Venture funding in Québec’s tech sector fell to a three-year low in the third quarter of 2022, according to a new report from briefed.in, but it’s not just a tightening economy that likely delivered harsh blows to the ecosystem.

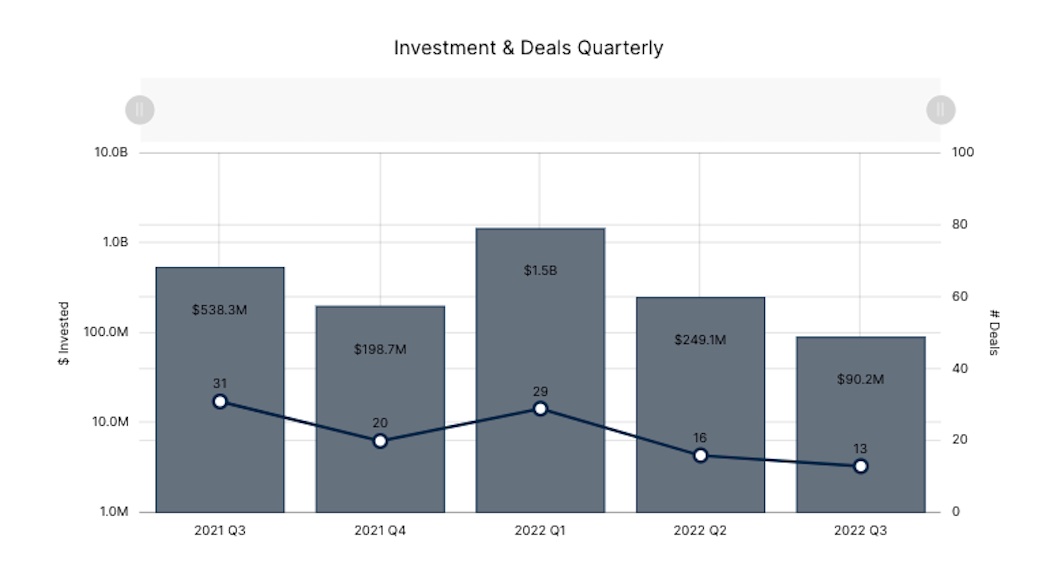

In Q3 2022, venture funding in Québec totalled $90.2 million, a 64 percent decrease from the previous quarter and an 83 percent decrease year-over-year. The third quarter represented the first time venture funding in Québec fell below $100 million since Q2 2019, and its lowest quarter for funding in the last three years, when briefed.in first began tracking the province.

Deal volume totalled 13 deals in Québec, making Q3 2022 the province’s least active funding quarter in the last two years. On a quarterly basis, deal volume declined by 19 percent, and on a year-over-year basis, the number of deals fell by 58 percent. Philippe Telio, founder of Montréal-based Startupfest, believes the results of Q3 2022 are concerning but were also anticipated.

“Deals are usually lower in Q3, but macroeconomic factors and heightened uncertainty in Québec are creating a perfect storm.”

“Q3 could not come at a worse time,” Telio told BetaKit. “Deals are usually lower in Q3, but macroeconomic factors and heightened uncertainty in Québec are creating a perfect storm.”

Telio said while there are plenty of obstacles nationally and globally that would explain a good part of the drop in investment, he believes there are additional factors unique to Québec that started to show an impact on the ecosystem in Q3 2022.

Those factors include a variety of new political and venture-related headwinds, from new language laws to a tightening on immigration, on top of a slowdown from one of the region’s most active investors. “Few people want to admit that these have an impact, but everyone knows they do,” Telio added.

Hugues Lalancette, partner at Inovia Capital, believes that Québec’s tech sector is still in a cooling period rather than a crash, and that staying calm and taking a long-term perspective is key for local tech companies.

“Yes, we are in a higher risk environment, and we haven’t seen the public markets bottom out, but that doesn’t mean it’s not possible to raise now,” Lalancette added.

The Real impact on early-stage activity

The third quarter of 2022 was not all bad news for Québec’s tech sector. According to briefed.in, two stages of deals saw an increase in activity in Q3 2022: pre-seed and Series A. Four Series A deals closed during the quarter, up slightly from the three closed in Q2 2022, and equal to the number of deals closed in Q3 2021.

Telio believes the creation of several new funds targeting Québec-based, Series A-stage companies during the first and second quarters of 2022 may be contributing to deal volume at this stage. Some of these funds include Toronto-based Amplify Capital, which closed $30.7 million for its second fund in February, and Inovia Capital, which closed its fifth fund at $420 million to invest in seed through Series A rounds.

