The Waterloo Region saw a continued decline in venture funding activity throughout 2022, culminating in a four-year low in deal volume for the region’s tech sector.

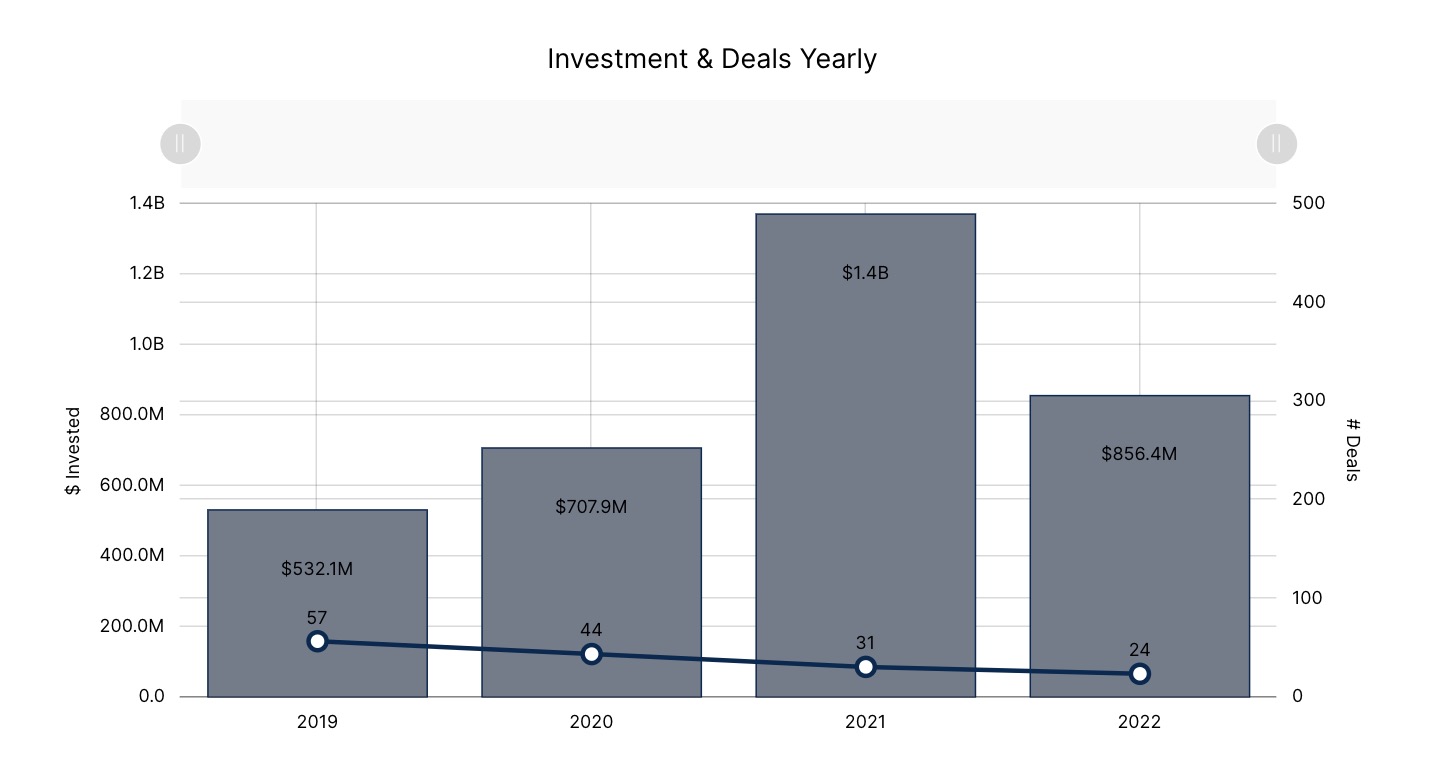

According to a new report from briefed.in, tech startups in the Waterloo Region raised a total of $856.4 million in 2022, a 38 percent decline from the $1.4 billion raised in 2021. It might look like a substantial drop year-over-year, but it is less remarkable when taking into account the exceptionally strong performance of Canadian tech in 2021.

