According to a new report from PwC Canada and CB Insights, the venture capital landscape in Canada is on a positive growth trajectory.

PwC’s MoneyTree report examines global trends in VC deal activity, and the industries getting the most investor heat. While MoneyTree reports have been released for the past 20 years in the US, this is the first year a Canadian edition has been made available, comparing Canada’s 2016 activity to 2015 (all dollar amounts in the MoneyTree Canada report are in USD, and have been converted to CAD throughout this article).

According to the report, Canada has managed to fend off the global trend of deal volume decreases. 2016 saw deal activity for VC-backed companies in Canada climb seven percent to 266, up from 246 the year before. While total investment of $2.2 billion ($1.7 billion USD) was virtually flat from the previous year, markets like the US and Asia faced deal and dollar declines in 2016.

“Whereas many other regions globally have seen a reset after the record financing we saw in 2015, the Canadian funding environment’s momentum continued to be strong. 2017 should be a good year.”

– Anand Sanwal,

CB Insights

In the US market, deals and dollars dropped 16 percent and 20 percent, respectively, in 2016, compared to the previous year. This was in line with global trends, which saw global deals and dollars declining 10 percent and 23 percent, respectively.

“Canada’s solid year is especially notable given the context,” said Anand Sanwal, co-founder and CEO of CB Insights. “Whereas many other regions globally have seen a reset after the record financing we saw in 2015, the Canadian funding environment’s momentum continued to be strong. 2017 should be a good year given the growth in Canada’s home-grown investor ecosystem as well as the interest in the market from US and European investors.”

Quarterly deal activity in Canada remained above 50 throughout the year and topped 70 deals twice — Q1 and Q4 2016. Quarterly financing also eclipsed $657 million ($500 million USD) twice, in both Q2 and Q4.

While Canada’s ability to grow amidst a global decline is some reason to celebrate, a look at the hard numbers shows that the US ecosystem still overshadows Canada’s total 2016 deal activity. In 2016, $77 billion ($58.6 billion USD) was invested across 4,520 deals in US-based companies, according to PwC’s US MoneyTree report.

In Q4 2016, investors deployed $693 million ($527 million USD) to Canadian VC-backed startups, a spike of 49 percent from the previous quarter’s $463 billion ($353 billion USD). While the US saw a 14 percent slowdown in deals and 17 percent decline in dollars in the same period, the amount invested was still significantly more than in Canada, with $15.3 billion ($11.7 billion USD) invested in companies.

Overall, North America showed healthy signs of deal activity in Q4 2016, with $15 billion ($12.2 billion USD) invested in 1,065 companies. In comparison, Asia had $7.2 billion ($5.5 billion USD) invested in 498 deals, and Europe had $3.9 billion ($3 billion USD) invested in 337 deals.

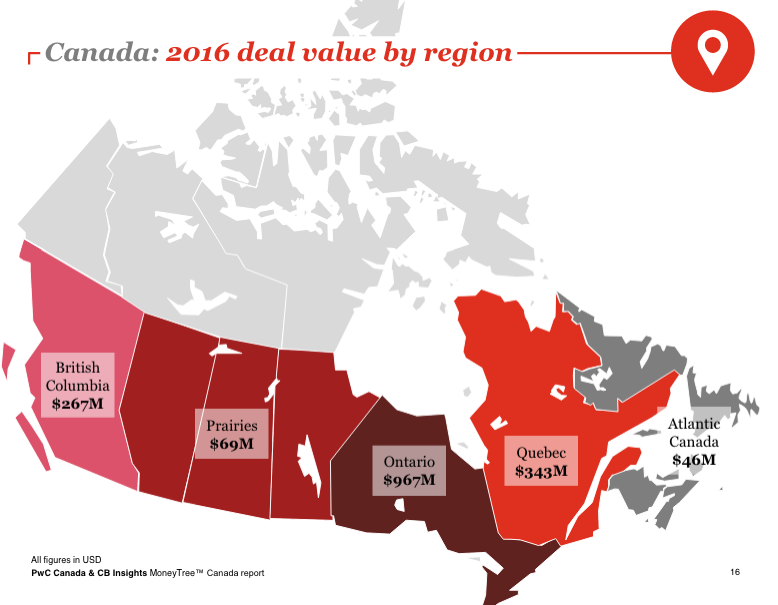

Across Canada, Quebec, Ontario, and BC took the biggest share of VC dollars for 2016. Ontario enjoyed the most with $1.2 billion ($967 million USD) in deal value, and Quebec and BC following with $451 million ($343 million USD) and $351 million ($267 million USD) respectively.

