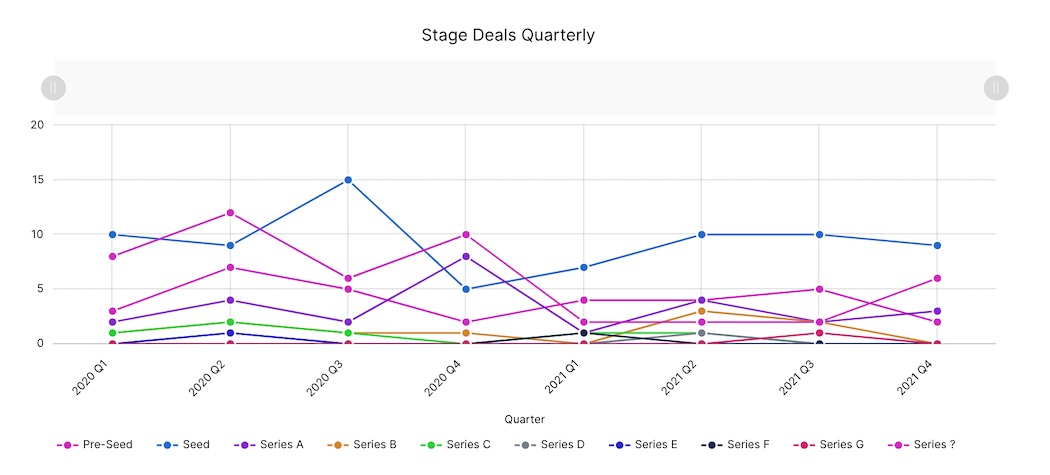

Lamonde noted that Montréal startups are also struggling to raise Series A funding rounds relative to companies in other Canadian cities. briefed.in’s data confirmed this, with the report finding that Series A deals declined from 15 deals in 2020 to 11 in 2021.

Lamonde said without this growth-stage support, some of Montréal’s Series A-stage companies are relocating to other cities that have better experience supporting scale-ups, while others have exited prematurely. “We were happy to see Montréal-based VC Inovia raise their second growth fund last year, bringing more funds and expertise at the growth stage,” Lamonde added.

According to briefed.in’s report, Montréal saw a minor decrease in reported pre-seed and seed-stage deals in 2021. In total, 36 deals in these stages were reported last year, compared to 39 in 2020.

briefed.in attributed this small dip in early-stage deals to the classification of company headquarters. An example of this would be ShopperPlus, which raised $20 million in Series A financing last year. ShopperPlus llists its headquarters as Vaudreuil-Dorion, Québec, a Greater Montréal suburb.

Other companies have dual headquarters in other cities, were founded in Montréal, and after expanding operations globally, still carry out a heavy volume of operations in Montréal. Such is the case with Sonder and AppDirect, which have significantly contributed to Montréal’s venture funding numbers in previous years.

This discrepancy could also contribute to the overall decline in reported deals over 2021, and the delta between Réseau Capital’s expected results. According to briefed.in’s data, all companies headquartered in Québec raised a total of $1.8 billion through 105 deals, which would be closer to the deal activity seen in 2020.

Lalancette said these varied headquarters listings could make it difficult to extrapolate venture funding trends when looking at city-level data.

“Over the last few years, talent has become way more decentralized, and the concept of an HQ location is becoming more fluid,” Lalancette added. “It’s not uncommon to see remote executive teams working from different locations, which makes tagging the HQ more subjective, especially for newer companies that have launched in the remote-first world since 2020.”

Quenneville noted that while he was satisfied with the Montréal tech ecosystem’s investment growth last year, the economic uncertainty and a possible market downturn remain important threats.

“Our ecosystem experienced a strong growth and development over the past years due to the efforts of all its stakeholders,” said Quenneville. “We need to capitalize on this strength and protect the progress we have made to pursue our growth.”

BetaKit is a briefed.in Tech Report media partner.