Toronto-based FinTech startup Moves has raised a $6.39 million CAD ($5 million USD) seed round led by OMERS Ventures. The financing also saw the participation of Panache Ventures and N49P Ventures.

According to Moves, the investment will help towards its mission of “making the gig economy work for its workers.”

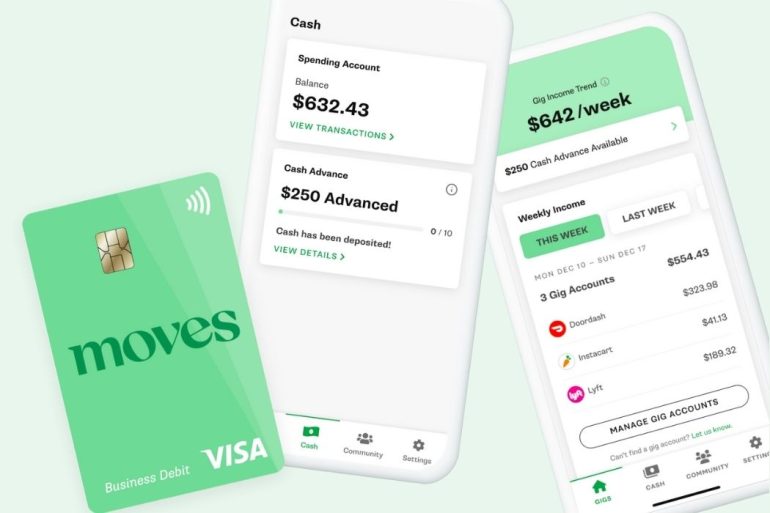

Founded in 2020, Moves offers an all-in-one banking app for gig workers. With a headcount of around 35 employees, Moves is led by CEO Matthew Spoke.

According to Moves, the investment will help towards its mission of “making the gig economy work for its workers.” The company previously raised $9.1 million in 2020 according to Crunchbase data. Moves has been noted as a Canadian tech company to watch in the past.

Since launching its mobile app, Moves has accumulated over 10,000 members, which the company said are on track to earn a collective $56 million by the end of this year.

Through its banking app, Moves provides earnings insights across over 16 supported platforms, as well as cash advances of up to $1,000.

In October, Moves launched an initiative, called Moves Collective, that allows its users to earn shares as rewards in the companies that they work for. Those companies being Uber, Lyft, Doordash, Grubhub, Target, and Amazon.

Through a partnership with Bumped Financial, Moves claims that Moves Collective users have a combined 4,500 shares across the supported public gig companies. Bumped is a stock rewards platform that lets users earn shares across over a thousand eligible brands when they shop. Its mobile application tracks spending with participating publicly traded companies, then gives consumers a percentage of their purchases back in fractional shares of stock.

RELATED: Moves expedites launch to provide loans to gig economy workers during pandemic

In 2020, Moves decided to expedite its launch in order to offer loans to gig economy workers amid COVID-19. The startup, which planned to launch in the Fall of that year, offered $2,500 one-year loans that were intended to be used as a “financial bridge to the post-COVID-19 economy” and support independent workers in Ontario that traditional banks and credit scores may disqualify from financial services.

In a report by Payments Canada, it said that the onset of the COVID-19 pandemic led to an increase in the number of Canadians who participate in short-term contracts or freelance work. As of May 2021, these gig workers now represent more than one in 10 Canadian adults (13 percent), and more than one in three Canadian businesses (37 percent) employ gig workers.

Featured image from Moves Financial’s website.