Venture funding in Montréal reached an impressive $1.15 billion in 2020, solidifying the city as one of the top startup ecosystems in Canada, only just behind Toronto, according to the BDO-Hockeystick Montréal Tech Report.

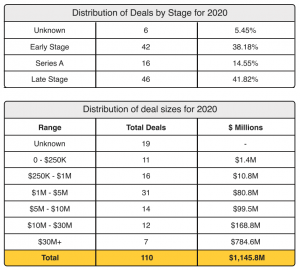

Montréal saw a handful of megadeals last year that fuelled the high number of total dollars raised. With 110 deals throughout 2020, Montréal demonstrated a healthy distribution of deal volume for early and late-stage startups.

“Montréal’s first three quarters of 2020 are a testament to its strong ecosystem.”

Hockeystick’s Montréal Tech Report looks at how the city’s tech ecosystem fared in terms of deals and dollars, with data sourced through exclusive partnerships with organizations like the Canadian Venture Capital and Private Equity Association (CVCA). Hockeystick also compiles data from startups using its platform, as well as public data sources.

Venture activity in Montréal last year puts the city far ahead of other Canadian ecosystems, including British Columbia, Calgary, and the Waterloo Region. Montréal’s total venture funding also puts the city very close behind Toronto, which typically leads in tech funding.

Over 2020, Toronto startups raised only four percent more funding than startups in Montréal, indicating that the Québec-based city is quickly gaining on the historically dominant tech ecosystem in Canada.

Toronto saw 186 deals last year, maintaining its position as the most active ecosystem by a solid margin. However, some recent Montréal deals, such as Hopper’s $213 million Series F round of funding, could push the city closer to matching or surpassing Toronto’s activity in 2021.

Montréal has also seen some large exits close in recent months, including Nuvei’s record-setting IPO and ServiceNow’s $230 million acquisition of ElementAI. Though these don’t directly impact venture activity, they do demonstrate a robust ecosystem where tech startups can start, scale, and exit.

“What’s interesting in Montréal is that they had 41 percent fewer deals compared to Toronto and 36 percent fewer investors, but they were very close in total funds raised in 2020,” said Rob Darling, research partner at Hockeystick. “We can account for part of this in the three largest deals in Montréal for 2020 that totalled $565.8 million, whereas the three largest deals in Toronto for 2020 totalled $238.2 million.”

Despite the strong year, funding in the fourth quarter of the year dipped 68 percent from Q3.

Hockeystick anticipated this drop, noting that the top deals following a record-setting Q2 and megadeal-fuelled Q3 would likely be much smaller in comparison (AppDirect’s $250 million deal in Q3 accounted for 83 percent of total quarterly deal value.)

Biggest deals bolstered by strong talent pipeline

Hockeystick noted several factors that are attracting both startups and investors to Montréal, with the foremost being Montréal’s wide access to talent for growing companies.

Montréal has approximately 248,000 post-secondary students enrolled in universities and colleges, and this talent pipeline is evident in the companies that raised some of the largest deals last year.

Top venture deals in 2020 included AppDirect’s $250 million round of funding, Sonder’s $230.4 million Series E round of funding, and Ventus Therapeutics’ $84.7 million Series A raise. Data from LinkedIn indicates 19 percent of AppDirect, 7.5 percent of Sonder, and 39 percent of Ventus employees have either graduated or taken courses from Montréal post-secondary institutions.

Distribution of early, late-stage deals was healthy

Hockeystick’s Montréal tech report tracked the spread of 2020 deals across early-stage, Series A, and late-stage startups. Early-stage deals accounted for 38 percent of the 110 total deals, while Series A took up 16 percent of the year’s deal share. There were a total of 46 late-stage deals in 2020, making up 41 percent of all deals. Six deals were undisclosed.

The distribution of deals was similar in Montréal to that of Toronto, though Toronto still saw more deals in each stage overall.

Not only was there a healthy spread across different stages, but the distribution of deal sizes was also well-balanced last year. The deal size with the greatest share of deal volume were those in the $1 million to $5 million range.

Seven deals raised in 2020 were over $30 million. Though this was the lowest share of deals in Montréal, it is equal to the number of deals in Toronto in that range, demonstrating Montréal startups’ ability to execute significant raises.

“Overall, the ecosystem looks really healthy in both distribution of deal and deal sizes,” said Darling.

