According to CB Insights and PwC’s Canada’s latest MoneyTree report, 2017’s sluggish start may transform into a podium finish by year’s end.

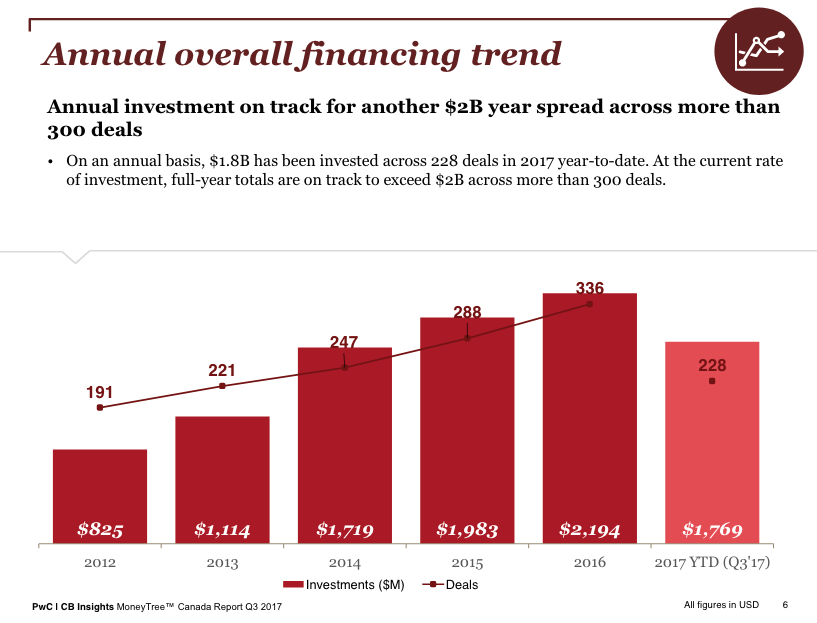

The report, which tracks VC activity in Canada for Q3 2017, indicates that Canada could exceed $2.5 billion ($2 billion USD) across more than 300 deals for the year. The result would match or surpass activity from last year, when a total of $2.2 billion USD was invested, and 2016, which fell just below the $2 billion USD threshold.

Current year-to-date financing has already surpassed 2014’s $1.7 billion USD total. Q3 2017 also beat 2016’s biggest quarter in terms of dollars invested.

Canadian VC-backed companies received $1 billion ($858 million USD) of total capital in Q3 2017, invested across 81 deals. On a quarterly basis, deals increased by 21 percent, and dollars increased by 110 percent from Q2 17.

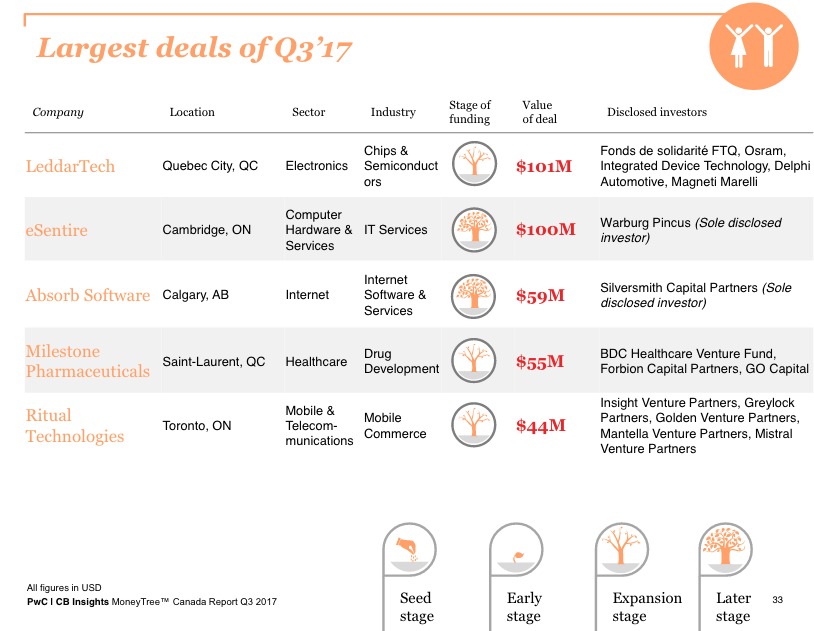

Q3’s deal total also nearly matched Q4 2016’s eight-quarter high, while surpassing the biggest quarter of 2016 in terms of dollars, driven by a pair of mega-rounds of $100 million USD or more.

“Canadian tech had a strong Q3 with a substantial rise in both deal volume and dollars invested. With this momentum, we look forward to a strong close to the year, as we’re on track to surpass $2 billion USD invested,” said Chris Dulny, National Technology Industry Leader at PwC Canada.

