PwC recently released its latest MoneyTree report for Q2 2018. Spotlighting funding trends from the country’s five major tech cities–Toronto, Vancouver, Montreal, Calgary, and Quebec City–the document revealed a large amount of capital being invested at the seed stage.

Nowhere was that truer than Vancouver.

Unlike early, expansion, and later-stage funding, which declined at a national level this past quarter, all phases of deal volume and dollars increased in Vancouver compared to Q2 2017. The seed stage was responsible for the biggest jump, with the number of investments rising from five deals to nine.

According to Cameron Burke, a Vancouver-based managing director within the technology industry at PwC Canada, the uptick stemmed from the growing maturity of the city’s tech sector.

“There’s a vibrant early-stage ecosystem, and not in one particular track.”

“The valuations of companies in the expansion stage have been increasing, and attracting funding,” he said. “I think investors and VCs looking for value have a bigger pool of people who have created and scaled good companies. Every quarter there is a bigger ecosystem of people who have done it before, and draw that capital back in [at the seed stage].”

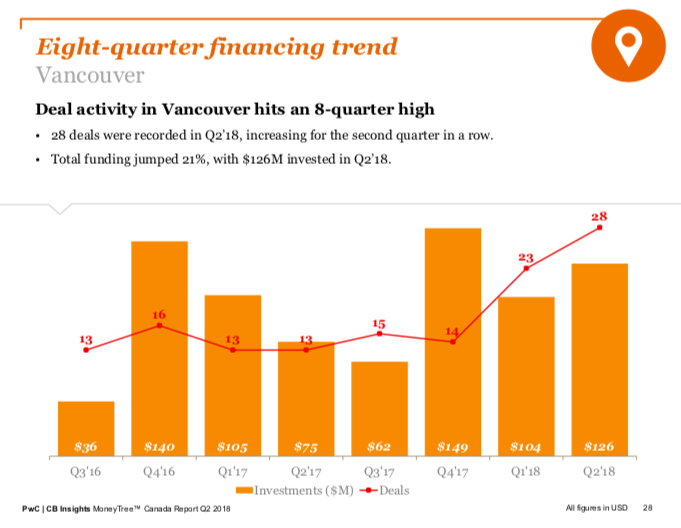

The emphasis on seed funding on the West Coast was reflected in the amounts received last quarter. PwC’s data reveals that Toronto secured only five more deals than Vancouver in Q2 2018 – 33 to Vancouver’s 28 – but its total funding was almost double. Toronto companies received $381 million ($290 million USD) of capital compared to Vancouver’s $166 million ($126 million USD), with the average Toronto deal clocking up $16.7 million ($12.8 million USD) to Vancouver’s $7.8 million ($6 million USD).

“A lot of companies in Toronto are expanding,” Burke said. “You saw deal volumes go up [because they were raising] later stage growth equity.”

Vancouver’s tech ecosystem, however, is still anchored by its early-stage companies. The 2017 Global Startup Ecosystem Report named the city as the top startup ecosystem in Canada, and the 15th best worldwide. Across the lower mainland, there are close to 1,100 startups, many with very competitive valuations. A few of those startups that raised funding this quarter include Dooly.AI, which was founded by a 10-year Vision Critical veteran that raised $2 million, and AvenueHQ, which raised $4.5 million to seek US expansion.

“There’s a vibrant early-stage ecosystem, and not in one particular track,” Burke said. “The city inherently breeds a pretty diverse collection of companies – [which is one of the reasons that] you saw money again going into the seed ecosystem in Vancouver after a drop. I think that speaks to the strength and the diversification, and that’s an endorsement of our earlier-stage businesses.”

One vertical that excelled in last quarter’s funding rounds was “internet software and services,” a category which includes e-commerce, web-hosting platforms, browser software, online advertising, and email. Ten of the 28 companies to secure investment in Q2 2018 create SaaS products, and Vancouver’s third highest deal was clinched by Elastic Path – an e-commerce enablement platform – which raised $43 million ($32 million USD).

True to form, however, the majority of Vancouver deals went to a range of different industries.

“I’d say last year’s Q2 didn’t see a lot of deals in the business and productivity space, and this quarter saw nine, raising $48 million,” Burke said. “In healthcare, there was only one deal last year, [valued] at $8 million, and last quarter there were nine deals at almost $59 million. That is a great metric to see, and I’m curious to find out whether Q3 and Q4 can build on that. Analytics, too, is a space that has continually driven and attracted investment. When I look at all of the companies raising capital last quarter, it’s a really diversified mix, far more diversified than I’ve seen historically.”

That multiplicity was mirrored in the nationality of investors. Of those putting money into Vancouver’s ecosystem, 33 percent were Canadian, 29 percent were American, and the remaining 38 percent came from other international destinations, including Australia, Singapore, Germany, and China. While those numbers remain consistent across the past eight quarters, Burke believes the composition might change in the future.

“Anecdotally, based on who I’m meeting and the people I see opening offices, the number of VC and private equity meetings and interest in the BC ecosystem is rising dramatically,” he says. “There’s growing recognition of the strength of the ecosystem, and an increased awareness of the strong companies that are coming out of Vancouver and BC I think that number will change, and I would say the investment from the US and out of Asia will increase significantly.”

BetaKit is a PwC MoneyTree Canada media partner. Photo via Unsplash.