COVID-19-impacted verticals lead in deal count, funding

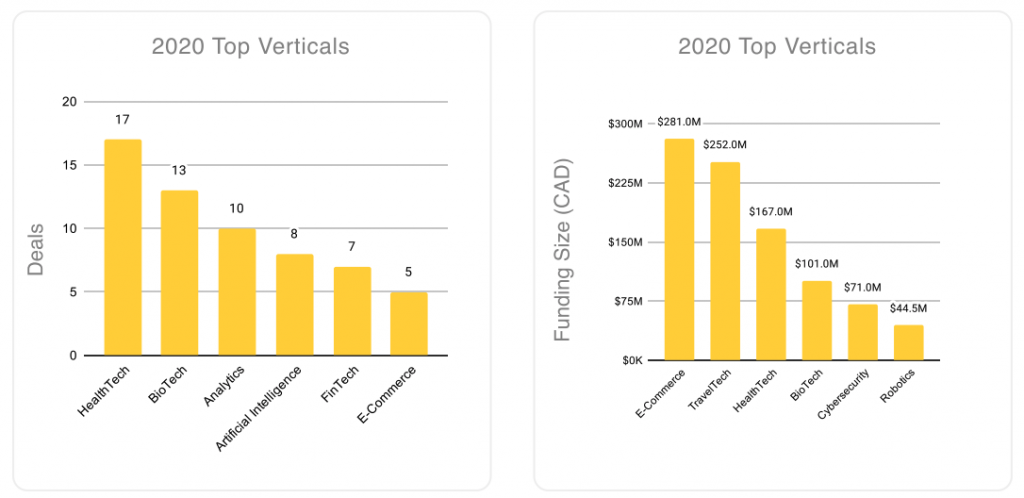

Hockeystick’s report also tracked funding and deal count across different tech verticals. Healthtech saw 17 deals last year, the greatest share of all verticals. Healthtech startups also collectively raised $170 million last year, the third-highest amount of funding. Other high-performing verticals by deal count included biotech, analytics, and artificial intelligence.

One notable healthtech deal included Dialogue’s $43 million equity investment. The raise came a few months before the startup exited, listing on the Toronto Stock Exchange in March of this year. The healthtech vertical was also active in Toronto last year, with the city seeing a total of 20 deals in that vertical, indicating that healthtech is a competitive sector in both ecosystems.

Montréal’s e-commerce startups raised the highest collective amount of funding in 2020 at $280 million, which is mostly attributable to AppDirect’s round of funding. Other top performing verticals in terms of funding included travel tech (dominated by Sonder’s deal), biotech, and cybersecurity.

What is notable about Sonder’s and AppDirect’s megadeals is that both companies, which were both founded in Montréal, are now officially headquartered outside of the city. However, both deals are still considered highly relevant to Montréal’s tech ecosystem, as the investors include very notable Canadian financiers, including Caisse de dépôt et placement du Québec and iNovia Capital.

A portion of the proceeds from AppDirect’s deal were expected to be used for hiring new team members in its Montréal office, which would make Montréal the company’s largest outpost by headcount. BetaKit has also reported about Sonder’s plans to open a second headquarters. Though the travel tech company has not officially confirmed these headquarters will be in Montréal, its increased activities there indicate Sonder is returning to its roots.

RELATED: Sonder to go public on NASDAQ through SPAC deal

“In Montréal, healthtech was the top vertical for deals in 2020 and the third in total investment,” “If we remove Sonder’s $230.4 million raise (travel tech) and AppDirect’s $250 million raise (e-commerce), then healthtech would also be the most funded vertical in 2020 for Montréal,” Darling added.

Both e-commerce and healthtech are sectors that saw leaps and bounds in 2020, as the COVID-19 pandemic drove a surge in demand for virtual health solutions and support to get retail businesses online amid lockdowns.

The broader Montréal tech sector also appeared resistant, for the most part, against the pandemic’s impact to the economy. Darling noted that, unlike Toronto, which experienced an unimpressive second quarter of 2020 as the pandemic began to take hold, Montréal was able to achieve high funding activity over the second and third quarters of the year.

“Montréal’s first three quarters of 2020 are a testament to its strong ecosystem, as it was able to withstand the early stages of COVID and continue momentum,” he said.

BetaKit is a Hockeystick Tech Report media partner.