Raymond Luk agrees with my conceit that Canadian entrepreneurs have a natural predisposition towards building B2B companies.

“For Canada, and first-time entrepreneurs, and the state of our ecosystem, B2B is a real natural fit,” he says, adding that startups looking to solve real problems for other businesses often have a quicker path to revenue. “In our case, we found a problem that no one really wanted to solve.”

That problem is one of data, specifically the financial data coming from equity or debt-invested companies, which should be going to their investors. But it’s not that simple.

“There’s so much focus on pre-investment – it’s a very sexy industry because people like reading about money.”

“There’s so much focus on pre-investment – finding good deals, raising money online – it’s a very sexy industry because people like reading about money. But behind closed doors, all the investors and funds that I talk to say that ‘after we write the cheque, we don’t have the stream of information’. We focused on the problem of, ‘what happens after a fund makes their investments’?”

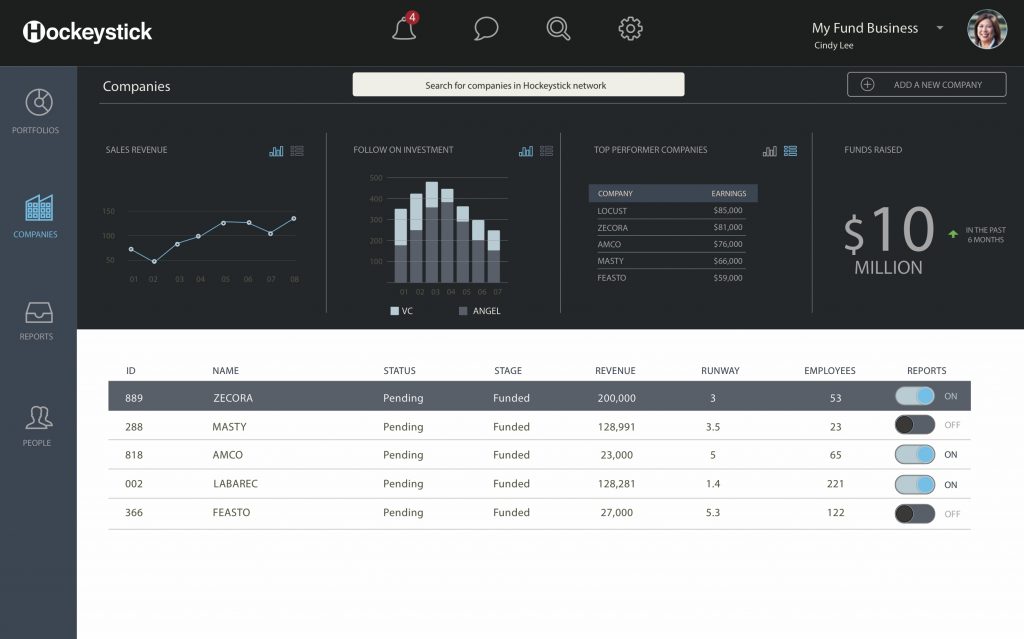

Luk’s company, Hockeystick, provides that post-investment stream of information through a variety of dashboards and reports, consolidating financial statements and cash statements, fundraising details, CEO updates and asks into one handy platform for each company in an investor’s portfolio. Hockeystick already has over 10,000 private companies on the platform, providing data to both VC and private equity investors with funds ranging from 100 to 5,000 companies in their portfolio.

“The hard part is getting the data,” Luk says, indicating that Hockeystick did the hard work of integrating with financial tools like QuickBooks to automate grabbing the data to make it very easy for entrepreneurs. He argues that this frees up investors to focus less on making sure the proper information is being delivered, and more on helping their portfolio succeed.

“The scariest thing for a CEO is starting every quarter with a blank email and having to generate good news, because that’s what they feel like they have to do,” he says. “With out platform, our investors design forms where it’s like ’tell us the bad news first’.”

While Hockeystick saves entrepreneurs from blank emails or ancient Excel spreadsheets, Luk acknowledges that some may balk at so much internal information flowing so freely to investors. However, he counters that those entrepreneurs looking to hide their company’s reality from investors are generally facing bigger problems.

“Entrepreneurs forget: yes, you’ve raised your first round, but every update, meeting, coffee is you raising your next round from investors. If those investors decide not to invest, it’s a huge negative signal to the next guy.”

“We’re getting extremely accurate data that nobody has.”

With that in mind, Hockeystick has raised its own $600,000 seed round from a group of U.S. and Canadian investors, including LaunchPad Venture Group, BDC Capital, York Angels, and Spark Angels (disclosure: as a HIGHLINE portfolio company, Hockeystick sat across from BetaKit for awhile in HIGHLINE Toronto’s co-working space). It’s a move that Luk says he avoided “as long as possible.”

“When you’re experimenting, you’re basically learning, the worst thing you can do is raise money,” he says. “Because raising money is about selling a business plan and the implication that ‘I will deliver this result for you’. it makes it harder to pivot. It’s easier under the microscope of a customer kicking your butt, because when you fix something you get your next stipend.”

But with consistent revenue (Hockeystick charges investors anywhere from $200 to $2,000 a month for access to their portfolio’s data) and a low burn, Luk felt that the model was sturdy enough to start gathering capital for the second phase of the plan: building the tools to make all the portfolio data the company is collecting useful at a meta-level.

“Our bigger vision is that all the operational data companies generate is really useful,” Luk says. “You can apply data science to it. We see a future where you can take that data and run predictive analytics on it.”

Luk believes that soon Hockeystick will be able to compete with investment databases like CB Insights, which rely mostly on survey data. By getting their info direct from the source – the startups themselves – Hockeystick is operating at a higher level of data fidelity. “We’re getting extremely accurate data that nobody has,” Luk says.

While his team builds out those tools and APIs to turn their data into insights, Luk is already looking to raise Hockeystick’s next round.

“I believe that you raise the amount you need plus a little bit to get to the next milestone. If you raise too much more than that, you just dilute at a really early stage. It kind of keeps the business honest.”