Healthtech has emerged as a leading vertical for venture capital investment in the Greater Toronto Area (GTA) as COVID-19 pushed governments and institutions to embrace health innovation.

According to Hockeystick’s fourth-quarter GTA Tech Report, the GTA tech ecosystem had 186 investments totalling $1.2 billion over 2020. While the top three company investments were in property tech, EdTech, and AI, healthtech led in overall investment with $186 million in funding, followed by biotech with $134 million in funding.

Hockeystick compiles data from both public and private sources and through partnerships with tech industry organizations. Hockeystick is the official data platform of the CVCA.

The Greater Toronto Area attracted the most dollars for healthtech out of all the ecosystems surveyed by Hockeystick, said Rob Darling, research partner at Hockeystick. This includes BC, Waterloo Region, Calgary, and the Greater Montréal Area.

Still, healthtech was a major theme across the country. “If you look across the five ecosystems that we covered, the healthtech vertical has jumped to the top two for all of them,” Darling said.

Consistent support across all areas

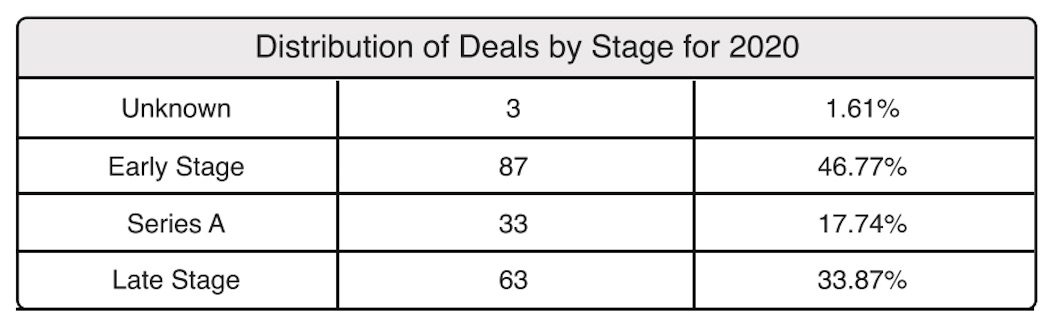

In a year where most quarters didn’t perform well compared to 2019, there are strong signs of health for the GTA ecosystem, with support for startups at all stages of growth. Early-stage deals accounted for 47 percent, while Series A and late-stage deals accounted for 18 percent and 34 percent, respectively.

Grouping deals by stage, Toronto exhibited a “barbell effect” with a healthy amount of distribution between stages. Most deals closed were in the early stage, at 87, while late-stage deals were second, at 63.

“When we look at grouping deals in the early stage, Series A, and late stage, that creates that barbell,” says Darling. “You’ve got big, you’ve got little in series A and then you’ve got a big again [in the late stage].”

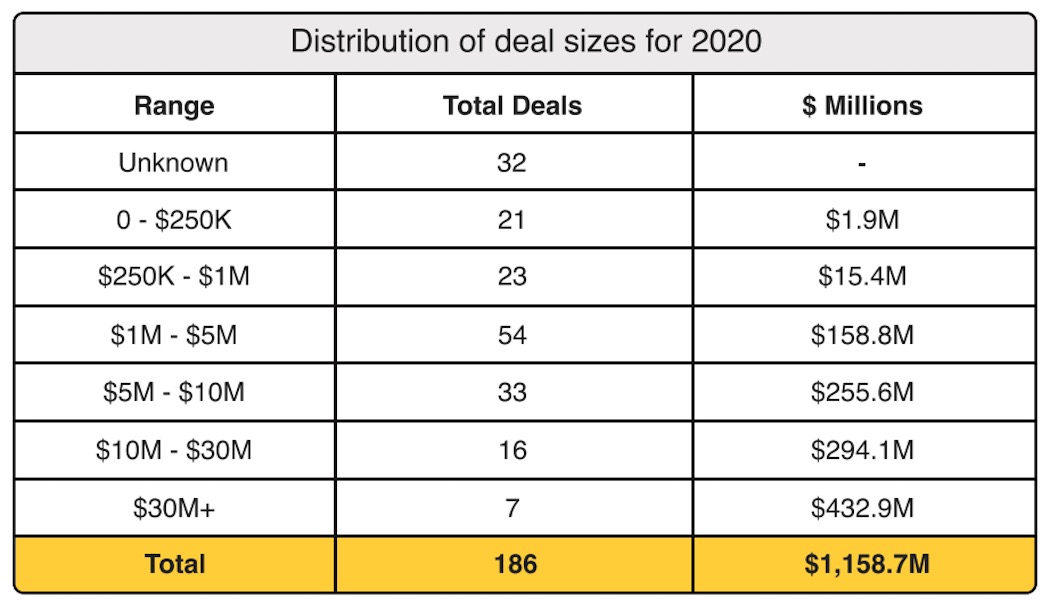

Deal sizes also showed a healthy distribution across each range, though the $30 million-plus category was the lowest, at seven deals. Darling said that grouping by deal ranges and breaking it down by funding, as shown in the chart below, tends to look more like a “funnel” than a barbell.

