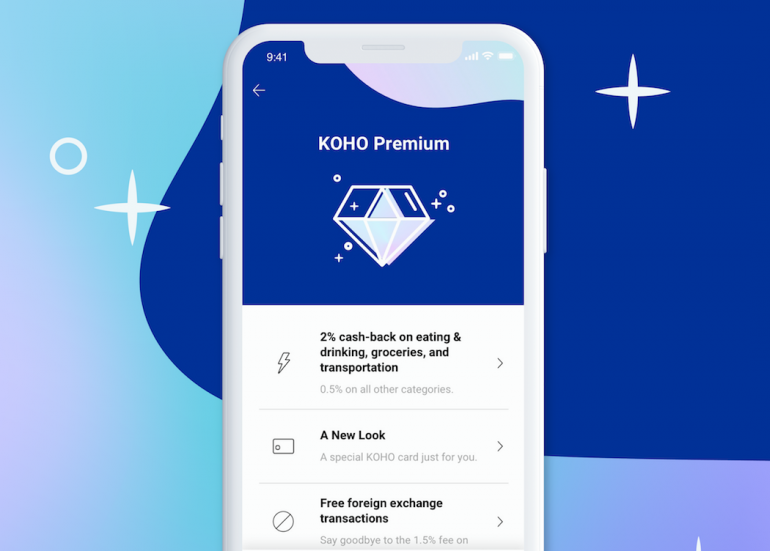

Toronto-based FinTech Koho is now offering Koho Premium, a new cashback program for Canadians through its pre-paid card. Koho called the program the first of its kind for a pre-paid card in Canada.

“Premium is an evolving offering that will continue to provide more value for Koho users as they adopt it.”

– Daniel Eberhard

The pre-paid card offers two percent cashback on groceries, transportation, and dining out with a full-service account. The program has no foreign exchange fees, free financial coaching in the app, higher balance limits, and price-matching. As part of the Premium account, which runs for $9 a month or $84 per year, users can buy their groceries at any store and can earn on transportation from Uber, gas stations, and transit. For all purchases outside of groceries, transportation, and dining out, users will earn 0.5 percent cashback.

“Just like the company itself, Premium is an evolving offering that will continue to provide more value for Koho users as they adopt it,” shared Daniel Eberhard, founder and CEO of Koho. “We’re constantly adapting our products to fit the lives of Canadians, to add value and help contribute to a more financially balanced future.”

This launch comes several weeks after the company announced the close of a $42 million Series B round, led by Power Financial’s Portag3 Ventures, which put the company’s post-money valuation north of $100 million.

RELATED: Power Financial now claims 89 percent stake in Wealthsimple following $30 million investment

Koho launched to the public in 2017, positioning itself as a millennial-centred alternative to traditional banking in Canada. The company does not operate with a Canadian banking licence, but does have partnerships with Visa and Peoples Trust Company to provide very similar services, such as e-transfers, ATM, insights on spending habits, and financial coaching. In May, the company said it had over 120,000 accounts and reached $500 million in annualized transactions.

The company has been rolling out new services and features over the last year, with a joint account feature being launched in February. What the Fee, a new feature and website to help Canadians uncover hidden bank fees, was made available in April.

The company is offering a free 30-day trial of the Premium account so users can see if the program is a good fit. Koho’s original 0.5 percent cashback app will remain free to use. Koho said more launches are expected to take place later this summer, including the arrival of metal cards.

Image courtesy Koho