While a number of reports have examined the growth and progress of startup ecosystems in Toronto, Waterloo, and Silicon Valley, the situation facing startups in the Montreal region has been sparsely documented.

But as Montreal’s startup ecosystem grows, so does the need to gather and analyze data on its growth and progress.

How rapidly is Montreal’s startup ecosystem growing? How are Montreal-based startups impacting the region’s economy? Does Montreal’s startup community have access to enough venture capital? Credo, in collaboration with the OSMO Foundation and Startupfest, has tried to answer these questions through a report providing a comprehensive view of Montreal’s startup ecosystem.

“The purpose of the study is to take a detailed look at the reality of Montreal startups,” the report reads. “[This] is a snapshot of the Montreal ecosystem taken in summer 2016.”

The report, Montreal Startup Ecosystem Report (MSER), presents data on how the region’s startup ecosystem is growing and its economic impact on the city of Montreal. Following a series of interviews with various stakeholders, including startup founders, investors, and supporters like accelerator programs, MSER has obtained qualitative data on how the region’s startup community views talent, financing, and the ecosystem as a whole.

To obtain data on Montreal’s startup ecosystem, many startups completed an online survey posted on MSER’s website throughout the summer of 2016. The startups were analyzed to ensure that they met the study’s definition of a startup: a business founded less than five years ago and a business for which tech and innovation form the core of its business model. Following the analysis, nearly 100 startups were retained to establish a statistical portrait of Montreal’s ecosystem.

Funding and economic impact

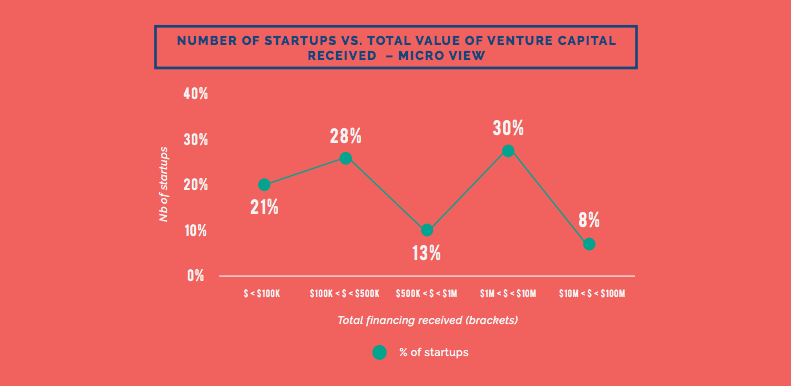

The report provides an overview of Montreal’s startup ecosystem in numbers, highlighting that currently, no Montreal startup has reached the $100 million mark in terms of funding, with more than 60 percent of startups being in the pre-seed stage. When it comes to funding rounds, the report finds that nearly 64 percent of funding rounds are below the $1 million mark; 31 percent of rounds are between $1 million and $10 million, for companies in the post-seed phase; and less than 6 percent of rounds exceed the $100 million mark.

