This week, Visa Canada hosted its first-ever Visa Developer conference as the company looks to expand beyond the payments space, where it’s found most of its success.

“This is all fairly new to us. We’ve been operating for 50 to 60 years in Canada, and grown into what many in Visa see as the most sophisticated payments market,” Brian Weiner, vice president of product and strategy at Visa Canada, said at the top of the event. “What we haven’t been sophisticated at is engaging with developer community and core institutions we deal with on a daily basis.”

“Tomorrow’s customer experience requires collaboration and co-creation” – Stacey Madge, President of @VisaCA #VisaMeetup pic.twitter.com/uB5hQehSOj

— VisaDeveloper (@VisaDeveloper) June 13, 2018

Two years ago, Visa opened up its Visa Developer ecosystem, allowing developers to access the company’s APIs and work with Visa payment products and capabilities. It’s the result of changing consumer expectations—as technology like chatbots and AI make experiences more intuitive and streamlined for customers, Visa has been pushed to innovate.

“If you look back decades ago, if you said ‘let’s open up the network,’ people would say ‘are you crazy? It’s secure, we can’t open up the network,’” said Derek Colfer, head of digital product at Visa Canada. “But we’re not opening up the core of the network, we’re opening up the edges.”

“Our brand will still be integral, but I also think volume in the network is critical.”

– Derek Colfer, head of digital product at Visa Canada

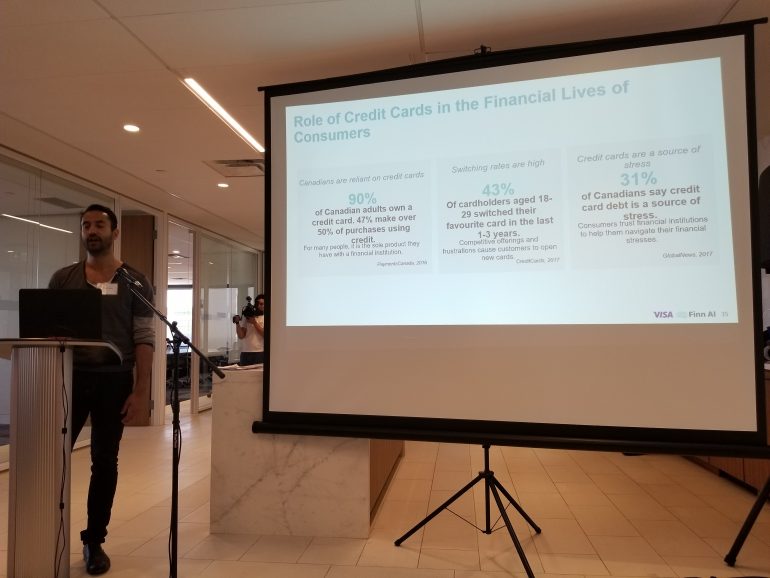

The event showcased use cases for Visa’s APIs to the developers in the room curious about what Visa could offer. Companies like Finn AI, which builds white-labelled chatbots for financial institutions, have used the Visa Developer platform to add more capabilities for its system. For example, users can request that a lost card be frozen, and unfreeze it if they find their card again. On the other hand, Peoples Payment solution, which offers payment processing, are bringing the company’s P2P Visa Direct to the enterprise.

As FinTechs have disrupted most of the services that financial institutions offer, there is a growing need for collaboration. Banks can offer security and consumer trust, while startups can move nimbly and stay on top of consumer trends. Colfer stressed that the company is “opening up the the edges” of its platform by providing access to its APIs. While Visa has taken more of a co-creation approach with companies like Finn AI in developing its ecosystem, the hope is to get as many users as possible on Visa Developer working in the sandbox.

“Our brand will still be integral, but I also think volume in the network is critical,” said Colfer. “As we move away from plastic and into digital forms, our brand will still be there, you’ll still see a Visa logo, but it will take a different form.”