Many founders have been vocal about the lack of growth stage funding in Canada, as well as the challenges of scaling.

The Impact Centre at the University of Toronto released a report looking at the scaling issue from another angle: does the way that Canadian companies raise funds impact this scaling problem?

The study compared 49 of Canada’s largest funded tech companies (between $58.8 million CAD to $385 million CAD), and compared them to 49 US Unicorns (valuations over CAD $1.3 billion) from a list by CB Insights. The study named three critical issues: Canadian companies wait longer before they start raising funding, they raise funds less often, and they raise less money over time.

The report recommends a strategy of providing more access to capital for scaling companies, and encouraging them to raise more frequently.

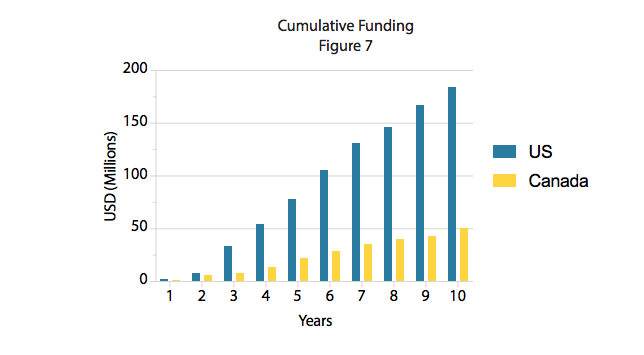

“What US companies raise in four years, Canadian companies take ten years to raise. US companies (in this study) have six times the capital on hand to spend in their first five years of existence on critical functions, such as marketing and sales, which contribute to growth and long-term sustainability,” the report reads. “The result is that, starved for funds, Canadian companies grow at a 47 percent compound annual growth rate (CAGR) while US firms grow significantly faster at a CAGR of 63 percent.”

The report says that this slow growth makes Canadian investment opportunities look unattractive, as US VCs willing to move to Europe, China, or India become less interested in what they see as slower-growth companies in Canada.

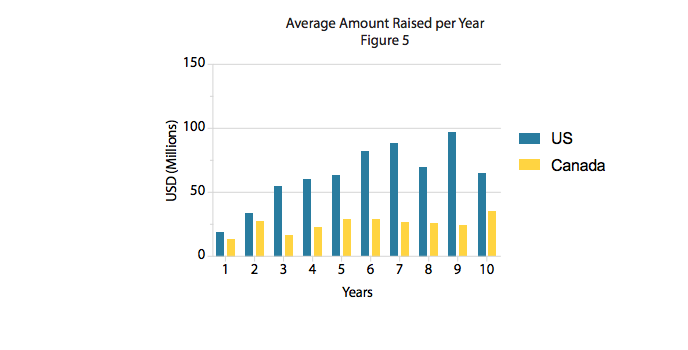

While the average American firm in the study started to raise money 2.2 years after launch, the average Canadian company waited 3.63 years before seeking investments. Canadian companies also take longer to raise follow-on investments; while US firms raise funding every 1.3 years, Canadian firms raise every second year.

“This means that Canadian firms must make their funds last longer and spread out between

essential business functions,” the report reads.

The report adds that there is a “striking difference” between Canadian and US companies right from the moment they begin fundraising. While a typical Canadian firm raises about 70 to 80 percent of the money raised by US firms in the first two years, the gaps after the third year are significant. “The highest fundraisers in Canada raise an estimated 35 percent of the amount obtained by their US counterparts.”

The cumulative effects of these fundraising trends add up: the average US firm raised a total of CAD $240 million within ten years, while an average Canadian company raised only CAD $65 million.

Although the CAGR of Canadian firms stood at a healthy 47 percent, the American firms in the study had a CAGR of 63 percent. The report notes that the US unicorns included in the story were from the bottom half (49 to 97) of a CB Insights list of 97 Unicorn companies. The top half, which includes companies like SpaceX and Airbnb, had a CAGR of 99 percent.

“Let us assume you are a large Silicon Valley-based venture capitalist with billions of dollars under management, and you see CAGRs of 63 percent from just the bottom half of US unicorns within the CB Insights database,” the report reads. “What will your reaction be if you are presented with an opportunity to invest in one of the best Canadian companies with CAGRs of 47 percent? Based on these numbers alone, you would probably conclude that Canadian companies would not be such an attractive investment opportunity.”

Overall, the report recommends a strategy of providing more access to capital for scaling companies, encouraging companies to raise more frequently, and turning these growth companies into world-class companies. Currently, Canada does not have a large enough pool of capital to fund companies through private firms, and the funds through governments and arm’s length organizations remain small.

Access the full report here.