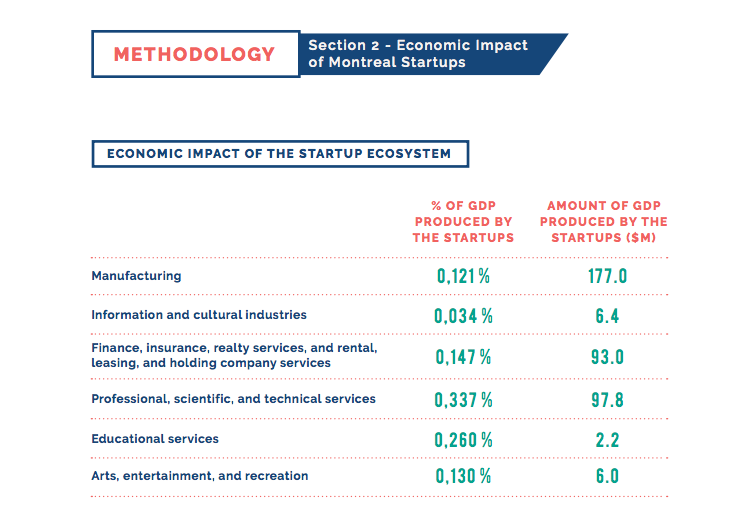

To assess the economic weight of Montreal’s startups, the study partnered with IS&B – Économique simplifée (IS&B), specialists in economic studies, to estimate the startup ecosystem’s contribution to production, employment, and public finances in Montreal.

The report highlights that Montreal’s startup ecosystem contributes to $704.6 million to Montreal’s economy per year. When compared to Montreal’s GDP in 2015, which was $189 billion, the total contribution of the startup ecosystem to the GDP is around 0.4 percent. While this percent seems low, the report states that those assessing this data should note that this contribution is generated by companies

“The very nature of startups implies that they tend to develop and grow quickly,” the report reads. “If they already show a significant economic impact early in their lifecycle, this impact will increase once they become major technology companies.”

According to MSER, Montreal’s startups provide direct employment to 9,815 people. The total sum of salaries for these jobs is approximately $190 million. MSER also found that Montreal startups bring in nearly $92 million in fiscal benefits for the different levels of federal and provincial government, which include payroll taxes, taxes paid by employees, taxes on goods, and taxes on production paid by the startups.

Talent

While MSER focuses heavily on the economic impact of Montreal startups, it also aims to provide an all-encompassing view of the reality of startups in Montreal, including the ecosystem’s successes and challenges. To offer qualitative data, Credo conducted over 50 interviews with key players in Montreal’s startup scene, which consisted of 20 investors, 18 supporters, and 14 startups.

With regards to talent, the report also gathered statistics on the employee makeup of startups, finding that 41 percent of employees in Montreal startups are born abroad; and in terms of diversity, 70 percent of startups employ women, but women account for only 22 percent of employees in startups.

“The important thing is that now we’ll have an objective resource for improvement opportunities, a view of what exists.”

The report found that 97 percent of interviewees said that Montreal has a “large pool of junior talent,” but it is not being leveraged by startups as much as it could. The report suggests that students don’t always connect with the startup community during their studies, and when students enter the job market, they are more likely to be drawn to large companies that have greater visibility within education and in the media, making it harder for startups to attract talent.

“In universities, tech profiles are not getting enough classes and training on other necessary skills to build a business,” the report reads. To address this, the report recommends that institutions integrate specific programs that connect students with startups and investors, citing Montreal’s École de Technologie Supérieure (ÉTS) as one school that does this well.

While attracting junior talent poses a challenge for startups, so does the recruitment and retention of senior talent. MSER states that as startups grow, it can be difficult to fill higher positions such as senior vice-presidents as experienced senior talent is in high demand in any industry.

According Jean-François Charette, the lead analyst and project manager at Credo, while recruiting specialized senior talent is challenging for many startups, they can often turn to foreign talent to fill certain positions.

“The more specialized talent Montreal startups look for, the harder it is to find someone,” said Charette. “When you’re in a startup…you don’t have the money to lobby or make your initiative more attractive to them [senior talent], so one of the things we said is [supporting] immigration processes for senior talent that did not study in Montreal.”