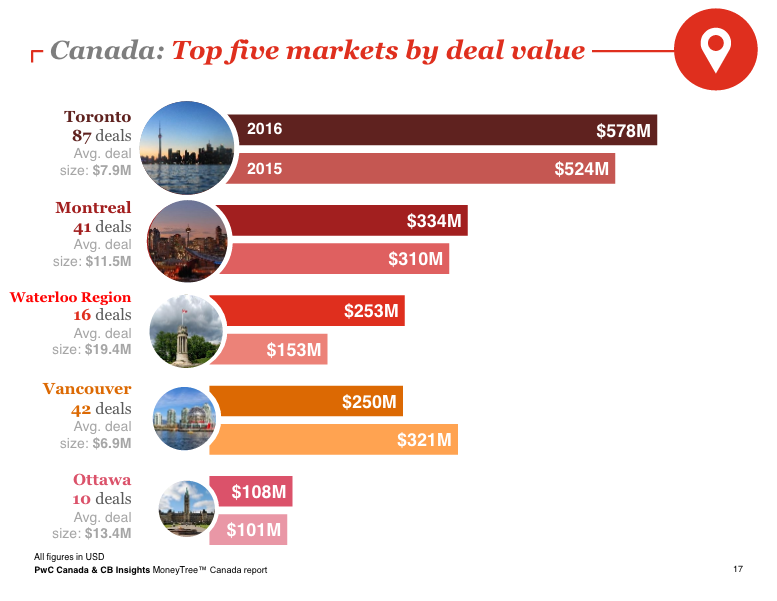

The cities that enjoyed the most VC dollars also reflected these provincial trends; Toronto and Montreal are Canada’s top two markets for investment dollars. Toronto companies closed 87 deals throughout 2016, with an average deal size of $10.3 million ($7.9 million USD). While Q4 2016 deal activity in Toronto jumped 42 percent from Q3 2016, the annual deal total of 87 was down four percent from 2015.

Toronto and Montreal are Canada’s top two markets for investment dollars.

For the full year of 2016, Toronto saw dollars invested up 10 percent to $760 million ($578 million USD), up from $688 million ($524 million USD) the previous year.

Montreal closed 41 deals with an average deal size of $15 million ($11.5 million USD), and the city saw deal activity grow eight percent to $440 million ($334 million USD), compared to $407 million ($310 million USD) the previous year. Funding totals to Montreal-based companies were up by 11 percent in Q4 2016, largely thanks to a Hopper’s $82 million Series C.

In the Waterloo Region, Thalmic Labs’ $158 million ($120 million USD) Series B was credited for boosting the city’s total funding to $333 million ($253 million USD) — a 65 percent jump from 2015. However, Waterloo-based companies only saw 16 deals throughout the year, down 11 percent from 2015, when there were 18 deals.

According to the MoneyTree Canada report, Vancouver is experiencing some decline, as its total deal activity was $317 million ($250 million USD), down from $421 million ($321 million USD) the previous year. Annual funding that year was driven by smaller, earlier-stage deals, and the report singles out companies like D-Wave, MSI, and Mojio as companies raising rounds of more than $19.6 million ($15 million USD). Vancouver actually saw more deals than Waterloo (41 and 16 respectively), but the smaller deal values put the Best Coast city fourth behind Toronto, Montreal and the WR.

Ottawa took fifth place in Canada’s top five markets, which saw $141 million ($108 million USD) invested in its companies in 2016, a rise of seven percent compared to the previous year, when companies raised $133 million ($102 million USD). This was thanks to Turnstone’s $54.3 million ($41 million USD) Series B. However, deal activity was slow compared to 2015.

“Standout annual and quarterly funding trends underscore the strength of the Canadian tech sector. Canada continues to attract significant global attention due to its impressive innovation initiatives and ambitious entrepreneurs,” said Chris Dulny, national technology sector leader at PwC Canada.

When it came to funding trends, investors showed the most interest in Canadian IoT, FinTech, and digital health startups this year, though consumer products and software followed behind in fourth and fifth place. While digital health took third place, this sector experienced a 34 percent drop in funding compared to 2015.

The lead in IoT was also partly thanks to Thalmic’s mammoth funding, as its Series B was a major contributor to Canada’s IoT sector securing $401 million ($306 million USD) across 23 deals in 2016.

“The Canadian technology sector continues to thrive, with strong activity from key markets across the country, encouraging a robust ecosystem for creativity and big ideas,” Dave Planques, national deals leader at PwC Canada, says in the report. “We expect this trend to sustain through 2017, with healthy levels of investment ultimately leading to increased M&A and IPO activity in the Canadian tech sector.”

The top five deals in Canada — which took place in Ontario and Quebec — raised a total of $551 million ($419 million USD). Thalmic Labs was the top deal, followed by Dalcor Pharmaceuticals with $131 million ($100 million USD) and Real Matters at $101 million ($77 million USD).

On its list of the most active investors in 2016, Montreal-based BDC took the top spot with 30 deals, and was singled out for its participation in Wave, Axonify, and Salesfloor’s rounds.

Halifax-based Innovacorp made 17 investments in fast-growing east coast companies like Clean Simple and Appili Therapeutics, and Montreal-based Real Ventures made 14 deals.

Shivalika Handa, director of corporate finance at PwC Canada, predicts that Canadian investors may start to see more competition from the rest of the world. “We’re starting to see an increase in the number of Canadian VCs across the country,” she said. “Canadian VCs will be more aggressive on deal terms and sheer deal volume and we expect them to continue to dominate in early stage rounds. However, innovation and creativity from the Canadian market will continue to attract global players, as the data suggests in the report.”

The full PwC MoneyTree Canada report in English can be downloaded here.

Pour lire en français, cliquez ici.

BetaKit is a PwC MoneyTree Canada media partner.