The Ontario Bioscience Innovation Organization has released a report outlining the challenges for companies working in health sciences, with recommendations on how to address the issue.

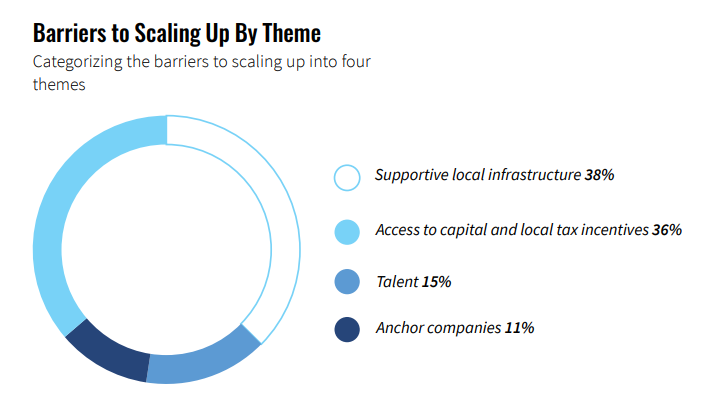

To create the report, OBIO surveyed 135 health science industry executives in 2017, identifying barriers to scaling in four main categories: a limited availability of capital (financial), a lack of infrastructure for technology trial and development (infrastructure), an absence of anchor companies (ecosystem), and limited availability of experienced workers (talent).

“There’s a whole regulatory and approval process that entrepreneurs have to manage before they can take a technology to market,” OBIO CEO Gail Garland said in an interview about healthtech’s unique challenges. “And often, in other sectors, your customer relationship is much more direct than it is in the healthcare technology sector where you’re selling to a health system.”

“To build health science anchor companies in Ontario, access to markets is becoming an increasingly important factor for Ontario companies.”

– Dr. Jeremy Bridge-Cook, chair of the board of directors at Ontario Bioscience Innovation Organization

The report did acknowledge that Canada’s health science industry is maturing, with over half of companies in the pre-clinical or clinical stage of development, and one in five generating sales or expanding their markets with their most advanced project. This maturation – the OBIO estimates that the Canadian healthcare market is a $9 trillion opportunity – is part of the reason why the industry’s challenges are becoming more pronounced.

The top recommendations from executives in response to these challenges include the creation of a health innovation capital fund; building a network of early-adopter institutions and investing in infrastructure to pilot new technologies at Ontario institutions; consolidating government funding programs; simplifying procurement processes; and creating globally competitive tax policies to attract investment.

Out of the recommendations, having a healthy funding environment was identified as one of the most important; of the companies surveyed, only six percent were eligible for raising funding in the capital markets. Over half the companies were pre-revenue, and the majority have less than one year of financial runway. Specifically, forty percent said they had zero to six months of runway left.

“What we found this year in our industry consultation…is the emergence of infrastructure as a priority as well for companies in addition to access to capital,” said Garland. “Being able to access local infrastructure to pilot technologies that scale and adopt their technologies is becoming increasingly important.

“Our ability to sell into local markets is often important for a foreign investor. Companies tell us that sometimes foreign investors will say, ‘how much of your technology are you selling at home?’ It’s important to build a network of key opinion leaders here in our own markets so that companies are establishing those relationships that will ultimately be sticky and contribute to keeping the company here.”

“To build health science anchor companies in Ontario, access to markets is becoming an increasingly important factor for Ontario companies,” said Dr. Jeremy Bridge-Cook, chair of the board of directors at OBIO. “For Ontario health science companies to stay here and grow here, this report’s recommendations indicate the need to create the conditions for the development of anchor companies.”

Executives said that the government, in particular, should provide clarification on policies surrounding procurement, designate certain hospitals as “early-adopter” institutions for piloting tech, and foster a business-friendly environment to encourage investors to participate in higher-risk investments. Currently, it’s difficult for companies to test their products in clinical settings because of a lack of time-efficient communication and adoption and reimbursement for successful technologies.

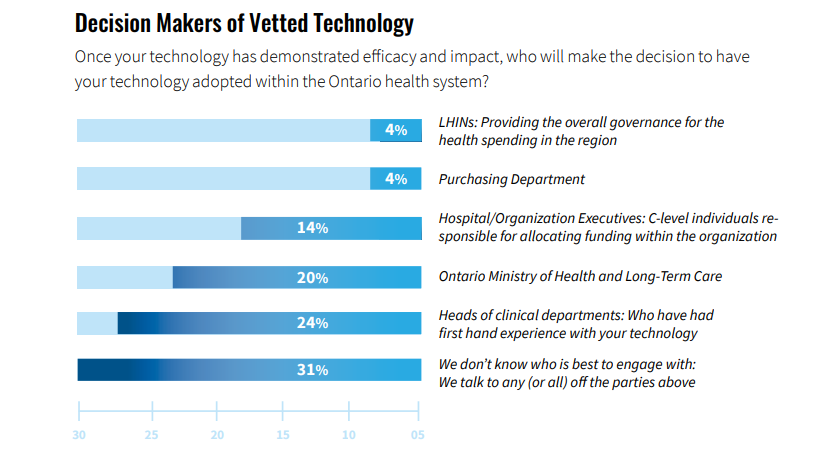

Seventy-four percent surveyed said they have a technology that will be ready for vetting within an Ontario hospital within the next year; when asked about participation in existing programs, almost sixty-seven percent said they had not participated. Of those that had, they said the program was only somewhat helpful.

“All of our companies are global and they’re global from the get-go,” said Garland. “It’s giving them reasons to stay here and grow here, and having the ability to access clinicians, hospitals, and health service providers here are all part of that formula for creating an ecosystem, and support of local infrastructure that will contribute to that.”

Access the full report here.

OBIO is a member-based non-profit. BetaKit’s healthtech partner MediSeen is an OBIO member, but was not involved in the creation of this report.

Photo via Unsplash.