PitchBook, a Seattle-based company providing a platform informing its clients of VC, PE, and M&A activity to make more informed decisions, has released its 2016 Canada PE & VC Breakdown: II report.

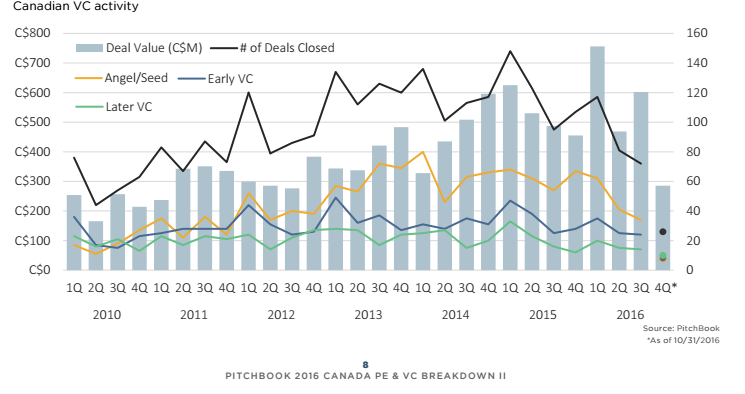

It’s the company’s second Canadian publication on PE and VC activity, which examines how activity has shifted over the years according to factors like sector and size. According to the report, deal value reached $2.11 billion through October, and 2016 saw more venture capital deployed into Canadian companies than any other year on record.

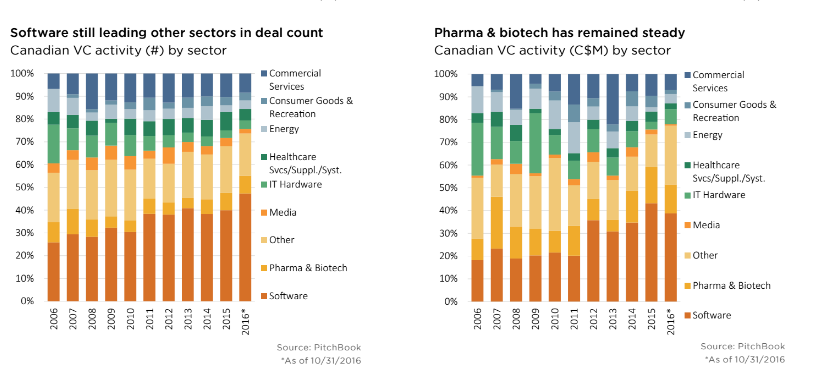

“More than 55 percent of the completed VC deals and 53 percent of the VC invested through October had been made in companies headquartered in either Toronto, Montreal, or Vancouver, each of which has a burgeoning tech scene,” the report read.

At the same time, the report said that just 296 deals were completed through October, meaning that 2016 is on track to reach 75 percent of last year’s total. This contraction mirrors trends in the global VC industry.

The IPO landscape in Canada wasn’t as promising. Through October 2016, just 37 exits were completed, putting 2016 on pace to see the lowest number of exits since 2009. At the same time, exit value amounted to $320 million, putting it on pace for the lowest in the decade and eight times lower than 2015’s total.

Corporate acquisitions accounts for 92 percent of all completed deals through October, which the report said was not surprising given the state of IPOs globally.

“Canadian companies may become the focus of even more cross-border acquisitions in the future, especially given the growing valuations of their US counterparts, and the continued strengthening of the US Dollar,” the report said.

Access the full report here.