Facebook, Apple, Amazon, Netflix, and Google – collectively known as “FAANG” – are often described as the most powerful tech companies in the world. And for over a decade, that analysis was correct. But a new Bessemer Venture Partners report shows the tech guard is changing once again, from FAANG to a new acronym, MT SAAS (pronounced “Mount SaaS”).

Whether public or privately-owned, SaaS companies are surging in terms of revenue, growth, and future opportunities. In a recent Sage Intacct webinar, Bessemer Venture Partners partner Mary D’Onofrio and investor Janelle Teng shared their insights on the state of cloud companies in 2021, and what that means for young SaaS startups.

A year of records

As the COVID-19 pandemic pushed people inside and towards remote work, cloud-based software providers experienced unprecedented growth. But as we potentially see a light at the end of the tunnel, Bessemer’s report indicated that SaaS isn’t slowing down at all.

“Cloud is accelerating,” said D’Onofrio.

The total valuation of all public cloud SaaS businesses in February 2019 hovered around $690 billion. D’Onofrio said that ambitious estimates in 2019 suggested public SaaS would hit the $1 trillion valuation mark in mid-2020. However, public SaaS hit a total valuation of $1 trillion in February 2020, just before the pandemic hit. With the acceleration provided by the pandemic, public SaaS hit a $2.2 trillion valuation by February 2021. This included Snowflake’s $30-plus billion IPO, the largest IPO in SaaS history.

Private markets did similarly well, with SPACs raising $82 billion and Salesforce’s acquisition of Slack becoming the largest acquisition of a private company in SaaS history.