“Fund creation is a leading indicator of funding, of course, but it takes time for money to work its way through the investment system,” Telio added.

Two pre-seed deals closed in Q3 2022, up from zero in the second quarter of 2022. While the increase in pre-seed activity is notable (and included a very significant $16.7 million pre-seed round of funding by Numida), two pre-seed deals amount to a pretty low bar for Québec’s tech ecosystem. This is particularly true when paired with the more significant drop-off in seed deal volume seen in Q3.

“Yes, we are in a higher risk environment, and we haven’t seen the public markets bottom out, but that doesn’t mean it’s not possible to raise now.”

In Québec, seed activity has remained stable at nine deals each quarter since the end of 2021. But in Q3 2022, only six seed-stage deals closed, which is fewer than half of the number closed during the same quarter last year. However, seed activity in Québec was the least impacted in Q3 compared to Toronto, British Columbia, Alberta, and Waterloo Region. Per briefed.in’s data, the rest of the country saw an over 70 percent decline in seed-stage deals, compared to Québec’s 33 percent decline.

One factor that could be contributing to the decline in early-stage activity could be the recent slowdown of Real Ventures, once considered to be among the most active seed-stage investment firms in Canada.

Last month, Real Ventures’ managing partner Janet Bannister was replaced by co-founder John Stokes. The news followed several months of difficulty for the firm, which failed to raise a new fund, experienced partner turnover, and reportedly saw poorer-than-expected portfolio performance.

Real Ventures is just one player in Québec, but it has nonetheless been a key source of early-stage deal flow and investment in previous quarters, particularly as the firm oversaw the creation of the FounderFuel early-stage accelerator program. Telio noted that a staple of the Montréal VC community hitting the pause on raising and writing fewer cheques is contributing to an uncertain atmosphere in the province. “Investors don’t like uncertainty,” he added.

Telio believes some larger political and societal factors in Québec could also be contributing to the lack of early-stage activity. For one, Québec’s controversial language laws have already received scathing criticism from the local tech sector, with many members arguing such restrictions could deter skilled tech immigrants from the province. Immigration was also a key point of contention during the province’s recent election, which was often dominated by xenophobic, anti-immigration rhetoric.

Competing for top talent has also become a hotter issue in the province, Telio said, particularly as remote work has pushed many tech workers to take roles for international companies. He added that many of these workers, who could have worked for a Québec-based company or launched their own business, are now in shorter supply compared to two years ago.

Megadeals bite the dust

Québec’s early-stage ecosystem was certainly not the only casualty of recent headwinds in the province. Like Toronto and British Columbia, Québec’s tech sector grew accustomed to massive raises each quarter of 2021.

But in the third quarter of 2022, the Québec megadeal was missing in action: briefed.in tracked no deals worth more than $30 million during the third quarter. The largest deals included BrainBox AI’s $30 million Series A round of funding, Planned’s $18 million Series A round of funding, and Kaloom’s $27.4 million investment.

Perhaps more concerning was the lack of recorded deals in Québec above the Series A stage, indicating that late-stage companies are struggling to raise capital. Lalancette noted that the pool of capital and investors that drove up valuations in 2021 is “essentially gone” this year.

“These were mainly crossovers and mega-funds with strategies that worked in a bull market but ended up being extremely fragile in a volatile environment, because those strategies were based on things that made businesses less resilient, not more,” Lalancette added.

A long storm ahead?

While the economy will no doubt have a bearing on the future of Québec’s tech sector, it is less clear how some of Québec’s unique challenges will impact local venture funding in the next few quarters. Lalancette believes it’s important for companies to prepare for the next few months by having enough cash, creating options, and staying “close to what your customers and data are telling you.”

Telio said he believes venture funding in Québec will continue to tighten over the next six months as talks of rising interest rates continue and a recession looms over the Canadian economy. He said in the near term, funds will likely look to deploy capital to fewer companies, adding that none of these factors bode well for seed-stage startups.

“As an investor, you need to reserve capital to keep your existing bets alive for what may be a longer time, so I expect this to be the case for a while,” Telio added.

But Lalancette and Telio both indicated that the long-term future of Québec’s tech sector is still bright, and said most entrepreneurs that continue innovating will be able to ride out this storm.

“Great companies will emerge stronger on the other side,” Lalancette added.

briefed.in is owned and operated by Communitech. BetaKit receives data from briefed.in as part of a media partnership with Communitech and retains full editorial control of all articles that reference the data produced by briefed.in/Communitech.