“You tend to see a large amount in the early stages…and then less as it gets to the later stages. It’s seven [in Toronto], and if you look across all the ecosystems that’s pretty consistent,” said Darling. “Large deals, like 30 million-plus deals, are large deals for Canada. I don’t think there’s anything to be concerned about.”

The top deals of the year included proptech Properly, which raised $100 million; edtech software company Top Hat, which raised $74.5 million; and AI startup Ada, which raised $63.7 million. While these large deals were in property tech, edtech, and AI, respectively, healthtech and biotech were leading verticals. In 2020, 193 investors participated in deals in the GTA.

RELATED: New report shows Montreal caught up to Toronto as Canada’s leading tech ecosystem in 2020

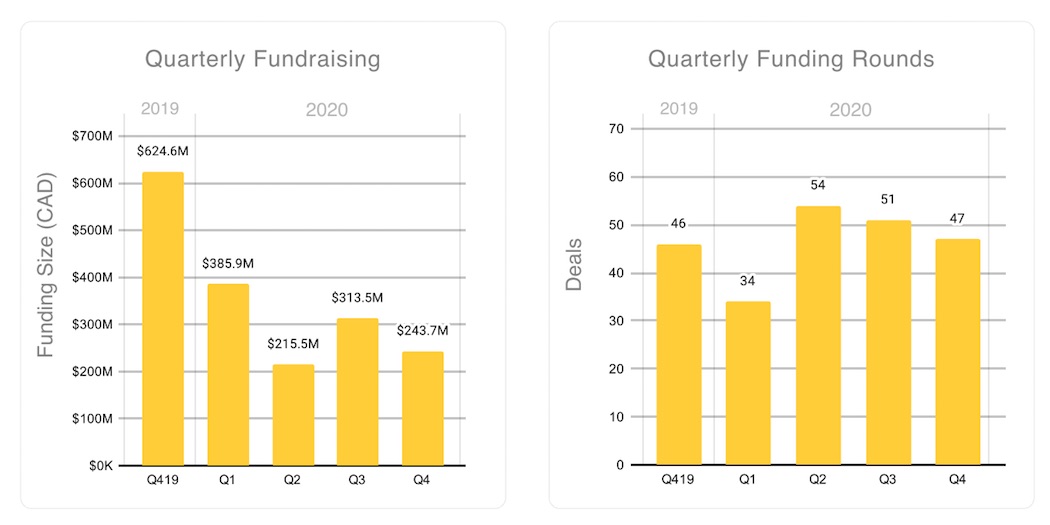

While Q3 2020’s performance made up for a lacklustre first half of 2020, Q4 2020’s investing environment was down overall compared to Q3 2020. In total, $243.7 million was raised, down 22 percent over Q3 2020. There were 47 deals in Q4 2020, down 7 percent over Q3 2020, and 57 investors in Q4 2020, down 30 percent over Q3 2020.

Darling was unsurprised that the GTA saw more activity in Q3 2020 than all other quarters — as investors began to adjust to the new reality of COVID-19.

“In Q2 [companies] would have started to see more demand because more people would have been shopping online,” Darling said. “People would have been adjusting to COVID, things would have been shut down, shopping online from home, using more digital tools, businesses having to do remote work. All those things would have created demand for these platforms.”

Year-over-year, Q4 2020 was also down more than 60 percent in funding compared to Q4 2019, due largely to two deals in Q4 2019 totalling $379 million combined: 1Password and Geneseeq.

In Q4 2020, the top deals included $33.9 million for Gatik, an autonomous driving solution for B2B short-haul logistics; $14.5 million for TailScale, which makes network security accessible to teams of any scale; and $13.6 million for Janpix, which is developing compounds that attack various forms of cancer. On a quarterly basis, Q4 2020 was led in deals by the FinTech, healthtech, analytics and biotech verticals, with FinTech and logistics tech leading in capital raised.

Healthtech a vertical to watch in Toronto

Many institutions have supported healthtech innovation in the Greater Toronto Area, setting the foundation for the strong healthtech investment seen this year. With hubs like the MaRS Discovery District, world-renowned hospitals like SickKids, and many post-secondary institutions operating in close proximity, Toronto has built the foundation to be a healthtech research hub. But capitalizing on that investment has been a challenge across Canada.

In the past, Canadian healthtech entrepreneurs have seen significant challenges to commercializing and selling unique to the sector. It’s been a combination of several factors: the complexity of navigating procurement from the government (a key buyer of healthtech technologies); an industry slower to adopt emerging technologies; and a fragmented regulatory landscape that varies across Canada’s 13 provinces and territories.

COVID-19 has forced healthcare professionals to adopt remote healthcare and an appetite for innovation, as scientists and researchers worldwide scrambled to find a vaccine and other solutions to COVID-19. While Ontario’s COVID-19 response has been scrutinized for its confusing vaccine registration system and general aversion to the advice of its own Science Advisory Table, startups have stepped in eager to help when they can. Toronto-based BookJane is helping Peel Region mobilize healthcare workers, and in March, Maple, a Toronto-based virtual care company, began offering online COVID-19 screenings covered by the provincially-run Ontario Health Insurance Plan.

“The maturity of investment in healthtech has increased in Toronto and there’s more of an ecosystem being developed,” said Daring. “I think we should continue to watch Toronto as a potential hotbed for healthtech.”

BetaKit is a Hockeystick Tech Report media partner.