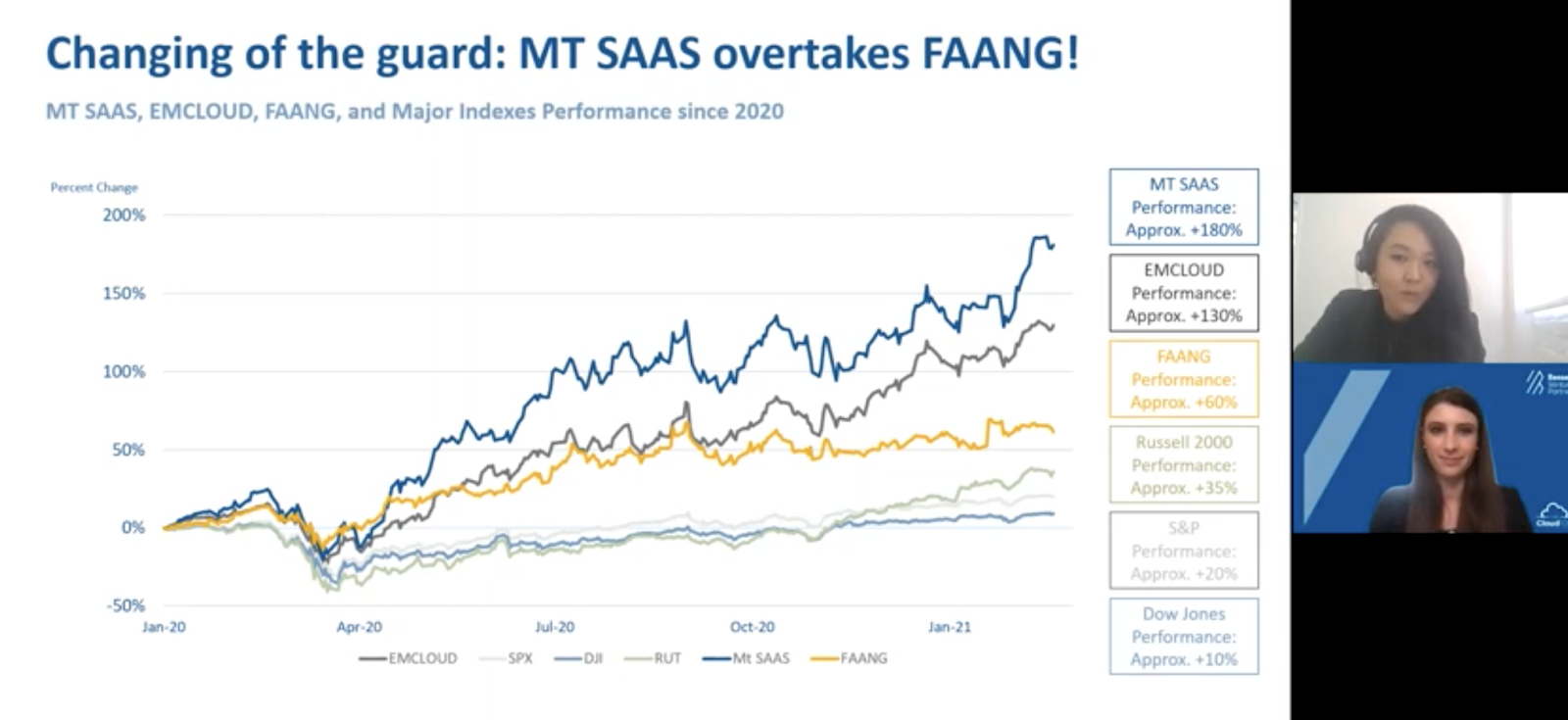

MT SAAS is taking over FAANG

The pandemic also changed the guard, so to speak, of companies dominating the tech ecosystem. Taking over from FAANG, a new acronym emerged to describe 2021’s market leaders, which included one FAANG incumbent. This new guard is called MT SAAS, standing for Microsoft, Twilio, Salesforce, Amazon, Adobe, and Shopify.

In terms of stock performance, MT SAAS delivered triple the returns offered by FAANG. According to Bessemer analysis, FAANG stocks delivered roughly 60 percent returns in 2020, while MT SAAS delivered 180 percent returns.

A part of this trend is due to strong earnings from SaaS companies, but there’s more at play. SaaS companies are also seeing significantly higher valuations, with investors valuing SaaS at 15-20x earnings multiples versus the 5-10x multiples from a few years ago. Teng explained that this surge in valuations comes from three factors: growth rates, growth endurance, and investor sentiment.

Teng said that top-tier SaaS companies like Shopify are growing 60 to 100 percent per year, many years after their IPO. That’s a huge increase compared to the growth rates of FAANG companies. Further, she said that SaaS companies are performing well in growth endurance, which is how much of the previous year’s growth a SaaS company maintains in the current year. She said that top-tier public SaaS companies retain approximately 80 percent of their previous year’s growth. For example, if a top-tier company grew 100 percent in 2019, it would have around an 80 percent growth rate in 2020. Top-tier private companies, on the other hand, are retaining 70 percent of the previous year’s growth.

The factor supporting strong revenue growth is dollars deployed in the cloud. D’Onofrio said that there has been a 10-fold increase in dollars going into cloud companies, reaching over $180 billion in spend, and that number is expected to increase by 10-fold again within the next few years.

How young SaaS startups can navigate a changing of the guard

The change from FAANG to MT SAAS should excite SaaS founders, but it’s also an indication that there will be more competition and scrutiny to justify higher valuations. According to D’Onofrio, SaaS founders should think about three different ways to navigate this evolution: sales and marketing, go-to-market, and metrics.

D’Onofrio said that the early-stage SaaS sales and marketing strategy is still founder-led. Founders often have the most in-depth knowledge of their story, along with the most passion, which can help sway early supporters. Founders leading sales and marketing also helps them stay close to customer needs, which is crucial as the company searches for product-market fit. Once there is some market validation, founders can scale up and remove themselves from day-to-day sales.

Another critical point is how SaaS startups go to market. The traditional playbook suggests hitting up warm connections and attending events to get your name out there. These can be helpful, but D’Onofrio also recommends trying new tactics such as product-led growth, usage-based pricing models, and leveraging cloud marketplaces to reach new potential customers. The first two go-to-market models help SaaS companies know how customers are getting value from their products. The third model is intended to help companies identify new potential verticals or use cases for their product which can help the company scale.

