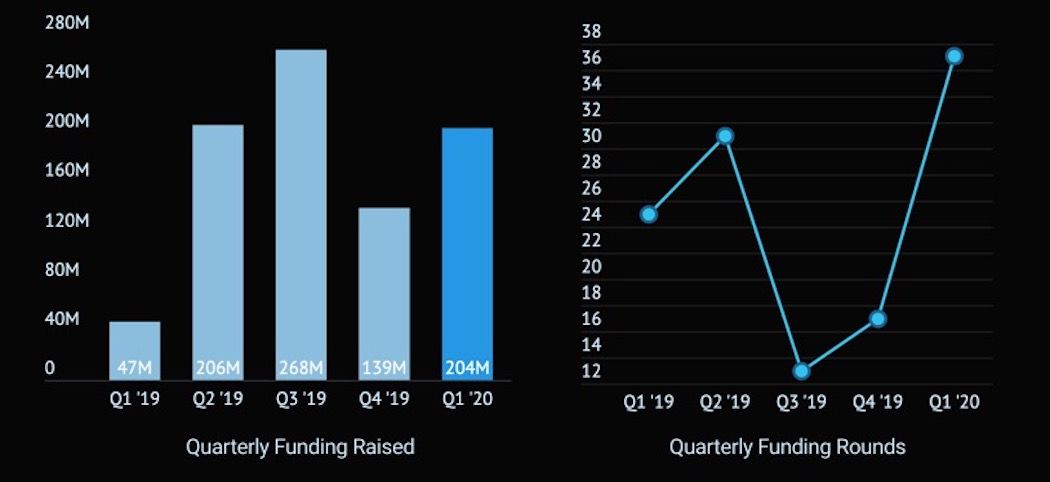

Montréal’s tech sector saw $204 million in VC funding in the first quarter of 2020, up 47 percent over the last quarter, according to Hockeystick’s latest ecosystem report.

Hockeystick’s data is sourced through exclusive partnerships with organizations like the Canadian Venture Capital and Private Equity Association (CVCA) and the National Angel Capital Organization (NACO). Hockeystick also compiles data from startups using its platform, as well as public data sources.

Funding in the first quarter of 2020 was over four times higher than Q1 2019.

The $204 million in Q1 VC funding was deployed over 37 deals. Funding in the first quarter of 2020 was over four times higher than funding in the same quarter last year. The 37 deals closed in the quarter were also the highest volume over the last five quarters, up 117 percent from Q4 2019.

“You really can’t deny that Montréal had a very strong start to the year, which makes the potential next quarter even more interesting,” Raymond Luk, CEO of Hockeystick, told BetaKit.

The city saw several large deals in the last quarter, including Ventus Therapeutics’ $81 million Series A round, and AlayaCare’s $47.5 million Series C round.

Top investors in Montréal over the first quarter by deal quantity included Anges Québec, Fonds de solidarité FTQ, Caisse de dépôt et placement du Québec, Desjardins Capital, and Fondaction CSN. The number of deals these top investors participated ranged between three and five.

However, Hockeystick’s data also indicates that, since 2018, Anges Québec and the Industrial Research Assistance Program have been the most active investors in Montréal by far, effectively doubling the third-place investor, with over 80 deals each.

Life sciences lead in funding

Biotech and healthtech dominated Montréal venture funding in Q1 2020, totalling a combined $136.05 million. Luk said the Ventus deal put biotech at the fore in Q1 as the only deal in the sector, but large investments in life sciences are not unusual for Montréal, which has had a strong healthtech and life sciences cluster for some time. Just last week, Montréal-based drug developer Repare Therapeutics debuted on the Nasdaq with the largest-ever initial public offering of a Canadian biotech firm.

RELATED: Bonjour Startup Montréal launches tool to help track city’s startup ecosystem

“Montréal investors have typically been attracted to and not afraid to invest in life sciences, whereas in some places, people are a bit gun shy to invest in something that’s so capital intensive, something that’s very long term,” Luk told BetaKit. “It’s partly probably proximity to Boston too, [which is] a very strong city in medtech and healthtech, but I think it’s a positive thing, because it takes a certain kind of specialist to invest in life sciences.”

The SaaS sector followed healthtech with $31.5 million in total funding, and saw the highest number of deals at seven total. Some notable SaaS deals in Q1 were Unito’s $10.5 million Series A round, and Contxtful’s $2 million in seed funding. EdTech came in fourth place, with the sector raising $10.5 million in total.

Early-stage investing still active

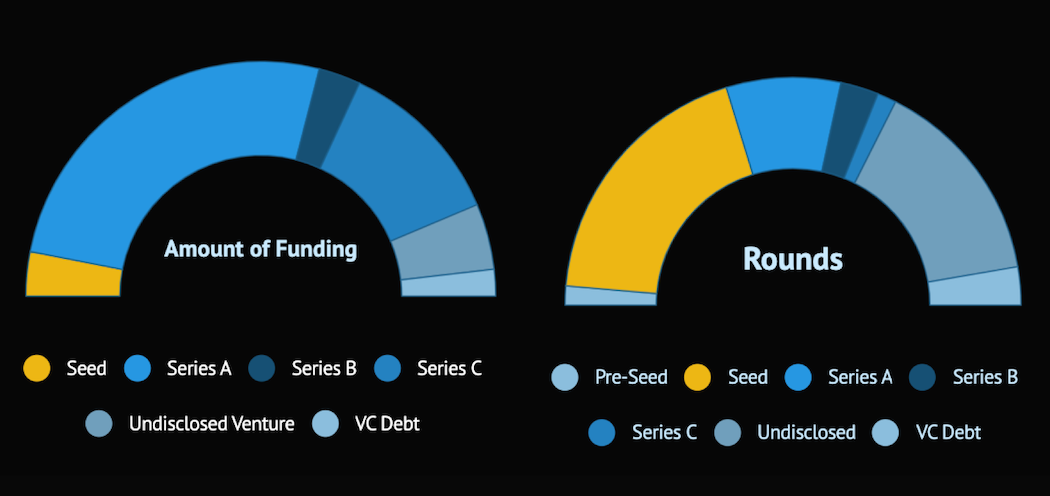

Later-stage deals comprised the majority of committed capital in Q1 2020, with $106 million going into Series A rounds, $11 million into Series B rounds, and $47 million into Series C rounds. However, 15 pre-seed and seed deals were closed in the quarter, the highest total by stage, indicating that early-stage investing was still active in the city. Venture debt accounted for $7.5 million of funding, and undisclosed venture capital accounted for $18 million.

Fifty-five percent of the investors who invested in Montréal startups in Q1 were Canadian, with the remaining 45 percent foreign. Luk said Hockeystick’s data indicates that the division is “unusual,” noting in the Greater Toronto Area, for example, the divide is closer to two-thirds of investors being Canadian.

Although Montréal saw a slight decrease in deals closed around mid-March, when COVID-19 restrictions first began to take effect, deals were still closing in the region right up to the end of the quarter. Luk told BetaKit it is still too early to tell what effect the pandemic has had on Montréal tech funding, adding that financial results in the second quarter will paint a clearer picture.

“The real evidence will be what happens in April, May, and June,” Luk said. “If we put the two quarters together, that will really tell the story.”

An infographic featuring Hockeystick’s preliminary findings for the quarter can be found here. Those interested in receiving the full forthcoming Montréal Technology Report can sign up here.

BetaKit is a Hockeystick Tech Report media partner.