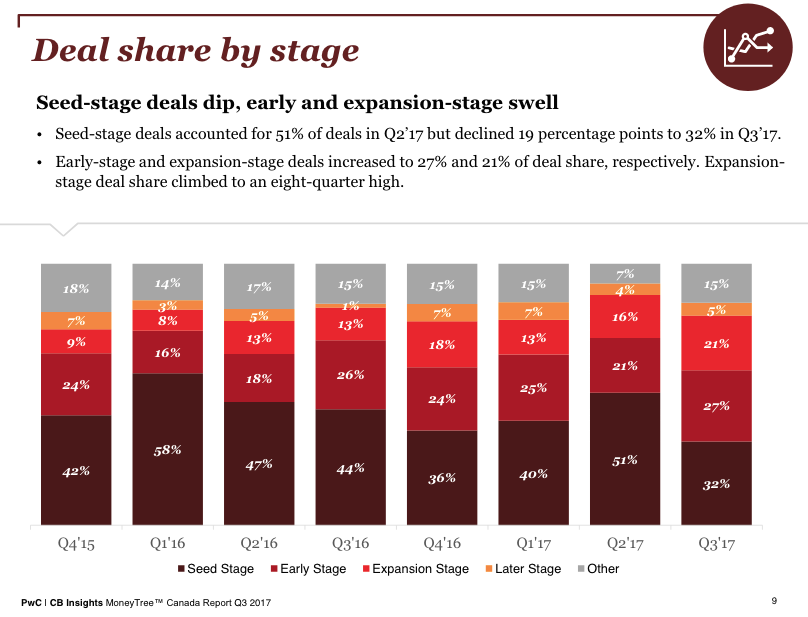

Seed-stage deals accounted for 32 percent of deals in Q3 2017, a 19 percent drop from 51 percent of all deals in Q2 2017. However, early-stage and expansion-stage deals increased to 27 percent and 21 percent of deal share, respectively. Expansion-stage deals climbed to an eight-quarter high in Q3 — a strong contrast from past quarters where seed-stage deals were the most prominent, and perhaps a sign of a more robust investment ecosystem.

Canada-based investors accounted for 62 percent of all active investors at the seed stage, while also representing over 50 percent in early and expansion-stage deals.

While an increase in corporate participation was a major theme of Q2 2017 — 27 percent of all Canadian companies had at least one corporate VC investor during this time — this number dipped to 21 percent this quarter. However, the report indicated some optimism around sustained corporate participation, as corporate investors continue to account for over a fifth of Q3 2017 deal share.

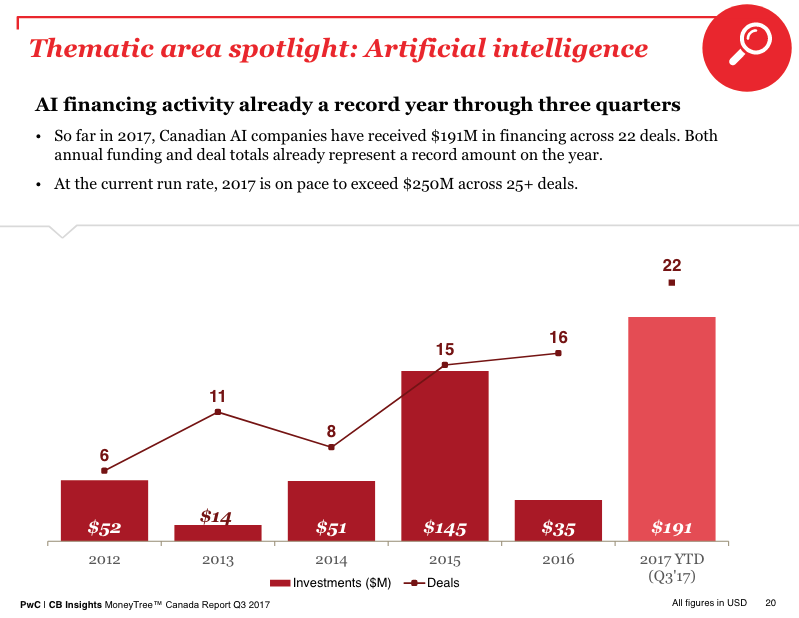

The momentum in AI funding from last year — driven by Element AI’s $137.5 million Series A — appears to continue as Canadian AI companies have received $241 million ($191 million USD) across 22 deals so far in 2017. At the current run rate, 2017 is on pace to exceed $316 million ($250 million USD) across over 25 deals.

FinTech was another notably strong sector, as Canadian FinTech companies have received $252 million ($200 million USD) across 27 deals. This year is on pace to see $341 million ($270 million USD) invested across over 30 deals, on par with last year’s figure of $351 million ($278 million USD)

“The health of Canadian FinTech companies is buoyed by continued funding to the sector,” said Diane Kazarian, National Financial Services Leader of PwC Canada. “We’re seeing more expansion-stage funding with larger deal sizes, driven by increasing adoption of FinTech by established players in the Canadian financial services sector.”

By province, Ontario had the largest number of deals and dollars, with $569 million ($450 million USD) deployed across 47 deals. Quebec followed with $318 million ($252 million USD) deployed across 18 deals, and British Columbia with $84 million ($67 million USD) across 12 deals. Waterloo-based companies jumped from $13.9 million ($11 million USD) in Q2 17 to $14 million ($112 million USD) this quarter, driven by eSentire’s $100 million USD financing round.

Access the full MoneyTree report here.

BetaKit is a PwC MoneyTree Canada media partner.