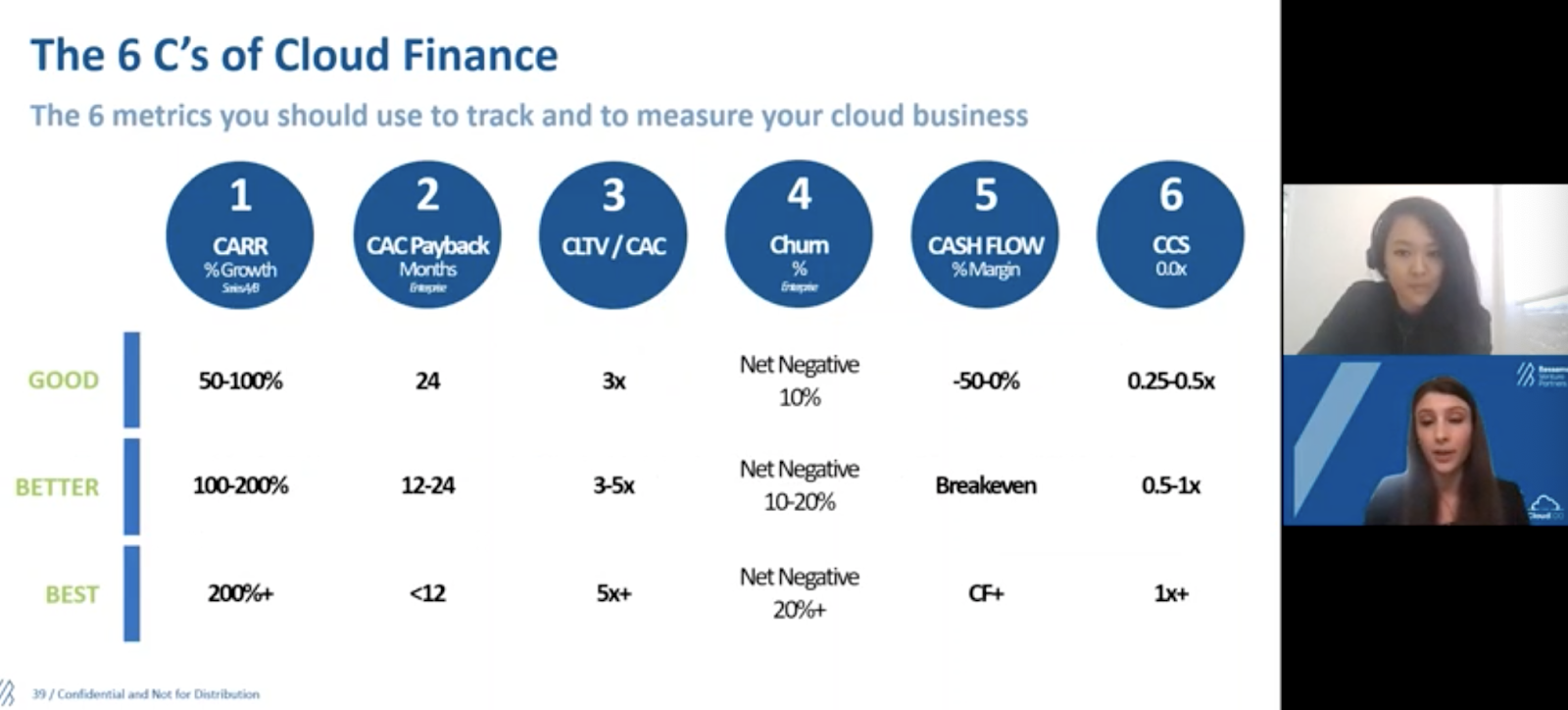

D’Onofrio also recommended a focus on what Bessemer Venture Partners calls the “6C’s” of cloud finance:

- 1. Committed Annual Recurring Revenue (CARR)

- 2. Customer acquisition cost (CAC) payback timeline

- 3. Customer lifetime value (CLTV) to CAC ratio

- 4. Churn percentage

- 5. Cash flow on a monthly basis

- 6. CARR to capital raised ratio (called a Cash Conversion Score, or CCS)

These metrics, particularly the cash conversion score, are indicators of health for SaaS companies and predictors of growth. For example, D’Onofrio said it’s impossible to have a good CCS metric if you aren’t efficient with capital, making the metric an internal barometer of capital efficiency and an indicator of whether you’ll have strong growth endurance in the future.

A SaaS revolution needs a new go-to-market playbook

Teng shared a Gartner statistic that 80 percent of sales interactions will take place on digital channels in the coming years. This, said Teng, means that the old ways of selling software may stop being as effective as they once were. This doesn’t mean you can’t try in-person sales methods, particularly as phenomena like revenge travel take hold, but new SaaS companies have to follow a different go-to-market playbook that gears towards supporting the new metrics that matter.

Feature image courtesy of Unsplash.