Toronto’s venture funding in 2022 may have dipped from a record-breaking 2021, but still far surpassed 2020 and 2019, signalling a “return to sanity” for the city’s tech sector.

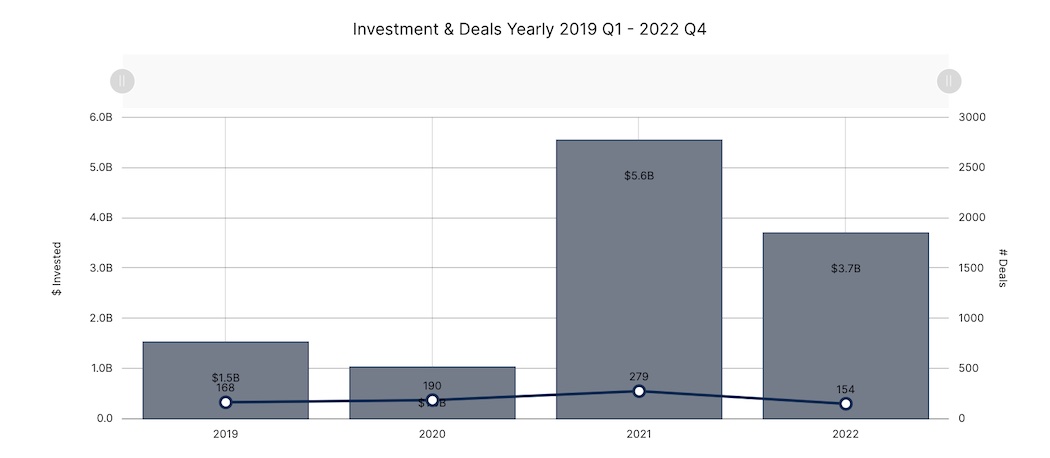

According to a recent report from briefed.in, Toronto tech startups raised a collective $3.7 billion through 154 deals in 2022. Venture funding decreased by 33 percent from 2021, but still vastly outpaced the level of funding briefed.in tracked across 2019 and 2020. In fact, Toronto’s tech startups raised twice the amount of money in 2022 compared to 2019, and more than triple that of 2020.

Jamie Rosenblatt, partner at Golden Ventures, believes the last three years for Toronto tech have looked like a “play in three acts.” The first act in 2020, he said, saw the creation of a funding bubble fuelled by “low interest rates, excessive government stimulus, and a consumer spending largesse.” The second act in 2021 was Toronto’s “crescendo,” the year where “anything can be a unicorn,” and the third act in 2022 saw inflation creep up and policymakers increase rates. “Higher rates mean lower valuations and a return to sanity,” he said.

The fourth and final quarter was an interesting one for the city’s tech sector. After experiencing significant declines in funding during the second and third quarters of 2022, Toronto venture funding shot up to $1 billion in Q4. Rosenblatt said this sudden jump could be due to a more confident investor pool that was able to better forecast interest rates and the impact they were having on public market valuation multiples.

“This stabilization helped to slowly reset expectations from founders and investors who were not quite ready to say goodbye to the halcyon pricing of 2021,” Rosenblatt said.

Some reports, including one recently cited by OMERS Ventures partner Laura Lenz, suggest a sizeable portion of Canadian tech funding deals in Q4 2022 were down rounds or bridge rounds, indicating that startups are still feeling the squeeze on valuations.

In recent months, Lenz and other Canadian investors have also expressed unease over LPs failing to fulfill capital calls from VCs, which is having an immediate effect on Canadian startups. According to several sources who spoke to BetaKit in January, these liquidity issues are leading investors to withdraw funds at the last minute, even after term sheets have been signed.

Despite the ostensibly healthy funding levels in Toronto, 2022 represented the slowest year for deal volume in the last four for the city, with only 154 deals tracked by briefed.in during the year. It’s a substantial decline from the 279 deals closed in 2021, but more on par with the 168 deals in 2019 and the 190 deals closed in 2020.

The lower deal volume in 2022 could indicate that VCs’ liquidity issues are stalling the pace of deals. Rosenblatt believes this is another reflection of Toronto’s return to normal, as diligence processes have grown longer and traction expectations and the bar for financing have risen higher. “Relative to the velocity of 2021, I think 2022 was a shift towards a healthier, more sustainable equilibrium,” he said.

