With nearly $4 billion in venture funding raised last year, British Columbia’s tech sector reached new heights in 2021 as startups across the province proved their ability to scale, according to a new report from briefed.in.

“2021 really felt like the year when BC stepped into the spotlight and took its rightful place as a major player on the global tech stage.”

– Chris Neumann, Panache Ventures

Throughout the year, BC tech startups raised $3.96 billion over 140 deals in 2021, putting the province behind only Toronto in the rankings of Canadian tech ecosystems. The province’s tech sector saw an increase in investment of 316 percent from 2020, the second-largest investment increase in Canada for the year, with Toronto maintaining the first-place lead.

Chris Neumann, BC-based partner at Canadian early-stage firm Panache Ventures, believes 2021 represented an “inflection point” for the province.

“2021 really felt like the year when BC stepped into the spotlight and took its rightful place as a major player on the global tech stage,” Neumann told BetaKit. “The successes that happened this year were the result of decades of hard work and a testament to people across the ecosystem.”

The fourth quarter of 2021 saw investment decline in BC compared to the explosive first three quarters. During Q4, total investment reached $662.2 million, a 40 percent decrease from Q3 2021, but still a massive 640 percent increase from Q4 2020.

Though BC’s total venture investment dipped below ten figures in Q4, the region still saw robust activity, with 35 investments closed during the quarter. This total represents a 40 percent increase from Q3 2021, but nearly double the deal volume of Q4 2020. Overall, briefed.in tracked 140 deals throughout the year, a 27 percent increase from 2020.

At one point in 2021, BC venture funding was on par with that of the country’s biggest tech ecosystem, Toronto. Funding reached a record $1.02 billion in Q1 2021, but even that record was quickly eclipsed the following quarter. Neumann said this level of performance “was a long time coming.”

BC tech is still building its identity

Neumann described BC as a province with lots of potential that is still struggling to find its identity among the many verticals of “tech.” Many of Canada’s tech hubs have managed to define themselves by one or two sectors. Toronto, for example, excels in the realm of SaaS and FinTech. Montréal has drawn eyes due to its expertise in artificial intelligence, while sectors like AgTech and CleanTech have put certain cities in the Prairies on the map.

“We must not be under the false illusion that there is ‘enough’ early-stage capital in Canada.”

Per briefed.in, BC companies in a wide variety of sectors managed to clinch major deals over 2021, spanning healthtech, cleantech, gaming, and blockchain. Yet Neumann acknowledged the city has never had a “clear identity.”

“While there have been plenty of individual success stories over the years, outside of gaming, there didn’t ever seem to be enough overlap to allow a cohesive international brand to form,” he noted.

While that sector diversity has contributed to the BC ecosystem’s success, Neumann noted several niche sectors are also beginning to define BC tech, including Web3, AR/VR and applied AI. He said the international community has begun to take notice of BC’s expertise within these fields, adding that he expects companies like Dapper Labs, Beatdapp, Manifold, and Covalent will continue to drive traction in these verticals.

Early-stage funding improves, but BC is not out of the woods yet

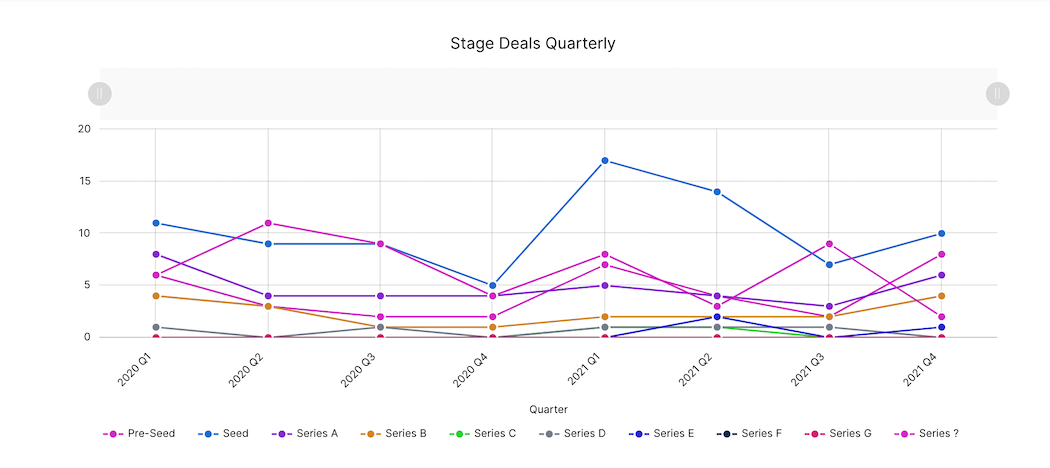

BC’s early-stage funding gap has been a prevailing narrative for the tech sector for several years. But there are signals that this situation improved in 2021. While most stages maintained their levels last year, there was a 62 percent increase in reported pre-seed investments, and a 41 percent increase in seed-stage investments for the region.

“This increase in early-stage funding shows that BC is attracting the funding and talent for continued technology growth and innovation,” briefed.in noted in its report.

While Neumann acknowledged a “dramatic increase of funding” so far in 2022, he disagreed with the notion that early-stage funding is no longer a concern for BC. “There is still a significant early-stage funding gap, not only in BC but across Canada,” he said, adding that the country seriously lacks a competitive ecosystem of pre-seed VCs present relative to other countries.

Other reports have noted an early-stage funding lag across Canada’s tech sector. A 2021 report from the Canadian Venture Capital and Private Equity Association found that average round sizes at the seed stage have grown “only moderately” in comparison to the other stages.

“This gap forces startups to raise larger amounts of early-stage capital from angel investors, which often takes longer and is more challenging,” Neumann said. “Credit to all of the angel investors across the country who are at the foundation of our ecosystem, but we must not be under the false illusion that there is ‘enough’ early-stage capital in Canada.”

Deal volume in the later stages also increased over last year. There were 18 deals in the Series B or higher stages in BC. Some of the most notable of these late-stage investments in BC included General Fusion’s $166 million Series E round of funding, Blockstream’s $266 million Series B funding round, and two major rounds for Vancouver-based Dapper Labs with a combined value of over $600 million.

Unicorns live on the West Coast

Before 2021, BC stood out in Canada due to its lack of tech unicorns. However, not only did venture funding excel in BC last year, one of the most notable developments from the province’s tech ecosystem was the emergence of several unicorns and exits. Some of the most notable include Thinkific’s $184 million IPO, Copperleaf’s $161 million IPO, and Diligent Corporation’s acquisition of Vancouver-based Galvanize for $1 billion.

“There’s a critical inflection point in every major tech ecosystem where the frequency of significant exits shifts from ‘few and far between’ to an expected, regular occurrence,” Neumann said. “When that happens, the flywheel of experience and capital that drives the ecosystem forward accelerates dramatically.”

Neumann said he expects last year’s exits to fuel the funnel of angel capital into companies this year. With that, paired with initiatives like the $500 million InBC fund, Neumann expects funding to remain robust in 2022.

BetaKit is a briefed.in Tech Report media partner.