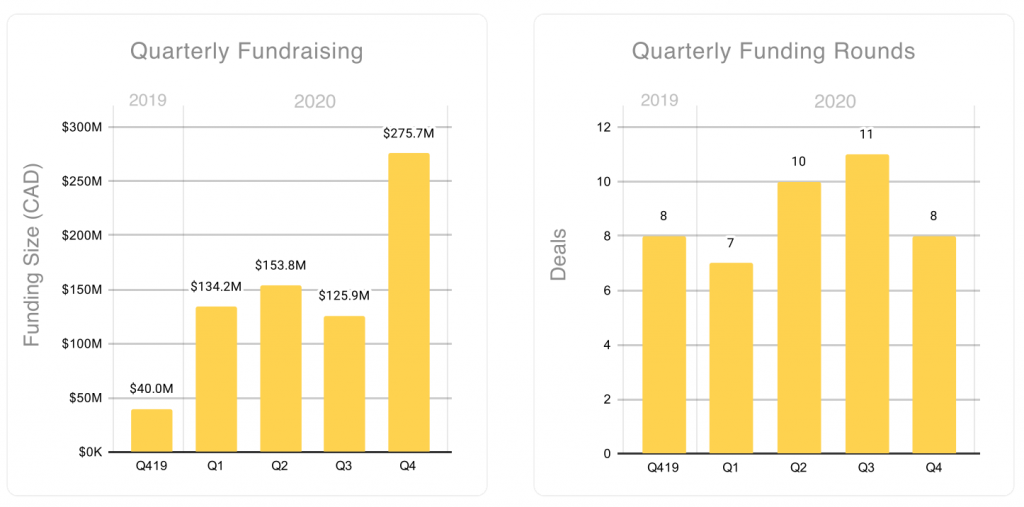

Waterloo Region startups raised $689.6 million for all of 2020 — up 107 percent over 2019, according to Hockeystick’s latest ecosystem report for the region.

The overall funding was driven by three notable deals in the region, including Faire, which raised $222 million, Miovision, which raised $120 million, and ApplyBoard, which raised a $100 million Series C in May 2020 and a $70 million extension following investor interest five months later. ApplyBoard and Faire also represented two sectors that saw a boom as COVID-19 forced businesses to embrace online services: retail and EdTech.

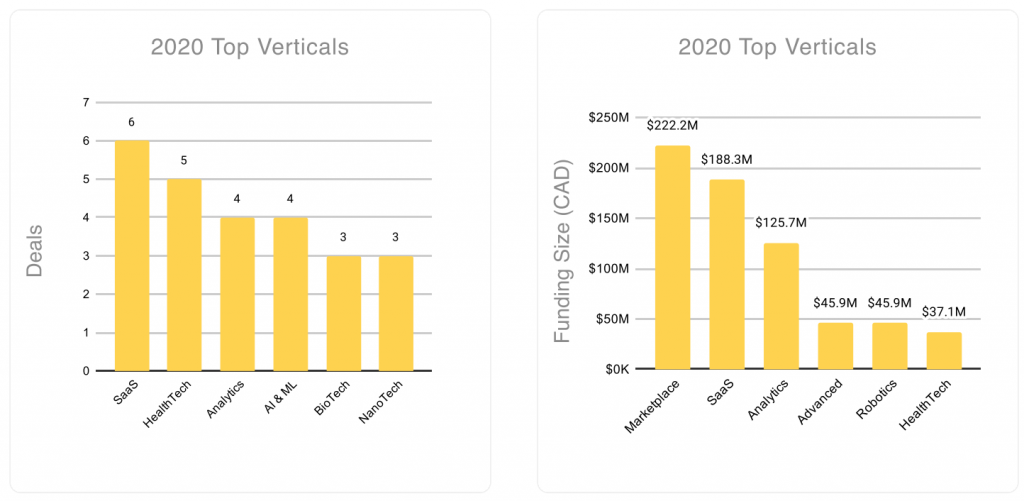

Wholesale marketplace Faire, which is headquartered in Silicon Valley and Kitchener, managed to push the marketplace vertical to the top of funded areas, followed by SaaS, healthtech, analytics, and AI. Even with Faire’s $222 million round removed from the quarter’s total, Waterloo Region remains up 34 percent in total funding compared to Q4 2019. However, removing Faire’s deal, Q4 funding was $54 million, a 57 percent drop from Q3 2020.1

In total, $276 million was raised in Q4 2020, up 119 percent over Q3 2020. Besides Faire, the largest deals of the quarter were EdTech startup Knowledgehook at $27.1 million, and an $11 million raise from Kenota Health, which offers medical technology for rapid in-clinic allergy testing. The largest deals in Q4 2020 were in the marketplace, EdTech, healthtech and AI verticals.

Though funding was up year-over-year, there was a decline in deals over this time period. Thirty-six deals closed in 2020, down 33 percent over 2019, with eight deals in Q4 2020, down 27% over Q3 2020.

Hockeystick sources its data through partnerships with organizations like the Canadian Venture Capital and Private Equity Association (CVCA). It also compiles data from startups using its platform and public data sources.

Despite declines in some areas, there were signs that showed the Waterloo Region — which is world-renowned for its regional startup support, strong universities and STEM talent — remains a healthy one with sustainable support and investor interest.

A healthy early stage

In 2020, the Waterloo Region showed mostly balanced funding across different startup stages. Early-stage deals accounted for 36 percent of funding, while Series A deals accounted for 25 percent, and late-stage deals accounting for 39 percent.