Per briefed.in’s report, venture funding in 2022 still exceeded the $707.9 million raised in the Waterloo Region in 2020 and the $532.1 million raised in 2019. Amber French, managing partner and co-founder of Catalyst Capital, told BetaKit that the fact that investment is increasing from years prior, excluding the “bumper year” of 2021, is a promising sign.

“To me, this indicates that despite macroeconomic factors at play, our Waterloo ecosystem continues to mature, as companies graduate to later stages and are able to attract larger funding rounds,” French said.

Faire’s $537.7 million Series G extension, which closed in May and was the largest deal tracked during the year, accounted for roughly 62 percent of all funding raised in the Waterloo Region in 2022.

Over the past three years, Faire and ApplyBoard have dominated the Waterloo Region’s funding scene, both often raising the lion’s share of investment capital for a given quarter. While this was still true for Faire in 2022, it was not for ApplyBoard, which did not raise a new round in 2022 but said it was “well-capitalized with years of runway,” in November.

Aside from Faire’s megadeal, the Waterloo Region had several other significant investment deals worth noting, including Avidbots’ $96.1 million Series C funding round, Axelar’s $44.4 million funding round, and DOZR’s $27.5 million funding round.

With only 24 deals tracked by briefed.in in 2022, deal volume in the Waterloo Region reached its lowest level since at least 2019. This is in line with a larger pattern of declining deal activity over the past four years and signals a potentially troubling trend for the region’s startup ecosystem. French said she has seen a “more challenging” fundraising environment lately, but noted that phenomenon is certainly not limited to the Waterloo Region.

“We’re seeing a bit less deal flow as some companies opt to delay fundraising and try to ride out the current climate,” French said.

The decrease in tech valuations from 2021 had a significant impact on many Canadian companies’ ability to raise funds in 2022. However, in the Waterloo Region, the number of deals tracked by briefed.in has declined every year since 2019, including in the watershed year of 2021. The 24 deals tracked in the region in 2022 represent slightly more than half of the 44 deals closed in the region in 2020, and less than half of the 57 deals closed in 2019.

“The past couple of years have seen a run-up in valuations, some supported by strong fundamentals, some not,” French continued. “There is a shift in expectations happening where we’ll likely see more down rounds if companies can’t justify their prior valuation. I think some companies who can hold off are delaying the next round as they focus on strengthening metrics.”

