While some of us might think the job of a venture capitalist mostly entails socializing at events with people who want their money, this is not entirely accurate. Our Venture Capital Insider, Ilan Saks, delves into the daily doings of these ‘gatekeepers of gold’.

Saks spent time working under the partners at Real Ventures before he moved on to start The Founder Project, an entirely student-run VC firm. -Joseph Czikk

The classic stereotypical view of a venture capitalist’s job is to sit back and listen to business pitches all day. However, that’s just a fraction of what they really do. While my time at Real Ventures was mainly spent crunching numbers I can tell you it’s the partners at venture capital funds who get to do the fun stuff.

Brad Feld, the managing director of Foundry Group and the author of Venture Deals, bluntly told me “VCs take meetings, do tons of emails, and are professional phone callers.” It makes sense: when entrepreneurs want your money, portfolio companies want advice, and limited partners want returns on their investment, it translates to meetings, emails, and phone calls.

But, for the time being, let’s dive into the four categories that iNovia Capital’s Chris Arsenault outlined in a little more detail:

1. Listening to Pitches

Venture Capitalists listen to hundreds of pitches every year. But, the pitch is just the tip of the iceberg. VCs have to ‘source’ potential deals, or to look for investment opportunities.

Venture Capitalists are always looking for entrepreneurs and startups to invest in, whether it’s at a networking event, a conference or any other event. There are a number of ways VCs source deals. They might get referrals from reliable sources such as past entrepreneurs they’ve invested in, other venture capitalists, lawyers or accountants.

Sometimes venture capitalists will receive cold emails from individuals, however, they’re (obviously) less likely to respond. The rationale follows that if you are truly an entrepreneur you’ll find somebody who knows them and have them introduce you to them. If you’re incapable of doing that, then you’re not a true entrepreneur. Period. I know… it’s sort of harsh.

(Editor’s Note: My Jewish friends often refer to what Saks is describing here as “chutzpah”, loosely defined as “the quality of audacity”)

2. Limited Partner and Fund Management

VCs are usually required by their limited partners to report the fund’s progress on a quarterly basis. These tasks are usually left to analysts, associates or accountants.

Limited partners usually want to know how many investments a fund makes each quarter, what their pitch-to-investment ratio is, what the average size of the investments are and what the valuation of those investments are today. Essentially, limited partners want to be know how their investment in the fund is performing. Often times, limited partners will ask for a snapshot of the progress of each of the fund’s portfolio companies.

VCs are also responsible for managing the day to day activities of the fund. Such activities include, hiring (and firing) employees, marketing for the fund, managing the pipeline and more. All of these tasks can take up significant time.

3. Networking

VCs are networking kings. Think about it: every month VCs meet hundreds of entrepreneurs in multiple industries, are constantly working with lawyers, accountants and other investors, and are always on the hunt to find talent for their portfolio companies.

Whether it’s at networking events, startup demo-days, or in one on one meetings, VCs encounter hundreds of interactions each month in different cities, and different industries.

4. Helping Portfolio Companies

The best VCs will take significant time to help their portfolio companies. Most VCs spend much of their time meeting and advising entrepreneurs within their portfolio (in best practices, strategy, expansion, etc.). Great VCs will find innovative ways to solve problems for their portfolio companies.

A big area where VCs help is in assisting portfolio companies to find talent. When startups are growing they often find themselves needing talent, quickly. Oftentimes the startups will reach out to the VCs in the hopes that in their wide network they’ll know the right person.

Finally, when it comes time, VCs will often play an active role in helping a startup exit or get acquired. After all, it’s in their best interests.

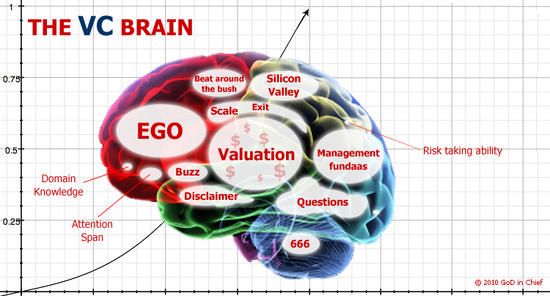

Here’s a little graphic I made summing up a discussion I had with Arsenault, showing how partners of venture capital funds spend their time: