PwC Canada and CB Insights have released the MoneyTree report on Canadian investment trends in Q4 2017, with an overall glimpse into how the country performed throughout the year.

Canadian companies raised $3.3 billion ($2.7 billion USD) across 333 deals in 2017, compared to $2.2 billion ($1.7 billion USD) the previous year. Total funding and average amount of funding increased seven percent and 31 percent respectively, while deal activity decreased by 12 percent.

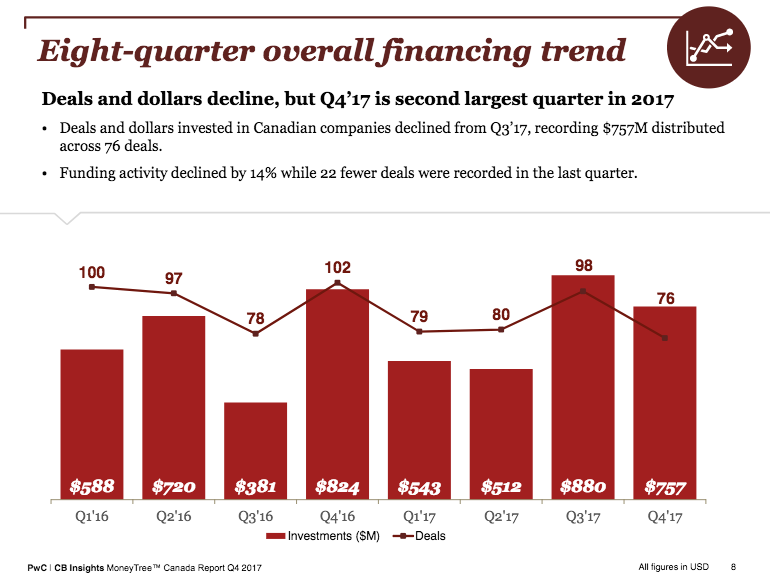

In total, $940 million ($757 million USD) was distributed across 76 deals in Q4 2017, making Q4 the second largest quarter for funding in 2017. This was an increase from Q4 2016’s 71 deals though the report notes that there were 22 fewer deals in Q4 2017 compared to the previous quarter. PwC national deals technology leader Michael Dingle, however, says this decrease is no cause for concern.

Dingle also noted that Canadian businesses are now moving beyond seed stage financing, something BetaKit called out in our healthtech deep dive at the end of last year, where Dingle argued that an increase in expansion stage funding means companies are finding their product-market fit.

“It tells us that the [idea] we all had years ago around whether Canadian companies continue to attract funding and get to that scale-up stage was true.”

– Michael Dingle

Q4 2017 was the second quarter in a row to have seed-stage deals declined, from 30 percent to 28 percent, and the share of early-stage deals also declined from 28 percent in Q3 2017 to 20 percent in the fourth quarter. The average deal size increased 31 percent from $10 million ($8.3 million USD) to $13 million ($10.9 million).

“It tells us that the [idea] we all had years ago around whether Canadian companies continue to attract funding and get to that scale-up stage was true, and this data is proving that Canadian companies can do it regularly. What we’re seeing is a good sign in every respect,” Dingle said.

As for the thematic areas that are driving an increase in expansion stage funding, cybersecurity, digital health, and FinTech are three industries to watch out for. Full-year funding totals for Canadian cybersecurity companies increased by 79 percent in 2017 — largely driven by eSentire’s $100 million mega-round in Q3 2017.

Canada’s AI and FinTech sectors were specifically called out by CB Insights CEO Anand Sanwal. “One bright spot for the market has been funding to Canadian AI and Fintech companies,” he said. “It is worth keeping an eye on these sectors going forward as market leaders in these areas have the potential to draw more significant venture funding in the coming years.”

One piece that Dingle specifically wanted to call out was Asia’s increased presence in investments.

Funding to Canadian AI companies surpassed 2016 full-year totals by a wide margin. AI attracted $312 million ($252 million USD) across 31 deals. Total funding to Canadian FinTech companies increased to $566 million CAD ($456 million USD), up from $559 million ($450 million USD) in 2016. Keeping with overall trends of declining deal activity, deal activity to FinTechs declined from 43 deals in 2016 to 37 in the full year 2017.