Financing

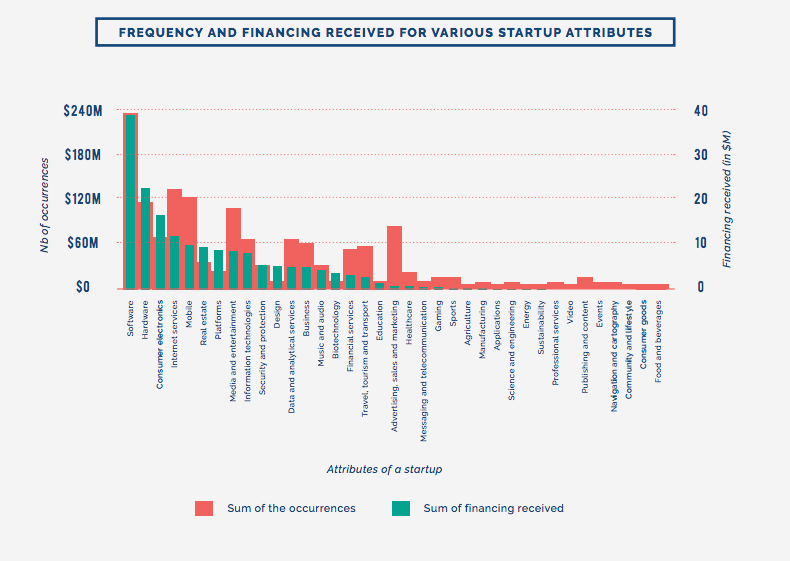

MSER also looks at the value startups and other stakeholders in the ecosystem place on financing. Among the stakeholders, while 79 percent investors said they believe enough capital is available, only 40 percent of startups thought that enough capital is available, emphasizing that the growth stage is when the lack of financing tends to be the most critical.

In addition, one in three entrepreneurs felt that VCs are “overcautious” with the number of investments they make, meaning they do not invest enough in Montreal startups.

Charette says the discrepancy between startup and stakeholder responses in this instance is not surprising. “I think a discrepancy like that, to some extent, is going to exist,” said Charette. “If you talk to a startup that didn’t get funding, they’re going to tell you there’s not enough funding. So I wouldn’t say the perceived gap was surprising, but it was surprising to what extent there was a gap.”

He added that it’s not that the capital doesn’t exist or that VC’s are overcautious, but rather that because there are fewer investors in Montreal compared to other ecosystems, investors have the time to carefully select which startups are viable and scalable enough to invest in.

“The majority of investors told us that they were really impressed with the quality of products that startups in Montreal present but what’s often lacking is the whole commercialization and marketing portion of the business plan,” said Charette. “Given the fact that VCs are looking for scalability, if you have a great product but no idea what its sales potential is, well, it’s kind of hard to get the financing.”

The report says that centralizing information about the available sources of capital for Montreal startups might help resolve the discrepancy between how much capital startups versus investors think is available. It states that online platforms like Startup HERE Toronto and Info Entrepreneur are “excellent” sources of information about Canadian funding programs.

The overall Montreal ecosystem

MSER addresses how startups, investors, and other stakeholders perceive Montreal’s startup ecosystem as a whole. The report finds that overall, key stakeholders view Montreal’s ecosystem positively, but some startups say that with so many accelerators, incubators, and events, it can be hard to find information about the most relevant events, opportunities, and resources in the startup community.

While the report recommends that Montreal could benefit from more centralized information about available resources, Charette says such systems already exist; people just aren’t aware of them.

“One of the [interviewees’] comments was that because there are so many resources now dedicated to entrepreneurship and startups, sometimes it’s hard to have visibility on that and when someone says there’s no database on VCs in Montreal and that we need to build a platform that talks about investment providers, capital….that actually already exists,” said Charette. “Info Entrepreneur already has that information and they did a pretty good job at mapping resources. The problem is people don’t know that exists.”

In addition, 80 percent of key players interviewed said that collaboration is a strong aspect of Montreal’s startup ecosystem and this collaborative mindset between startups can help the ecosystem grow and establish a “well-defined identity.”

According to Charette, the key findings of the report and the recommendations it makes will help different players in the startup ecosystem work together more cohesively to improve and grow the ecosystem.

“I think the important thing is that now we’ll have an objective resource for improvement opportunities, a view of what exists, what are strengths, what are the things we need to work on; which actually helps coordinate the work they want to do within the ecosystem going forward,” said Charette.