Drier soil for seed startups

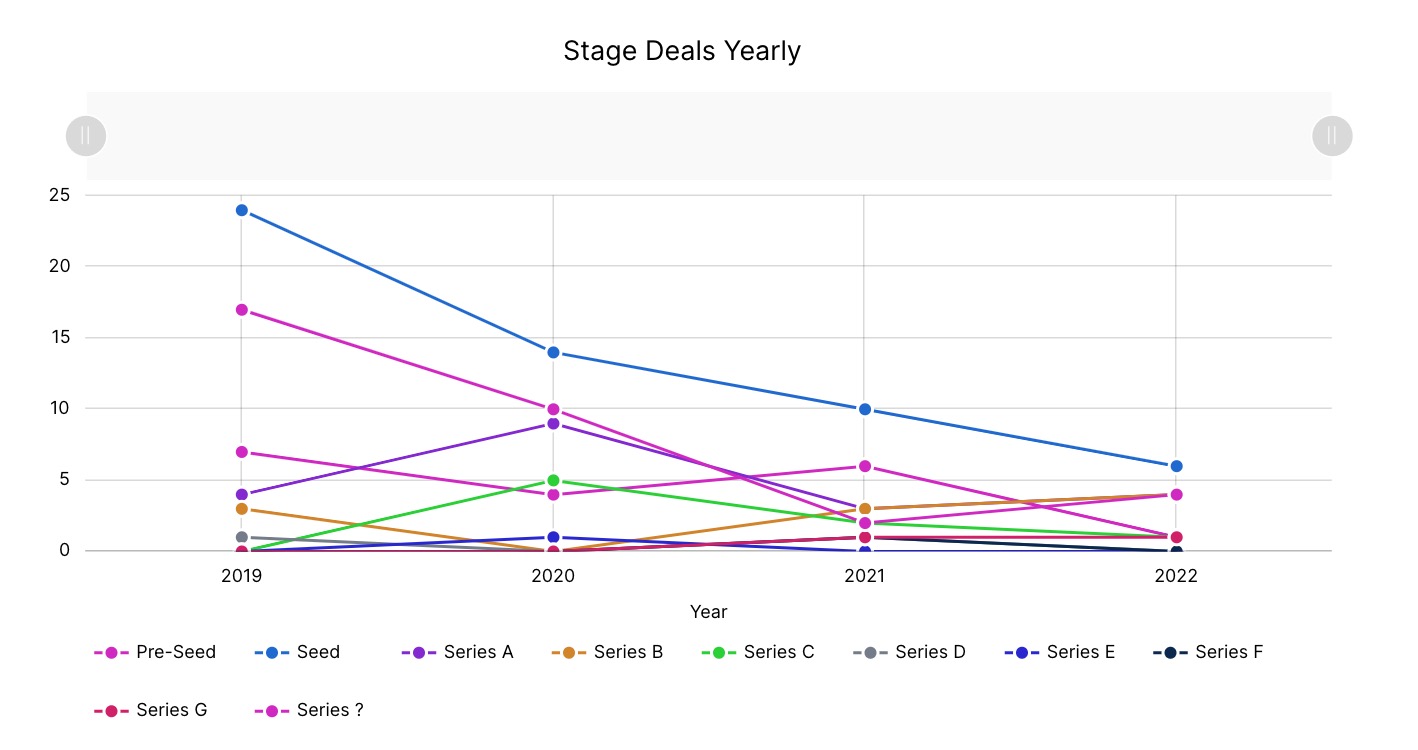

Dwindling seed-stage activity has emerged as a major factor contributing to the lower deal volume observed in the Waterloo Region over the past four years. Since 2019, when the local tech sector saw a total of 24 deals closed during the year, seed deal volume has fallen each year, and reached a four-year low of just six in 2022.

The second half of 2022 was particularly dry for early-stage funding in the Waterloo Region, with briefed.in reporting zero deals at the seed or pre-seed stages in both the third and fourth quarters of the year.

“Last year was definitely a challenging year for seed-stage companies,” she said. “In times of economic uncertainty, there can be less of a funding pool to draw from at the earlier stage, as some investors take a more conservative approach with their portfolios.”

The Waterloo Region is hailed nationally for its strong network of early-stage hubs, accelerators, and top-tier university programs, which has made the scarcity of early-stage deals even more concerning.

Some of those hubs have had to cut their own costs amid the macroeconomic climate, but the region still has many active angel investors that are managing to close deals. The Golden Triangle Angel Network (GTAN), for example, was recently listed as one of Canada’s most active independent venture firms by the Canadian Venture Capital & Private Equity Association.

French added that early-stage companies in the region appear to be doing rather well, even if they aren’t raising. At Catalyst Commons, which is Catalyst Capital’s 65,000-square-foot coworking space in Kitchener, French has seen more early-stage companies increasing, rather than scaling back, their headcounts.

“[Catalyst] Commons is a microcosm of what’s happening in the greater Waterloo Region, but we’re seeing that it’s not all bad news on the talent front. There are many companies growing,” she added.

A flight to quality in 2023

Amid a still uncertain funding environment, French believes startups can ride out the current market in 2023 by focusing on strong fundamentals, acquiring talent, and strategic growth. “There has definitely been a shift away from a ‘growth-at-all-costs’ mentality to more capital-efficient models,” French added.

The frequency at which startups raise funding is also not always a leading indicator of growth. Many companies in the Waterloo Region that did not raise money in 2022 are still reaching some impressive milestones this year, either by achieving sustainable revenue growth or through acquisition.

In January, Vidyard said it was considering M&A opportunities and feels well-positioned to achieve $100 million USD in revenue. In February, Waterloo-based software company Descartes Systems Group acquired GroundCloud for $184 million. Thoma Bravo’s acquisition of Waterloo-based and TSX-listed Magnet Forensics is also expected to close by the second quarter of 2023 (despite opposition from one of Magnet’s investors).

“Waterloo has always been a resilient and collaborative community,” French said, adding that while 2023 could continue to be challenging for the region’s tech sector, it may also prove to be very opportunistic for tech startups that approach this moment strategically.

briefed.in is owned and operated by Communitech. BetaKit receives data from briefed.in as part of a media partnership with Communitech and retains full editorial control of all articles that reference the data produced by briefed.in/Communitech.