Shop.ca has filed for bankruptcy, according to documents obtained by BetaKit. The news comes just six months after Shop.ca board member Tony Chvala replaced James Haggarty as CEO to right the ship of the struggling Canadian e-commerce player, which acts as a marketplace between consumers and merchants.

The Toronto-based company filed for bankruptcy on June 7th, and as part of filing submitted a notice to the Office of the Superintendent of Bankruptcy Canada asking for an order approving:

- a filing extension and protection from creditors until July 16th

- in order to complete a sale of Shop.ca and its assets

- while approving Key Employee Retention Agreements (KERAs) and payment arrangements to the lawyers and financial consultants filing on Shop.ca’s behalf

The motion was approved by the Ontario Superior Court of Justice on June 9th, and Shop.ca’s creditors (over 150 in total) were notified on June 14th.

UPDATE (07/08/16): Shop.ca lays off 30 employees in advance of potential sale

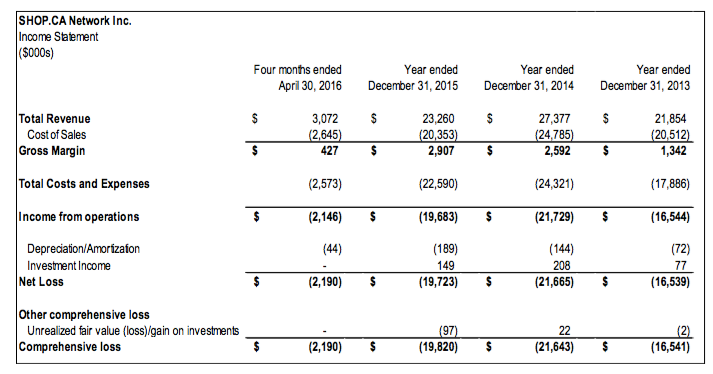

Shop.ca’s financial status

The documents obtained by BetaKit paint a dire picture of Shop.ca’s current financial status. As of June 5th, the company had approximately $1.5 million in cash remaining, down from $2.3 million on April 30th. Based upon Shop.ca’s own projected expenses the company will have less than $100,000 by the July 16th deadline, depleting all cash reserves by August 2016.

Shop.ca’s financial reality is particularly shocking when placed against the company’s equity financing, totaling just over $72 million CAD from 2011-2015. Shop.ca’ last reported funding round was a $31 million Series B in May of 2014, but the company privately raised a $13 million Series C round in May of last 2015, issuing common shares to existing investors (past investors include: Shaw Ventures, Torstar Corporation, Slaight Communications, Difference Capital, and Don Tapscott, among others).

Over five years Shop.ca raised $72 million in equity financing and in less than six lost it all.

However, for the last three years, Shop.ca has suffered comprehensive losses of $16.5 million, $21.6 million, and $19.8 million in 2013, 2014, and 2015, respectively. The company’s comprehensive losses in 2016 up to April 30th totaled $2.2 million, and cumulative losses since the company’s founding are over $72 million.

To simplify, over five years Shop.ca raised $72 million in equity financing and in less than six lost it all.

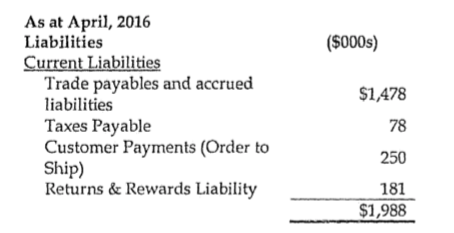

As of April 30th, Shop.ca’s net book value was $4.055 million, with $2.3 million of that amount being the company’s aforementioned remaining cash and cash equivalents, and $1 million being intangible assets (defined in the documents as customer goodwill, brand and domain name, IP, etc.). However, as of April, Shop.ca has liabilities of approximately $1.99 million, consisting mostly predominantly of trade payables and accruals owed to merchants (Shop.ca says it is current on all trade payables as of June 2, operating on a “net 15” term).

In addition to the above liabilities, Shop.ca also has contingent liabilities estimated up to $2 million, consisting of potential termination and severance obligations owed to employees. This leaves Shop.ca potentially liable for more than it has on hand. According to a sworn affidavit by Shop.ca CFO Robert Lee (dated June 8th):

“If all current, future and contingent liabilities were to crystallize during the upcoming days, [Shop.ca] would be unable to meet its financial obligations as they become due. [Shop.ca] is effectively in the vicinity of insolvency and without the stabilization and breathing space provided by the [request for creditor protection extending to July 16], [Shop.ca] will continue to deplete all its cash resources preventing any going-concern solution or even an orderly wind-up or dissolution.”

Selling Shop.ca

While Shop.ca’s “vicinity of insolvency” forced the company’s hand to pursue a sale, documents BetaKit obtained indicate the company has been attempting to either find further financing or sell the business since August 2015 (5 months before Chvala replaced Haggarty as CEO).

