Small businesses in Canada are not leveraging the power of online payment and ecommerce tools, according to a new study by PayPal Canada.

PayPal’s study was led, designed, and managed by Barraza & Associates and executed and reported by Northstar Research Partners. Between December 2015 and January 2016, PayPal interviewed 1,000 Canadian small business (SMB) owners online to look at how many small businesses embrace ecommerce practices, as well as factors that may prevent them from doing so.

PayPal’s study revealed that while four out of five Canadians shop online, less than one in five (17 percent) Canadian small and medium-sized businesses are using online payment tools such as electronic invoicing, online marketplaces, or ecommerce-enabled websites.

“A thriving ecommerce environment in Canada can lead to greater trade, employment, and income opportunities,” said Paul Parisi, president of PayPal Canada. “As a digital payments leader, we at PayPal are focused on offering solutions that benefit our 250,000 small business customers across the country, and we are actively collaborating with ecosystem players to help grow Canada’s digital economy.”

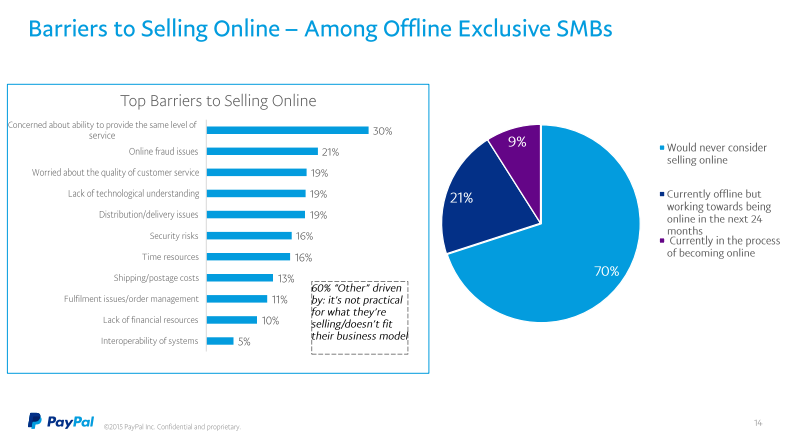

According to PayPal, a significant majority of Canadian SMBs are not ready to participate and compete in the digital economy. The study indicated that 83 percent of Canadian SMBs don’t accept any form of online or mobile payments, and 71 percent said they would never consider selling products online.

PayPal suggested that one step to integrate ecommerce practices in a business is creating a website. But while building a website isn’t too difficult, the study showed that only seven percent of Canadian SMBs surveyed have a website capable of processing online payments via credit or debit cards. In addition, 34 percent of businesses that don’t currently accept online payments don’t intend on building a website for the foreseeable future.

When looking at how supporting online payments impacts a business’s revenue, PayPal found that businesses that accept online payments, in addition to an offline revenue stream, reported an average revenue of $175,000, which is more than double the revenue stream of businesses that don’t accept payments online ($80,000).

To paint a better picture of why there is low ecommerce usage among Canadian SMBs, PayPal also looked at what keeps small businesses from embracing ecommerce.

“More Canadian businesses should invest in the development and adoption of new technologies. That’s how Canadian businesses will remain globally competitive.”

The study showed that 30 percent of Canadial small businesses said their key concern is being unable to provide the same level of service by adopting ecommerce platforms. This was followed by other concerns including online fraud (21 percent), limited understanding of technology (19 percent), and distribution or delivery issues (19 percent). Seventy-two percent of offline businesses said they are not particularly seasoned when it comes to tech and e-marketing knowledge, suggesting another reason why they may not embrace ecommerce.

“Virtually every sector of the economy is rapidly being reshaped by technology,” said Navdeep Bains, Cana’da minister of innovation, science, and economic development. “In a global and digital economy that allows consumers to purchase goods and services from anywhere in the world, more Canadian businesses should invest in the development and adoption of new technologies. That’s how Canadian businesses will remain globally competitive and create well-paying jobs for the middle class.”

PayPal’s study also looked at geographical distribution and gender makeup of Canadian small businesses. It found that the geographical distribution of Canadian SMBs across Canada is fairly even, and that 67 percent of Canadian small business owners are men aged 55 or older.

This number contrasted with businesses that embrace ecommerce; seventy-seven percent of SMB owners that accept payments through online and offline channels, and 66 percent of businesses that only accept online payments, are under 55 years of age.

The study also revealed a significant under-representation of women SMB owners, finding that only one-third (33 percent) of Canadian small businesses are owned by women, a stat that is consistent across businesses that both sell online and offline.

Photo via Unsplash