Toronto-based FinTech Wealthsimple has partnered with Mercer, a consulting firm for the health and wealth management industries, to launch Mercer’s Invest Wise solution.

“This new service brings investment solutions to the Canadian workforce that were previously only available to the largest retirement plans.”

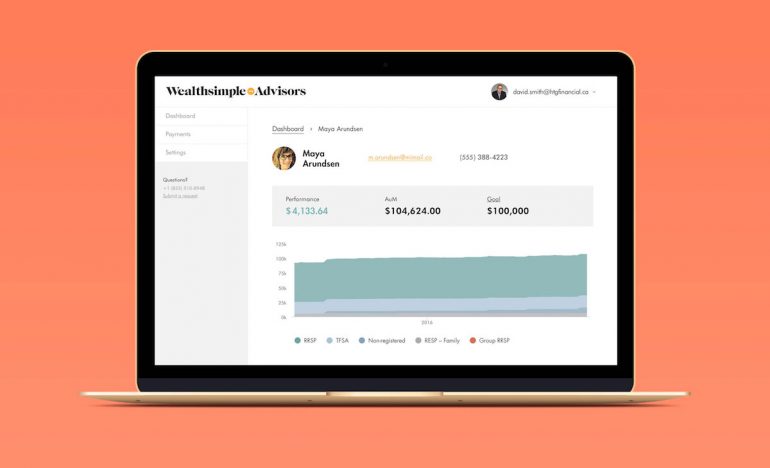

Invest Wise is a white-labelled version of Wealthsimple’s product. The platform combines Wealthsimple’s automated investing technology and Mercer’s curation of portfolios. Canadian employers can offer their employees the service, which allows users to manage retirement savings and digital investing. Mercer is a New York-based wholly owned subsidiary of Marsh & McLennan Companies, a professional services firm in the areas of risk, strategy, and people, which is approaching $17 billion USD in annualized revenue. It has 75,000 consultants in over 130 countries.

“Our mission has always been to enable all Canadians to achieve financial freedom through access to high-quality, low-cost tools and advice that help them manage their wealth and invest wisely,” said Michael Katchen, CEO and co-founder of Wealthsimple. “By collaborating with Mercer to introduce Mercer Invest Wise, we’re able to provide these savings and investment products to even more people, regardless of their life stage or how much money they have to invest.”

While Canadian employees often have multiple savings accounts like TFSAs, RRSPs, RESPs, and pension plans through their employer, Invest Wise allows them to manage a wide array of these accounts in one platform. The goal is to give companies another tool for making benefit packages competitive.

RELATED: Wealthsimple raises $100 million led by Allianz X to build a full stack financial service

“This new service brings investment solutions to the Canadian workforce that were previously only available to the largest retirement plans in the country. It’s an alternative to high-fee, more limited options available in the retail market for people who want to save more in an affordable way, and simply and easily transition into retirement with confidence,” said Jean-Philippe Provost, senior partner and wealth business leader for Mercer Canada.

“With Wealthsimple’s technology, advice, and service, and our investment expertise, users of Mercer Invest Wise can build their savings and drawdown their retirement money, knowing it is being expertly managed at fees that are much lower than the average mutual fund,” he stated.

Wealthsimple has announced several partnerships throughout 2019. In March, it partnered with H&R Block to allow the tax preparation company’s customers to contribute to a Wealthsimple portfolio without management fees in the first year they open their first account. Prior to that, the FinTech partnered with TurboTax, allowing the latter’s users to see the effect RRSPs would have on their taxable income.