This week at Montreal’s Startupfest, Female Funders announced the launch of its Women in Venture report analyzing the Canadian angel and venture capital landscape.

The report found that just 14 percent of Canadian venture capital partners are women, which is double the seven percent of partners at the top 100 American VC firms. When analyzing senior roles, women’s representation is cut in half. Women hold 58 percent of all analyst roles, 27 percent of all associate and principal roles, and represent 14 percent of GP and partner roles.

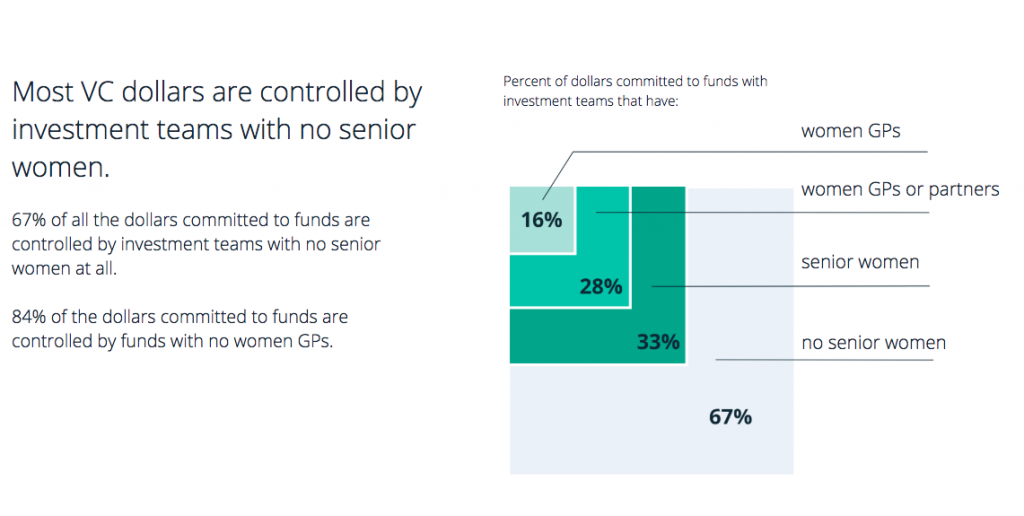

Eighty-four percent of dollars committed to the country’s top funds are controlled by teams with no women general partners.

The report was produced with Toronto-based Hockeystick, and uses public data from VC firm websites, and platforms including LinkedIn, Crunchbase, and Hockeystick itself. The dataset includes 33 Canadian venture capital firms that either made investments in 2017 or announced the close of a fund in the last 12 months, and the self-reported makeup of 22 angel groups in 2017.

The report acknowledges that women entrepreneurs have a higher chance of closing investment when a woman investor is involved, citing data that women-led startups are more likely to get investment if they have at least one woman partner on their team. However, eighty-four percent of dollars committed to the country’s top funds are controlled by teams with no women general partners.

“While Canada is leading the conversation about women in entrepreneurship, we also need to consider who’s on the other side of the table,” said Lauren Robinson, executive director of Female Funders and COO at Highline BETA. “Deal flow often comes from pre-existing networks, which explains why when investment teams include women, they are more likely to invest in female entrepreneurs. Until we have women on both sides of the table—among both entrepreneurs and investors—we won’t see real change.”

Robinson noted that entrepreneurs-in-residence were also taken into account for their ability to add expertise to investment committees. The report found that 18 percent of EIRs and advisors are women, but zero percent of venture partners at Canadian VC funds are women.

Female Funders’ Lauren Robinson and Jill Earthy talk discuss the report on the CanCon podcast.

On the angel investor side, Female Funders found that on average, women make up less than 15 percent of angel groups’ membership. The membership of most angel groups range from seven percent to 17 percent women.

Firms should encourage mentorship and sponsorship of talent within to ensure that women are moving up in seniority.

The Canadian number is lower than American angel groups, where women comprise 22 percent of angels. It’s noted within the report that this number exists despite the fact that in the last decade the potential pool of angels has grown. The total number of women earning at least $250,000 jumped by 49 percent, which is three times the 16 percent increase in men seen in the same time period.

Female Funders, which works to support women pursuing angel investing, was relaunched by startup co-creation and venture development company Highline BETA in May 2018. The Summer 2018 Angel Academy cohort is officially kicking off with investor partners like iNovia Capital, OMERS Ventures, ScaleUp Ventures, and Vanedge Capital. The partners will host virtual office hours and providing targeted mentorship to participants.

“Being a woman in tech is hard. Being a female entrepreneur is hard. Luckily, we’re starting to talk about it as a community and make changes for the better. But we talk less about the challenges of being a female investor,” said Elizabeth Caley, chief of staff at Meta. “I’m excited to join the next cohort of the Female Funders program because clearly, diversity is a strength. I’m proud to join and learn from a community dedicated to strengthening tech ecosystems around the world.”

As for what’s next, Female Funders recommends creating pathways for potential women funders, including looking at recruiting technology and evaluating corporate executives as potential venture partners. Firms should encourage mentorship and sponsorship of talent within to ensure that women are moving up in seniority.

While the report works to provide a foundation for surveying the landscape of women in venture capital, it acknowledges the limitations of the data currently available: less than one-third of firms publicly list VC roles.

Access the full report here.

Photo via Unsplash.