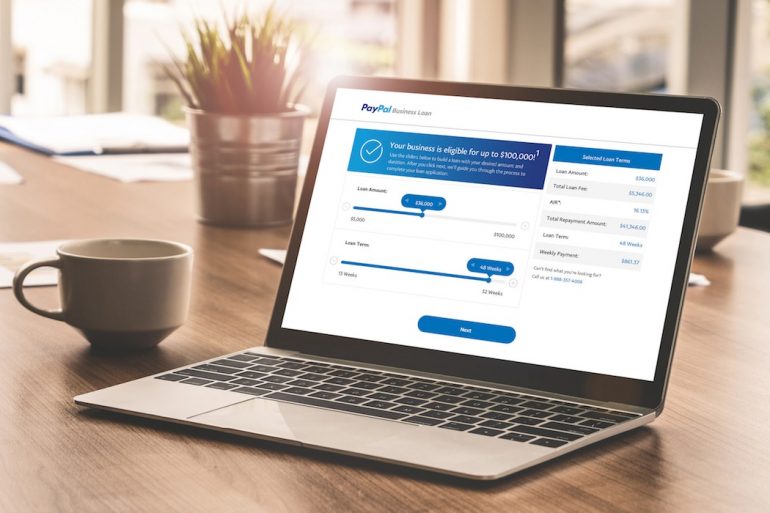

PayPal has announced it is now offering loans ranging between $5,000 and $100,000 to select small business owners in Canada. The new loan offering is currently only being offered to a select group of PayPal merchants.

“We’re launching the PayPal Business Loan to offer our merchants easy access to financing, something they desperately need.”

– Paul Parisi

The company is trying to simplify the loan process through a quick application process that can approve an applicant in minutes and transfer funds in one to two business days. The loans are being made out for business owners looking to buy inventory, invest in equipment, expand products or locations, or manage cash flow, though the loans are not limited to those uses alone.

“Applying for a traditional loan takes time and isn’t always favourable to small business owners,” said Paul Parisi, president of PayPal Canada. “We’re launching the PayPal Business Loan to offer our merchants easy access to financing, something they desperately need. We look forward to helping more small business owners achieve their dreams to grow locally and globally.”

PayPal said merchants who have taken one of its business loans in the US experienced an average growth of 21 percent, and 88 percent of those businesses reported seeing a revenue boost in the first three months after accepting the loan. The most common uses of the loans include managing cash-flow (44 percent), purchasing inventory (37 percent) and investing in marketing (31 percent). The Silicon Valley company added the new loan for Canadian businesses has no origination fees, late payment fees, early repayment fees, or application fees.

RELATED: Mogo partners with goeasy to pilot new personal loan offering

Credit history, long wait times, and high barriers to borrowing from traditional lenders have been some of the biggest challenges faced by small businesses, PayPal claimed, with 20 percent of entrepreneurs saying the process of securing financing from a traditional institution is challenging.

PayPal has been ramping up efforts recently to create solutions for Canadian business owners, also recently launching a platform for online businesses to manage cross-border shipments between Canada and the US. In May 2018, the company partnered with Visa to brings its digital and mobile payment collaboration to Canada. A month later, it acquired HyperWallet, a digital payout provider aimed at the sharing and gig economies, for $400 million in cash. In December, the company launched Xoom, its international money transfer service, in Canada.

The company expects the new loan program to be more widely available to Canadian PayPal business account holders in 2020. Beyond Canada, PayPal financing products are available in the US, UK, Australia, Germany, and Mexico.

Image courtesy PayPal