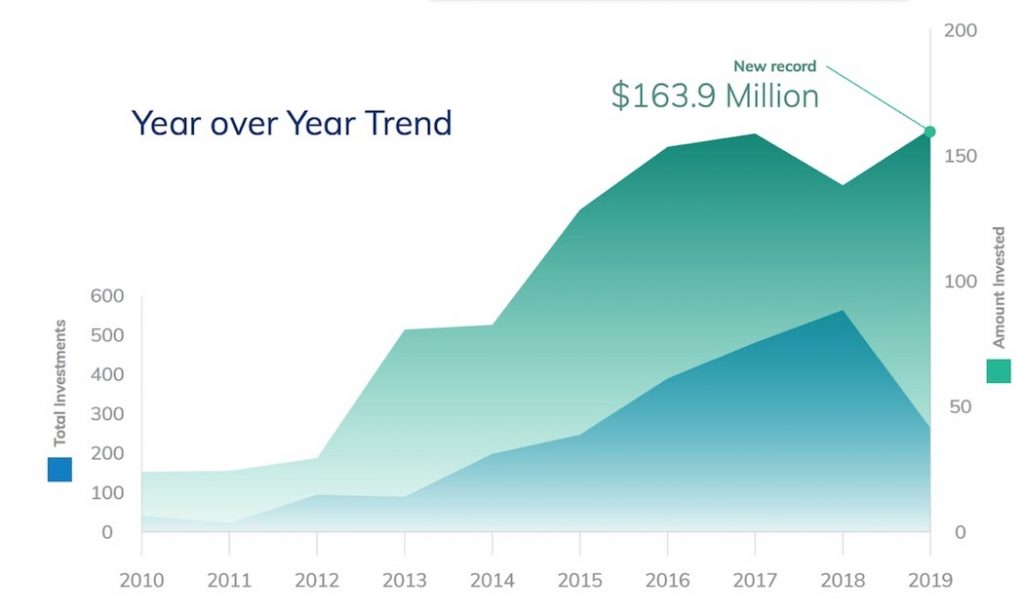

Angel investment reached a new record of $163.9 million in 2019, bringing angel activity to more than $1 billion in Canada over the last decade, according to a new report from the National Angel Capital Organization (NACO).

“To emerge from the economic crisis, Canada needs to activate increased angel capital by an order of magnitude.”

– Claudio Rojas, CEO of NACO

NACO’s 10th annual report spotlights angel investment activity and year-over-year trends to provide insight into the significance of angel investing in Canada’s innovation economy. The report defines angels as community-based investors that are the main source of early-stage capital for Canadian entrepreneurs.

“This report demonstrates the important role that angel investors have had in the development of the innovation ecosystem, marking a new milestone with $1 billion invested in support of Canada’s entrepreneurs,” said Claudio Rojas, CEO of NACO.

The record $163.9 million in funding was tracked across 299 investments in 2019. This is the highest annual amount invested in the last decade, an increase of approximately 15 percent from 2018 figure and exceeding 2017’s previous record. NACO determined that every dollar of angel investment results in $156 in revenue for angel-backed companies.

Women represented less than one-fifth of angel group members last year, which NACO noted was “consistent” with 2018’s numbers. This indicates that women participation in angel investing has not improved significantly over the last year.

RELATED: Canadian angel groups mixed on capital availability in COVID-19 world

Angel investment activity is also distributed unevenly across Canada, the report found. Central Canada, including Ontario and Quebec, accounted for 86 percent of investments, compared with 13 percent in Western Canada, and only one percent in Atlantic Canada.

The report noted that last year, angel groups primarily invested in small businesses with one to five or six to 10 employees at the time of the investment, accounting for 42 percent and 18 percent of investments, respectively.

“It was angel investors who believed in our mission and invested half a million dollars in our company and using that, we developed our technology and have moved into pilot trials with multiple companies,” said Julie Angus, CEO and co-founder of Open Ocean Robotics. “We would not have been able to scale our company without this early support and mentorship.”

The COVID-19 pandemic has had a major impact on Canada’s entire investment community, as groups have been forced to move their activities online. In May, several angel groups expressed mixed views about the outlook of capital availability during and after the pandemic. NACO conducted a poll of entrepreneurs and investors about capital availability, which suggested capital availability amid the pandemic had decreased and will continue falling.

RELATED: New investor network ArchAngel launches fund in response to COVID-19

NACO’s angel activity report made several recommendations to the federal government to support and stimulate angel investing in Canada. The first was to leverage angel investment by creating co-investment initiatives or “matching funds.” The second was to reduce risk by creating tax incentives for angel investors.

The third was to implement securities exemptions to increase the pool of potential angel investors. NACO’s fourth recommendation was to provide more support to the non-profit angel group network to give entrepreneurs centralized and coordinated access to capital and resources.

“To emerge from the economic crisis, Canada needs to activate increased angel capital by an order of magnitude or risk losing a generation of entrepreneurs,” Rojas said.

Image courtesy NACO