Toronto-based ScaleUP Ventures (SUV) announced today a second close of $32.25 million for its ScaleUP Ventures Fund, which now has over $70 million in committed capital. The funding was led by $25 million from the Province of Ontario, via the Ministry of Research, Innovation and Science.

“We need to continue to strengthen Ontario’s innovation ecosystems and that includes helping our startups and entrepreneurs succeed and create good jobs for Ontarians,” Reza Moridi, Minister of Research, Innovation and Science, told BetaKit. “The ScaleUp Ventures Fund gives high potential technology business access to capital and, at the same time, provides mentorship from Ontario’s business community to help them grow.”

“We are trying to build a new model to help improve the Ontario ecosystem so that companies can hit global scale.”

– Kent Thexton, ScaleUP

The Province of Ontario had previously committed the $25 million amount back in 2015, but the funding plans were put on hold. Things picked back up for SUV following the arrival of Kent Thexton, former Managing Director at OMERS Ventures, as General Partner in May of last year. By August, SUV had its first fund close of $38 million, and Thexton told BetaKit that the firm’s third and final close in the coming months will allow it to over-achieve the fund’s $75 million target.

SUV has made seven investments to-date, the most recent being Toronto-based enterprise cognitive digital care provider Crowdcare. Less than $10 million of ScaleUP Ventures Fund I has been invested, so the team is obviously looking to make moves, with a target of 25-30 investments. Thexton explained to BetaKit that SUV is looking to make targeted seed and Series A investments in the B2B space.

“We mostly focus on B2B SaaS. We like that in general as it has a more predictable value creation. Consumer is very hit and miss,” Thexton said, before conceding that his consumer marketing background would allow SUV to do consumer deals in the right circumstances. “We’re looking for a great entrepreneur and a good market and then if they line up with our leadership council.”

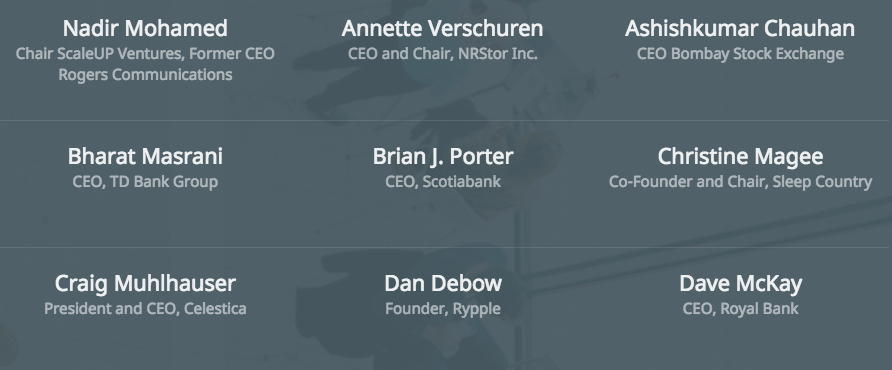

That leadership council is an important component to SUV, as it contains over 30 names, featuring former and current leaders of Royal Bank, Communitech, Telus, OMERS, TD Bank, and Rogers, of which Council Chair Nadir Mohamed was notably the former CEO. In an age where many investment firms set a thesis on bridging the gap between startups can corporate partners, SUV promises a large network and access to the top of corporate Canada to help startups scale quickly and globally.

“We’re helping them get from the front door to the 50th floor in one step.”

“We are trying to build a new model to help improve the Ontario ecosystem so that companies can hit global scale,” Thexton said. “And Nadir had the vision of working on this, researching that we’re producing lots of young companies and not producing enough out of the top end.

“Our companies here have great incubators and good government support but we don’t have this developed ecosystem that might exist in Silicon Valley or Israel or other markets. And getting corporate Canada involved, both as LPs, but also as engaged partners that can help our portfolio companies allows you to get one of those bigger contracts. It might be the proof-point that’s a leapfrog to more global success.”

Thexton pointed to Crowdcare as one such example, which was able to launch a pilot early with Rogers, but then leverage SUV’s connections in other verticals for connections to banking partners. “We’re helping them get from the front door to the 50th floor in one step.”

SUV does have a lot of competition in the space, with Highline BETA and Diagram just being two of the many Canadian firms taking a more holistic corporate partnership approach. But Thexton said that more competition would only improve the Canadian startup ecosystem.

“In this industry, Darwinism is critically important. So I think Darwinism for companies and Darwinism for funds where the funds that can select the best companies and help them achieve success should succeed,” he said. “More selection, more founders, and then you get to outputs. That’s a really healthy part of the ecosystem.”