Contactless payment platform Mobeewave has received additional funding as part of its Series B round. A new investment from Samsung Venture Investment Corp. brings the total amount for the round to more than $26 million CAD ($20 million USD).

The Series B funding was originally announced in November when Mobeewave secured $22 million CAD ($16.5 million USD) in an investment round led by Mastercard, and European based VCs NewAlpha Asset Management and Forestay Capital.

“It is a lot about timing and we were not able to close on time with Samsung [before the first Series B announcement],” said Benjamin du Haÿs co-founder and co-CEO of Mobeewave, noting however that this new investment from Samsung is exciting for the Montreal-based company.

His fellow co-founder and co-CEO Maxime de Nanclas said, “Samsung’s financial investment will help support our research and development in further progressing digital transformation through innovative, customer-focused solutions, a goal that we both share.”

Mobeewave signed an agreement with Samsung Electronics in February, but user growth on the platform has been slow.

In February of last year, Mobeewave signed an agreement with Samsung Electronics making its platform available for commercial use on all Samsung devices. It also announced a partnership with National Bank of Canada in July for a mobile point-of-sale (POS) tool allowing small and medium-sized businesses to accept payments through compatible smartphones. Mobeewave currently operates in Australia, Canada, and Poland, in partnership with three banks – Commonwealth Bank, National Bank, and Polskie ePlatnosci, respectively.

While Mobeewave has secured these global partnerships and investment du Haÿs told BetaKit that the company has not been pleased with the usage of its platform. The co-founder admitted that there was not an uptake in usage as the company had expected once partnerships were secured.

“The challenge is in many ways is that we are a platform provider and we propose our platform to large organizations that then push it through their own product to the merchant,” du Haÿs explained. “With that comes limitations and hesitation from our customers about going to market, so it takes time to create usage.”

Because of this Mobeewave plans to make increasing usage a key element of 2019. The company will use its Series B funding to boost usage by increasing marketing outreach, developing current partnerships, and furthering reach with financial institutions, tech companies, as well as the app developer community.

du Haÿs said the company plans to release a Native Development Kit (NDK) which would allow Android third-party app developers to integrate its contactless payment platform into their own apps.

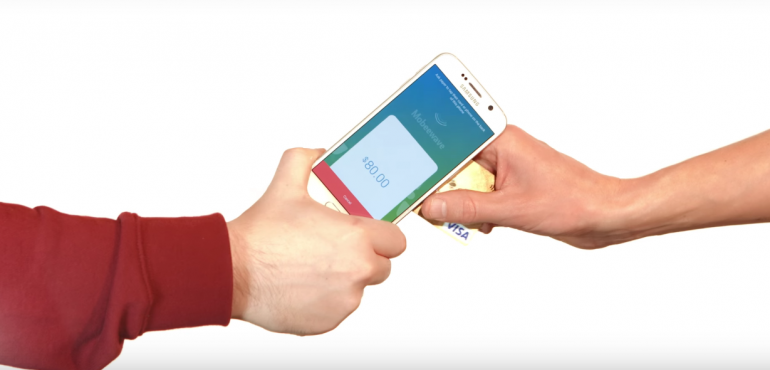

Mobeewave’s contactless payment platform allows mobile devices to accept payments via NFC, making it possible to accept contactless card or mobile wallet payments without the need for external hardware. “We’re making it easier and less expensive for small and micro merchants to adopt cashless payment acceptance, which ultimately feeds back into the growth of a cashless society,” said du Haÿs.

Related: Mobeewave officially opens beta of PayMeTap to kickstart the future of contactless payments

The FinTech startup was founded in 2011 by du Haÿs and de Nanclas with the goal of creating a solution giving businesses of all sizes easier access to digital payments. The two founders quickly recognized that the digitization of payments and the widespread adoption of smartphones created the need and opportunity for a technology platform that could turn any phone into a payment terminal. Mobeewave touts itself as a way for struggling micro-merchants and entrepreneurs to “gain traction” in an increasingly cashless world by adopting digital payment methods.

Mobeewave has no plans to expand into new countries in 2019 and instead will focus on increasing awareness about its platform in conjunction with its current partners.

“We want to focus on our customers because if they succeed we succeed. There is a lot of focus on product and helping our partners sell our solution because its a pure innovation,” said du Haÿs. “No one has done this before, and we are the first and only ones in the world being accepted by Visa and Mastercard. So when we sell to our customers they don’t know how to sell [our product] because it’s an innovation. We have to help them in telling merchant and consumer stories, creating marketing content in order to spread the good word about Mobeewave.”

Mobeewave does not expect any more investments as part of its Series B and will spend the rest of the year focusing on investing in its product, NDK, and marketing strategy.