Venture capital funding across the Canadian software sector is now seeing a return to normal after a challenging two years, signalling the start of a promising new phase, according to a new report from Inovia Capital.

The Montréal-based VC firm found that capital deployment in Canada in 2023 was back to pre-2021 levels, both in venture ($1.0 billion USD) and growth ($2.5 billion USD) funding.

Canadian VC funding is restabilizing despite the challenges of rising interest rates, struggling deal volumes, and declining valuations.

The report found that SaaS free cash flow margins are also up 10 percent since before the 2021 VC boom. This, coupled with historically low valuations, suggests a sector primed for a cash influx.

Emerging managers have also represented a growing force within the Canadian software market, the report notes. The number of early-stage funds with investors who have raised three or fewer funds has quadrupled since 2013.

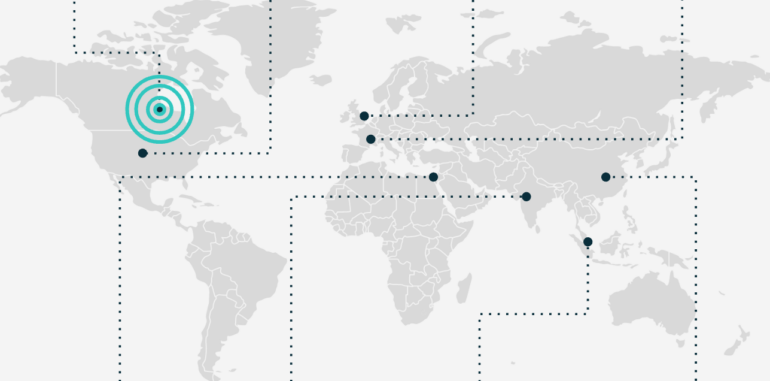

Looking forward, the report predicts a shift from Canadian-led investments to a flourishing of international investment interest in home-grown companies. Sixty percent of the top 20 growth companies since 2019 had a Canadian leader or co-leader with rounds of $50 million or more.

Capital and talent growth across regions

Inovia’s report also highlights the unique offerings each Canadian region brings to the software scene. Ontario still holds the lion’s share of funding and is considered a hub for the Canadian footprints of big tech companies such as Google and Meta.

However, Western Canada (25 percent) and Québec (23 percent) combined now comprise 48 percent of total funding since 2019, nearly as much of the market share as Ontario’s 55 percent.

Vancouver and Calgary, in particular, saw their talent pools grow 69 percent and 61 percent respectively since 2017—the fastest in the country—followed by Waterloo at 52 percent. But all eight of the top Canadian markets had workforce growth in the double digits.

While Montréal didn’t crack the top 10 ranking of the largest tech markets in North America, it still saw a healthy 43 percent increase in its tech workforce. An estimated 30,000 jobs in Québec, or 17.4 percent, are now AI-related positions.

AI insights

2023 saw a fivefold increase in generative AI startup investments worldwide, with Canadian companies such as Cohere, CentML, and Spellbook Canada counting among them. According to the data in Inovia’s report, Canada is home to nearly 700 AI startups and ranks fourth globally in generative AI companies per capita.

Success with generative AI technology has mostly concentrated on preexisting companies implementing AI tools, rather than new startups building their model around the tech (notable counterexamples include ChatGPT).

Inovia partners also claim that data and information hygiene, or well-organized information, will give companies an edge when implementing AI tools. However, they also note that large language models would best be used to push data-driven jobs forward rather than replace them.

The rise of FinTech

FinTech companies such as Wealthsimple and Neo are now the most dominant in terms of VC funding, the report shows, with $5.7 billion invested into the vertical since 2019. FinTech, digital health, and “future of work” verticals together accounted for over half of total VC funding in that same period. Digital health and travel & hospitality have both doubled their funding since 2019.

“FinTech cuts across almost all software categories now,” said Mia Morisset, Inovia principal, who cited Lightspeed and Hopper as examples of software companies with FinTech leanings. “These sectors are not mutually exclusive; we think of them as massive waves of digital transformation that software businesses are riding.”

Rebundling

Mergers and acquisitions are expected to ramp up, if the 50-plus acquisitions by Inovia’s portfolio companies over the companies’ lifetimes are any indication.

Public software acquirers such as Constellation Software and OpenText saw double-digit surges in their stock prices from Jan. to Dec. 2023. Inovia expects more Canadian software companies to strategically use mergers and acquisitions to their advantage this year.

“If the last decade was about unbundling software, the next decade will be about rebundling it,” said Lalancette. “The wave of M&A we started seeing in 2023 is a rising tide lifting all boats and will create opportunities […] across all sectors.”

“If 2023 was a year of planning, 2024 will be the year of execution.”