When it came to sectors, internet financing declined with $935 million ($753 million USD) invested across 132 deals, down from 166 deals in 2016. Canadian mobile companies saw eight less deals in 2017, whereas funding increased by 66 percent for a total $539 million ($434 million USD). Healthcare companies saw six more deals in 2017, while funding declined 24 percent.

Corporate participation also grew last year, as 28 percent of all deals to Canadian companies featured at least one corporate or corporate venture capital investor in 2017, up from 16 percent in 2016. In BetaKit’s deep-dive on corporate participation, Canada’s high-quality of life, openness to immigration, and burgeoning AI ecosystem may be attracting corporates interested in Canadian tech.

“Year over year, corporates are showing twice the support for venture-backed companies in 2017,” said Dave Planques, national deals leader at PwC Canada in the report. “This is also reflective of the global results, as the theme of collaboration and strategic partnerships between incumbents and the technology sector continues to evolve.”

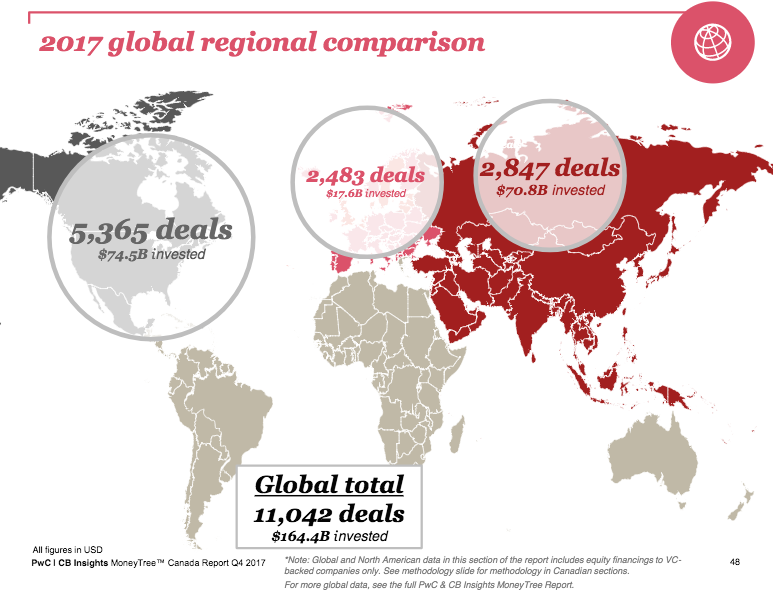

While Canadian companies raising $3.3 billion CAD was a point of celebration in the report, it pales in comparison to overall North American activity. In North America, $92 billion ($74.5 billion USD) was invested across 5,365 deals, meaning US companies received around $89 billion ($71.8 billion USD) of that total. For 2017, Canada made up only six percent of total deal count and 3.6 percent of funding. But Dingle noted that it’s important to anticipate this number increasing instead of comparing it to a more mature US ecosystem and its larger population.

“We need to look at the history of VC activity and of the tech sector…just the population numbers we need to dig into that and realize we’re talking about our major Canadian centres here,” he said. “When you look at the US, you’ve got substantial ecosystems…that have more than a head start. The Valley is the epicentre of all things venture globally. It doesn’t surprise me to see that the funding isn’t proportionate to the population basis.”

One piece that Dingle specifically wanted to call out was Asia’s increased presence in investments. Canada-based investors represented at least 50 percent of all active investors in Canadian companies in seed and early-stage deals, while US investors participated in at least 40 percent of early and later-stage deals. Asian investors accounted for 10 percent of later stage deals; earlier this year, Wattpad confirmed an investor in China’s Tencent, which led the storytelling platform’s $61 million round.

He said that a look at global trends speaks to competition we’re facing in sectors like AI and quantum — the Asian market is showing a higher risk appetite with $87 billion ($70.8 billion USD) in 2,847 deals, compared to the US’ $91 billion ($74 billion USD) over 5,300 deals.

“We’re starting to see more balance there; traditionally that Asian number hasn’t been as high. Just like corporate participation, when you start to see money come from geographies or come strategics, it means it’s not just money,” said Dingle. “A Canadian technology company receiving support from an Asian investor is either, the Asian investor believing that the Canadian company can generate economic returns for them based on their current plan, or they are a strategic that wants to see the technology and team have impact in their markets.”

View the full report here.

BetaKit is a PwC MoneyTree Canada media partner.