Montreal-based FinTech company Mobeewave, which is dedicated to creating mobile, contactless payment solutions, is officially one step closer to realizing its vision of helping mobile drive the next generation of commerce — its PayMeTap application, which allows users to securely accept a payment by tapping their phone with a credit card, has officially opened out of its closed beta.

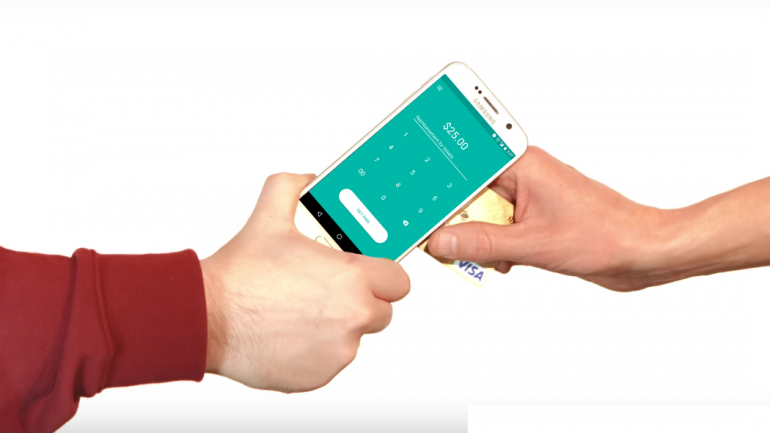

Unlike offerings like Square, which target small business owners looking to accept payments more seamlessly, PayMeTap targets the everyday users looking for an easier way to process payments. Using NFC, users can tap the card they want to charge to their phone, and money is deposited to their account within 48 hours, after which they can even send a receipt.

“The flexibility offered by mobile contactless payment is great, it doesn’t meet all of a user’s needs. People also need contactless payment services that enable them to get paid.”

– Benjamin du Haÿs

“People are using it to easily pay friends and family members back; fundraisers are using it to collect donations; and service providers – like tutors, babysitters, landscapers – are using it to get paid what they’re owed,” said Maxime de Nanclas, COO and co-founder of Mobeewave. “It can also be an excellent way for accepting payment from people you don’t know. For example, imagine you’re having a garage sale. PayMeTap gives you the flexibility to accept payment by credit card for the items you’re selling. And the person buying from you isn’t forced to give you his personal information, his email address or sign up to the same service.

What’s more, the person making the payment doesn’t need to be signed up for the service, and PayMeTap doesn’t store credit card information to the cloud, nor does it allow encrypted personal information to be stored on the phone. de Nanclas said that in particular, markets like Australia, Canada, and the UK — coupled with Apple and Samsung’s activity in the contactless payments area — show that it will only continue to become the norm, and Mobeewave is looking to establish itself in the space early. “While the flexibility offered by mobile contactless payment is great, it doesn’t meet all of a user’s needs. Just as they have the option to make payments, people also need contactless payment services that enable them to get paid,” said Benjamin du Haÿs, CEO and co-founder

The app, which is available on Android, will initially launch across Canada as the company said that this is a market with high contactless payment usage — though Mobeewave which was recently selected as a finalist in the Payment and FinTech category of the eighth annual 2016 SXSW Accelerator Competition, doesn’t show signs of slowing down. It raised a $6.5 million series A last year, and was recognized as the Best Mobile Security Solution at the 2015 SESAMES Awards organized by CARTES SECURE CONNEXIONS.

“The flexibility offered by mobile contactless payment is great, it doesn’t meet all of a user’s needs. Just as they have the option to make payments, people also need contactless payment services that enable them to get paid,” said de Nanclas. “We wanted to create a pilot campaign that offered users across Canada the chance to get paid using their mobile devices. By doing so, we hope to get a clear understanding of the kinds of people who use mobile P2P payment and how we can best meet their needs.”