Shop.ca has been attempting to either find further financing or sell the business since August 2015.

At that time, Shop.ca reached out to Canaccord Genuity Corp. to provide the company with a strategic review and approach potential purchasers or investors. Shortly after, in October of that year, Shop.ca laid off 28 employees and reduced its marketing budget throughout Q4 in an effort to reduce costs.

Canaccord approached approximately 25 potential purchasers and found significant interest. In April of this year, Shop.ca received two separate letters of intent to purchase common shares of the company, but a final deal could not be obtained; at that time, Canaccord removed itself from Shop.ca’s sale process. Also at that time began an exodus from Shop.ca’s board of directors, with six directors resigning over the last eight weeks. Only Chvala, former CEO Drew Green (now CEO of Indochino), and President Trevor Newell remain as directors.

According to documents obtained by BetaKit, in May of this year, Chvala approached 17 different potential purchasers of Shop.ca, including some of those originally approached by Canaccord, in addition to canvassing prior investors for additional funding. Chvala was able to secure three letters of intent to purchase Shop.ca’s share capital or assets, with one getting as close as an 11-day exclusivity period, with the potential purchaser that offered “the highest value and minimal closing conditions relative to the other bids,” according to Lee’s affidavit. Again, no deal was finalized (at no point in the documents obtained by BetaKit was an explanation provided for the failed deals).

Last Chance

As indicated above, Shop.ca’s most recent failure to close a sale forced the company into an insolvency proceeding with creditor protection in order to find a suitable buyer.

According to one document obtained by BetaKit, Shop.ca asked for the July 16th extension in order to have at least 30 days “to establish whether there is any serious interest in acquiring [Shop.ca] and/or its assets.” The hope is that the company can go again before a judge on July 7th after reviewing potential offers.

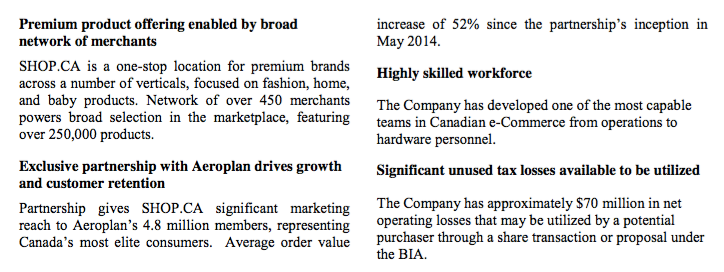

To solicit offers in that time, Shop.ca has developed and distributed a teaser letter (shown above), along with an NDA, to potential buyers (the company has developed a new list while also re-engaging previous prospects).

In the teaser letter, Shop.ca notes that it has over 1,200,000 members for its e-commerce marketplace, with 1 million website visitors per month, and a $200 average order value spend per transaction. In addition to its IP, workforce, and “young and affluent” customer base, Shop.ca argues that one of the most attractive opportunities for investors is the company’s $70 million in net operating losses that could be used as a tax benefit.

Shop.ca required all prospective buyers to submit an “as is, where is” proposal by June 30th, as well as a 10 percent deposit fee. BetaKit currently has no knowledge of how many submitted offers Shop.ca has received.

Side note: Shop.ca’s KERAs

This section should be of particular interest to Shop.ca’s shareholders, creditors, and remaining 40 employees.

Following Canaccord’s departure, the task of completing Shop.ca’s sale was left to the company’s remaining management. According to documents obtained by BetaKit, Shop.ca’s board “believed additional incentives were needed to ensure management’s continued willingness to assist in the [sale].” The stated reasons include the significant increase in day-to-day responsibilities, as well as Shop.ca’s current liquidity situation.

To that end, a Shop.ca director (which the documents note, has since resigned), developed Key Employee Retention Agreements (KERAs) for Chvala, Lee, and company CTO, Gary Black. The KERAs include incentive payments between 3-6 months of salary, with an aggregate amount of $201,000.

The funds to pay out are currently being held in trust by Shop.ca’s legal council, with conditions to trigger payment differing per each employee. For Lee and Black, the KERAs trigger upon change of control or liquidation of Shop.ca’s assets; for Chvala, upon review and analysis of the purchase bids submitted June 30th. Chvala will also remain on as a director throughout company’s current legal proceedings.

In Chvala’s case, the amended KERA was negotiated in part to reduce “the quantum of the Incentive Payment and forego any payment on account services rendered for acting as an officer or director of [Shop.ca] after June 30, 2016 in order to assist [Shop.ca’s] liquidity.” It should also be noted that according to the documents obtained by BetaKit, Chvala – while CEO of the company and currently negotiating its ultimate sale – is not technically a Shop.ca employee, but is working “under a consulting arrangement.”

At time of writing, Shop.ca had not yet replied to BetaKit’s request for comment. BetaKit will continue its reporting in a follow-up piece on the contributing factors that lead to such a dramatic loss of revenue and shareholder value.