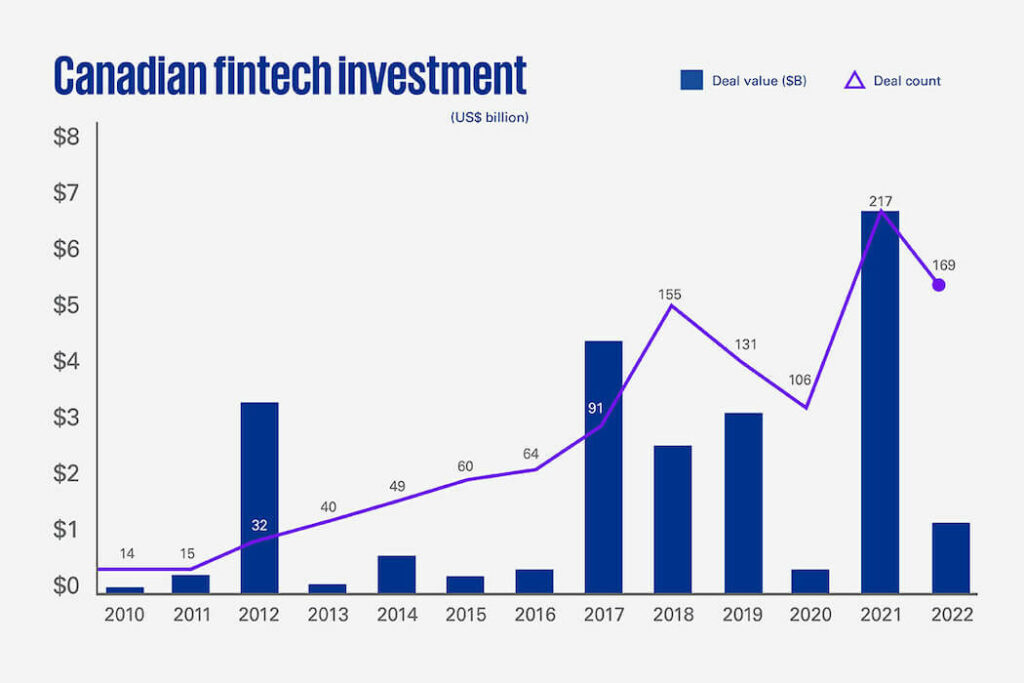

Investment in the Canadian FinTech sector dropped sharply in 2022, despite being the second-best year for deal volume, according to KPMG’s latest report.

The drop also followed a record year for Canadian FinTech investment in 2021.

Deal volume dropped by 22 percent year-over-year while the amount invested fell by 81 percent.

There were 169 Canadian FinTech investments worth $1.3 billion (all numbers USD) in 2022, down from a record 217 deals worth $7 billion in 2021. This is according to data compiled by PitchBook for KPMG. Comparatively, deal volume dropped by 22 percent year-over-year while the amount invested fell by 81 percent from 2021 to 2022.

“It’s not surprising to see a decline given the market rout, and the fact that FinTech investments hit such feverish heights in 2021,” said Geoff Rush, financial services industry leader at KPMG in Canada.

He emphasized that while 2022 saw a drop in investments, there was still stronger activity compared to 2020. “Clearly investors were still finding many attractively priced opportunities,” Rush added, citing last year marking the second-highest number of deals ever.

Looking at where that attraction lies, the KPMG report found the highest number of deals (57) in FinTech last year went to seed rounds. This was followed by early-stage (41 deals) and late-stage (30 deals).

Rush called the number of seed rounds and early-stage investments “a positive sign for the strength of Canada’s FinTech ecosystem going forward,”

The report also noted 20 mergers and acquisitions, seven buyouts, five private equity deals, and nine angel investments. KPMG reported that there were no FinTech initial public offerings (IPOs) in Canada last year, which followed an IPO-heavy 2021.

The majority of the investments came from the first half of last year, which saw $810 million was invested in 85 deals.

The fourth quarter was the weakest quarter of the year, according to KPMG, with 27 deals worth $154.8 million. In terms of year-over-year, the fourth quarter of 2021 saw 52 deals worth $956 million. Comparatively, the first quarter of 2022 saw 41 deals worth $285 million.

By sector, the report found that crypto-assets and blockchain companies garnered the most interest in Canada despite a year of volatility that affected everything from stablecoins to crypto exchanges and lenders. Globally, the “hottest” sector remained payments, which also came in as the number two sector for investment in Canada. RegTech and InsureTech also garnered similar interest last year.

Rush indicated that interest in crypto and blockchain in Canada could be related to efforts around regulation and transparency.

“We expect to see a slimmed-down, more transparent and accountable cryptoasset ecosystem emerge this year,” he said, acknowledging that investor interest in Canadian crypto companies could wane in 2023, but adding that “as long as transparency, trust, regulation and innovation are the forefront, the cryptoasset ecosystem has a sustainable future.”

RELATED: The bottom fell out of Canadian FinTech funding in Q2 2022

The trends in Canadian FinTech investment last year mirrored the global stage. KPMG reported that, around the world, there were 6,006 deals last year worth $164 billion, down from a record 7,321 deals worth $239 billion the previous year. Much like Canada, it was the third-best year for FinTech investment ever and the second-best year for deal volume globally.

Despite the positive signs, the KPMG report highlighted that “the slump” in Canadian and global markets has led to falling valuations compared to the highs of years past. The report stated that it expects this trend to continue.

“A potential recession, rising interest rates and inflationary pressures are top of mind for investors, so we expect valuations and deal volumes to remain subdued through 2023, with a slight pickup near the end of the year,” said Georges Pigeon, a financial services-focused partner at KPMG in Canada.

Pigeon also argued that “the FinTech space is also undergoing a bit of a mentality shift.” He cited the “huge influx of capital from VC investors” in 2021 arguing there is a likelihood that some companies won’t need cash until 2023 or maybe next year.

“So instead of a ‘growth at any cost’ mentality, many FinTechs are now focusing on sensible growth while preserving the cash they have on hand for as long as they can with an eye to achieving sustainable profitability in a not-too-distant future,” Pigeon said.

The change in mentality can be seen across the tech sector, but in FinTech specifically, Canadian companies from crypto exchanges to lenders and challenger banks have adjusted their growth trajectories.

Feature image courtesy Unsplash.