A stunted generation

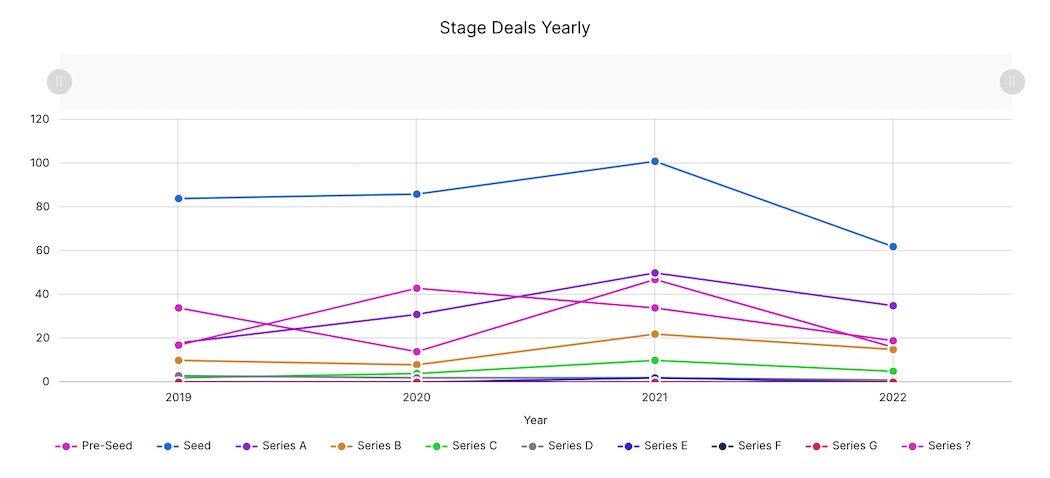

briefed.in tracked a total of 62 seed-stage deals and 16 pre-seed-stage deals in Toronto in 2022. Collectively, pre-seed and seed-stage deal volume declined by 44 percent between 2021 and 2022. More alarming still, early-stage deal volume hit a four-year low in 2022 and was noticeably lower than the deal volume tracked in 2019 and 2020.

briefed.in’s data is collected from founders who submit their deal information directly, or from online, public sources, and not all companies or investors publicly disclose early-stage deals. Still, the lack of early-stage funding is a problem that appears to have emerged before 2022.

Even in 2021, when Canada’s late-stage startups were raising blockbuster deals, there was a persistent drought at the seed stage. Early-stage risk capital represents the first step in the startup’s growth pipeline, and a contracting supply of this seed support could cripple the growth of an entire generation of Toronto tech companies.

“There is a historic amount of dry powder available. I think on the VC side, investors need to start taking bigger risks in emerging categories,” Rosenblatt said. “Chasing quick markups in overfunded categories is not a long-term recipe for success.”

A megadeal comeback in Q4

Late-stage funding and deals generally slowed down in Toronto in 2022. According to briefed.in’s data, the average size of a Series B funding round in Toronto fell from $72 million in 2021 to $52 million in 2022, and similar declines were also tracked in the Series D and E stages. There were also slight drops in deal volume in the later stages between 2021 and 2022.

Megadeals, or deals valued at more than $100 million, were commonplace in Toronto during 2021, but seemed to drop off the face of the earth in the middle of 2022. For one point of comparison, briefed.in tracked 14 megadeals in Toronto during Q3 2021, but zero in the third quarter of 2022.

However, the fourth quarter of 2022 saw the megadeal make a comeback, specifically with TouchBistro’s $150 million round of funding and Xanadu’s $132.6 million Series C round of funding. Rosenblatt believes the megadeal comeback at year’s end is not all that surprising.

“Interest rate changes have their most dramatic impact on late-stage investment activity. If you believe that investors had a better handle on the rate environment towards the end of 2022, it would make sense to see an uptick in activity of this sort,” he added.

With the third act complete, what’s the encore?

Toronto’s 2022 venture funding results may have exceeded expectations given the macroeconomic environment, but these factors are still casting a dark cloud over the tech sector’s 2023 prospects, as central bankers continue grapple with inflation and investors come to terms with the steep declines in tech valuations.

The first two months of 2023 have not brought much reprieve from the challenges of the previous year. Startups and unicorns in Toronto and across Canada have continued the trend of layoffs seen throughout 2022, and the future of the city’s fundraising environment remains uncertain.

Several VCs have speculated that the current market turbulence may ultimately give rise to stronger, more sustainable companies, provided that companies act strategically. In a recent report by the Canadian Venture Capital & Private Equity Association (CVCA), Sanjay Zimmerman, a partner at White Star Capital, said the economic conditions of 2022 are forcing investors to refocus on capital-efficient and recession-proof businesses.

Should this approach continue to hold sway over investors, Rosenblatt said he “can’t help but be excited about what’s going to be built” in Toronto in the coming years.

“When a bubble bursts, it is incredibly painful, particularly at an individual level,” Rosenblatt added. “But the evidence is unequivocal: following these periods of upheaval, you see more innovation, better companies, and elevated returns.”

briefed.in is owned and operated by Communitech. BetaKit receives data from briefed.in as part of a media partnership with Communitech and retains full editorial control of all articles that reference the data produced by briefed.in/Communitech.