“Typically across these ecosystems, I’m seeing kind of a barbell around those numbers,” said Hockeystick research partner Rob Darling. “So the early stage is bigger, Series A is kind of a smaller amount, and then the late stages are bigger.”

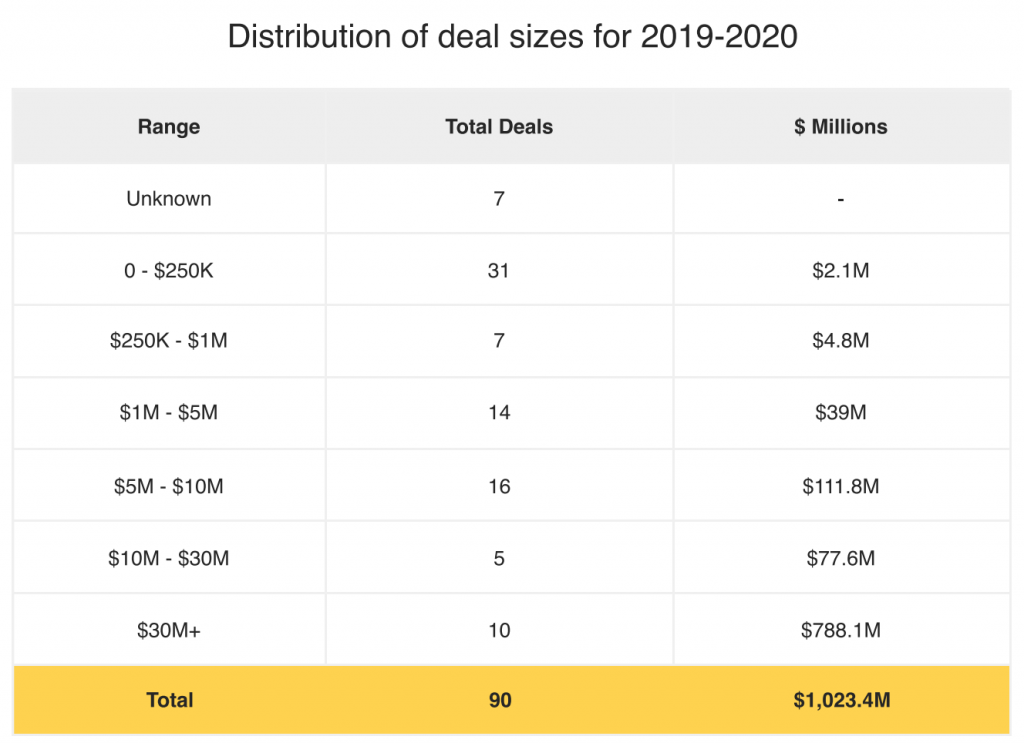

An analysis of deals between 2019 to 2020 shows this barbell effect in action: the majority of deals for these years fall between the $0 to $250,000 range, while the second and third biggest are $5 million to $10 million and $1 million to $5 million, respectively. The numbers pick up again in the later stage (over $30 million).

For Darling, the early-stage dominance within the Waterloo Region is a good thing. “The one thing that we really want to see is a high number of those early-stage companies, because a lot of them do fail,” he said. “That means that the ecosystem is well-rounded and doesn’t have a drop-off in late-stage support.”

Investor participation saw an uptick throughout the year, indicating strong interest in the region. A total of 70 investors poured money into the region in 2020, up 40 percent over 2019. Over quarters, there were 27 investors in Q4 2020, up 35 percent over Q3 2020.

While mega-deals drove a strong year for Waterloo Region, it was also behind the Greater Toronto Area, the Greater Montreal Area and B.C. (other regions surveyed by Hockeystick) in funding, raising $1.2 billion, $1.15 billion and $1.1 billion for the year, respectively. Waterloo Region beat out Calgary, which raised $307 million for the year.

An ecosystem built to last

The top Waterloo Region investors for 2020 include the Accelerator Centre, BDC, Creative Destruction Lab, Garage Capital, MaRS IAF, Velocity, and Y Combinator for the early stage, while BMO Capital Partners, BDC, iNovia Capital, Kensington Capital Partners Limited, McRock Capital Corporation, RRE Ventures LLC lead the late stage.

As BetaKit noted following the Q2 2020 report, the region’s accelerators, incubators, and hubs provide key startup support, while the engineering programs from local universities foster the expertise needed to grow these companies and important IP.

Darling specifically noted the Accelerator Centre and the University of Waterloo’s Velocity, identified as top funders in this report, as key to getting startups off the ground in the region. The Accelerator Centre, for example, runs the FedDev Ontario-funded AC JumpStart program, which offers $30,000 grants and mentorship. Meanwhile, the Velocity Fund pitch competition event, which invests $50,000 to $100,000 in early-stage startups, has so far created over $1 billion of equity value.

“Without them, we wouldn’t see 38 deals in the zero to $250,000 range,” said Darling.

The strong talent base created from local universities is a big reason why companies stay there even when they reach the later stage. Per the report, twenty-five percent of Faire employees, 55 percent of Miovision employees, and 35 percent of ApplyBoard employees have graduated or taken courses from Waterloo Region post-secondary institutions.

“lt shows that the ecosystem can support large players, and that means that the ecosystem is well rounded,” said Darling.

BetaKit is a Hockeystick Tech Report media partner.

1 Faire was initially included in Hockeystick’s Q3 2020 report. However, as the deal closed in Q4 2020, Hockeystick included this figure for Q4 2020. Without Faire’s funding, total Q3 2020 funding was actually $126 million.