Investments in software as a service (SaaS) companies reached $1.17 billion so far this year, only 22 percent of the $5.13 billion raised in 2019, according to Ottawa-based accelerator L-Spark’s latest State of Canadian SaaS report.

The number of deals closed this year also shot down from 206 to 127.

The annual report looks at broad trends and figures, industry highlights, investments, valuations, and acquisitions for Canada’s software companies. L-Spark surveyed the SaaS investment from January to September 2020, however its previous SaaS reports measure investment from January to November.

In addition to the drop in total funding, the number of deals closed this year also shot down from 206 to 127. The report comes amid a year of disruption in the tech industry, as the COVID-19 pandemic has impacted startups and their ability to raise capital.

“Although the COVID-19 pandemic has brought unpredictability that has negatively impacted the industry, many SaaS companies continue to accelerate and remain unscathed,” said Leo Lax, CEO of L-Spark.

RELATED: Nearly half of Canadian VC firms have seen a decline in deal flow during COVID-19

L-Spark tracked 127 total deals over the year so far, with 181 investors. Notably, 70 investors were Canadian, 92 were from the United States (US), meaning more US investors are participating in Canada’s SaaS ecosystem than Canadian.

Among the most active Canadian investors were Yaletown Partners, BDC, Panache, MaRS IAF, and Techstars. Other countries that invested in Canadian SaaS startups included the UK, France, Spain, and the Netherlands.

Some notably large deals so far this year include ApplyBoard’s $100 million CAD Series C round, Miovision’s $120 million CAD round, and Semios’ $100 million CAD round.

The report noted 23 exits in Canadian SaaS this year. Top acquisitions so far in 2020 include Versapay’s $95 million acquisition, Rubikloud’s $60 million acquisition, and Quickplay’s $29 million acquisition. Exits over the year still represented a notable decline from 2019’s 45 exits.

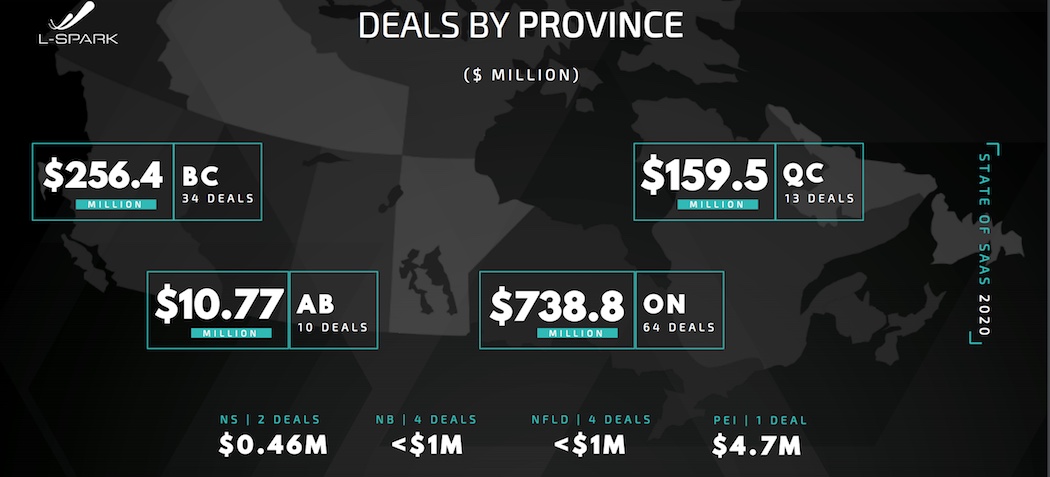

Ontario continues to receive the highest volume of deals and capital, although funding declined from $1.78 billion to $738.8 million in 2020. Quebec also saw a notable decrease in investment, with $159.5 million invested in 2020, representing only one-fifth of the $756.6 million invested in 2019.

Image source Unsplash. Photo by Hack Capital.