You run a reputable small business. You’re looking to grow, but you can’t get you the credit you need from traditional lenders – and you’ve tried. You’d rather not hit up ‘Uncle Vinnie’ for the dough, given his rather high interest rates and the off chance you’ll wind up on the receiving end of a lead pipe – er, skiing accident.

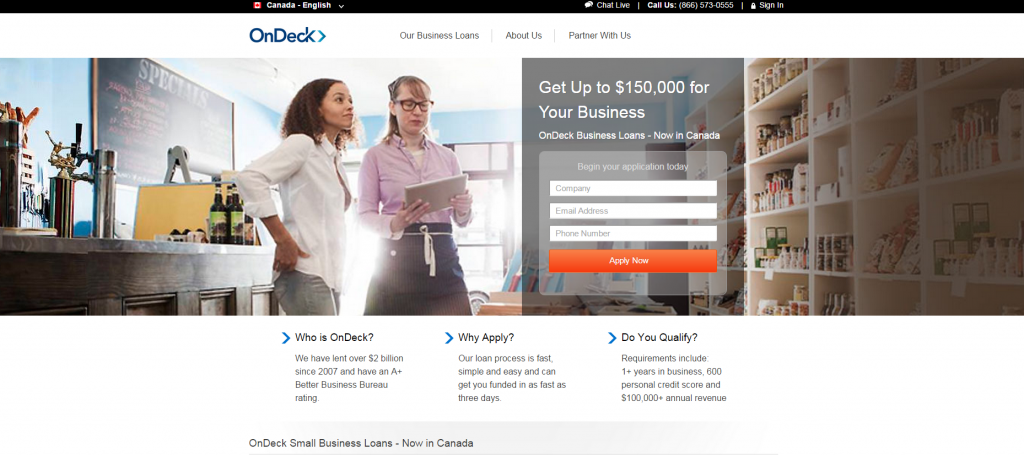

Enter OnDeck, a financing firm that makes it easier for small businesses to get the credit they need when they need it – all thanks to some nifty technology that can evaluate borrowers in a way that cuts the time and red-tape to a minimum.

OnDeck announced last week that they were officially launching big into the Canadian market, but the truth is the company has been here for about a year already – with a soft launch that helped it work out the kinks for a different kind of business culture.

Entering the Canadian market has come with a learning curve and some new challenges.

“We’ve already been in Canada for about 12 months in a test phase to see if there was really a market need for our service – and we’ve already gotten tremendous uptake from small businesses here,” says Rob Young, OnDeck Senior Vice President, International (Canada, Australia).

Young added that OnDeck has lent to over 150 different business sectors in Canada, which is no small feat, even compared to the 700 sectors it has serviced with over $2 billion in credit in the U.S.. OnDeck’s customers are in just about any sector you could name, from restaurants and lighting stores to doctors, dentists and more. The small-to-medium business is the sweet spot for the company – and with 99 percent of companies in Canada fitting that bill, OnDeck has got plenty of room to grow. According to OnDeck, traditional Canadian lenders are able to give access to capital to less than half of the SME’s that need it – creating a real market opportunity.

What’s the big draw for OnDeck’s customers? While most traditional lenders look at credit scores and need to follow pretty stringent protocols before they can turn on the credit taps, OnDeck’s technology and process focuses on evaluating performance; instead of waiting weeks or months for a positive word from the big lenders, OnDeck can shave that time into just a few days, delivering credit chunks from $5,000 to $150,000 – repayable over much shorter periods than conventional loans. Time-crunched, growth-focused firms have latched on to this alternative financing in a big way.

Entering the Canadian market has come with a learning curve and some new challenges.

“We’ve had to integrate different kinds of data sources here since the customer journey is a bit different,” Young says. “As well, we’ve found that Canadian customers need to speak to a live person. If you run a gas station, for instance, and need $50,000, you want to be able to talk to that person on the phone.

“But other differences are more about nuance, like with seasonality. We see that businesses gear up for winter in different ways, such as when they need to stock up on inventory. We also see different kinds of factors affecting some sectors, like how a dip in the energy sector here can affect the construction firms that serve it. Where we see those local differences, we need to adjust both our product and our assumptions.”

After adjusting to that learning curve, OnDeck is here to stay. “We want to be part of that long-term solution,” Young says. “Companies are already going online for hiring, shipping and other solutions, we want to be there for their credit needs.”