Quantum security startup EvolutionQ is contributing to a Bank of Canada research project involving quantum-safe cybersecurity technologies for digital currencies.

EvolutionQ co-founder and CEO Michele Mosca believes that given recent advancements in the space, it’s time for organizations to “future-proof” their systems and ensure they are ready to weather the threat of quantum computers by migrating to quantum-safe cryptography. Cryptography is the process of hiding or coding information (also called encrypting) so that it is only available to the person it’s intended for.

“We can’t tolerate much risk here—we need to be ready.”

—EvolutionQ CEO Michele Mosca

Quantum computers have the potential to process massive amounts of data much more quickly than the classical computers we use every day, meaning that in the wrong hands, they could be used to breach conventional password-based security systems. Quantum computers are not currently widely available commercially.

Mosca has previously warned that “The stakes are very high,” given that almost everything in today’s world is connected by technology. “It’s the entire economy,” he said. “It’s not just information security and safety … It’s operational technology, cyber-physical systems, driverless cars, implanted medical devices.”

While the development of quantum computers has been slow-moving, Mosca says organizations can’t afford to wait to update their cybersecurity. “We can’t tolerate much risk here—we need to be ready,” he said. “The price of being too late is far too great.”

One potential impact of quantum computers would be on the proposed Canadian digital dollar. The Bank of Canada is exploring technologies and technical ecosystems that may help decide how a Canadian digital dollar would be developed.

A digital dollar, or central bank digital currency (CBDC), would be different from cryptocurrency, as it would just be a form of the Canadian dollar and not tied to cryptocurrency fluctuations. Several countries already use or are experimenting with digital-only currencies, and there is potential for them to facilitate faster and more secure digital payments (no more waiting one to three business days for a transaction to clear). However, like any digital system, there would be challenges to rolling out a digital dollar securely.

Working with the central bank, evolutionQ will analyze approaches to meet the advances in cryptography, including quantum computing, to improve the security of central bank digital currencies.

Through the engagement with the bank, evolutionQ will analyze approaches to work out how to respond to advances in cryptography, including quantum computing, to improve the security of central bank digital currencies.

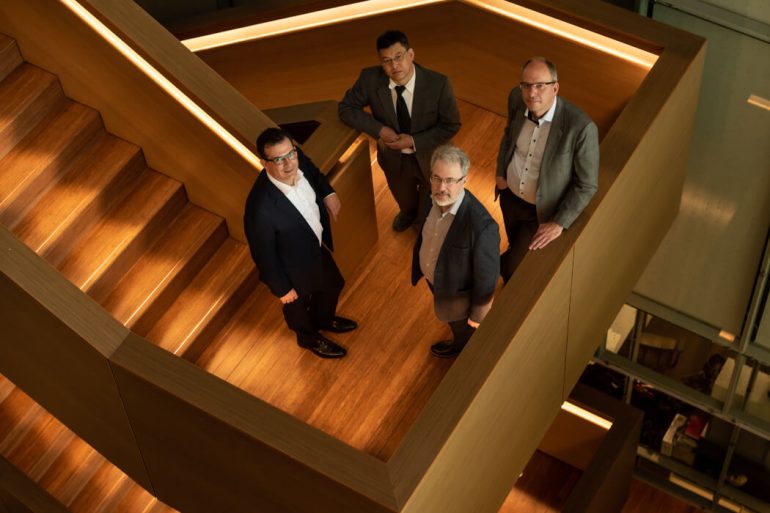

Cryptography experts Michele Mosca, Norbert Lütkenhaus, and David Jao co-founded evolutionQ. With offices in Waterloo, Ont., and Aachen, Germany, EvolutionQ says it works to help organizations ready themselves for quantum computers.

In June of last year, the startup raised over $7 million CAD ($5.5 million USD) in Series A financing, led by Quantonation, a Paris-based, quantum technology-focused VC fund, with support from Toronto’s The Group Ventures, to scale up its quantum-safe cybersecurity tech.

RELATED: Xanadu, Toronto Metropolitan University to develop quantum computing educational program

The research comes as investment and interest in quantum computing are growing.

At the beginning of 2023, the federal government unveiled its National Quantum Strategy (NQS), which is meant to support the growth of Canada’s quantum science and technology ecosystem.

According to the Government of Canada, the NQS will focus on building on Canada’s strength in quantum research, growing the nation’s quantum-ready technologies, companies, and talent, and solidifying the country’s global leadership in the space.

Following the establishment of the NQS, two Canadian global innovation clusters joined forces, launching $30 million in new projects to drive the commercialization of quantum technologies.

NGen and DIGITAL intend to build on Canada’s National Quantum Strategy (NQS) to deliver industry-led commercial projects. The projects are designed to use quantum technologies to solve industrial and societal challenges.

In the interim, Quebec is positioning itself as a leader in the quantum space, establishing infrastructure and welcoming projects and initiatives. Quebec is gaining the Quantum Innovation Zone (DistriQ), a collective of quantum expertise based in Sherbrooke, Que., which will house both a tech hub and a factory.

The factory, announced in June, is being established by the Canadian subsidiary of the French quantum company PASQAL. Though they are two separate initiatives, both will be located in DistriQ’s Espace Quantique 1, a 50,000-sq. ft. building set to open in early fall.

Swedish telecom gear giant Ericsson announced in March that it is establishing a quantum research hub in Montréal. And in January, Québec became home to what will be the world’s fifth IBM quantum supercomputer.

But not everything in the quantum space looks so rosy, D-Wave is a cautionary reminder that the technology is still new and evolving. The company, which was founded in BC in 1999, announced in June that it would be moving its executive office to the United States. Since going public on the New York Stock Exchange last year, D-Wave has been losing money, leaving the company with a “significant cash crunch,” according to The Globe and Mail.

Feature image of EvolutionQ CEO Michele Mosca, Chief Cryptographer David Jao, CTO Norbert Lütkenhaus, and VP Brian Neill, courtesy EvolutionQ.