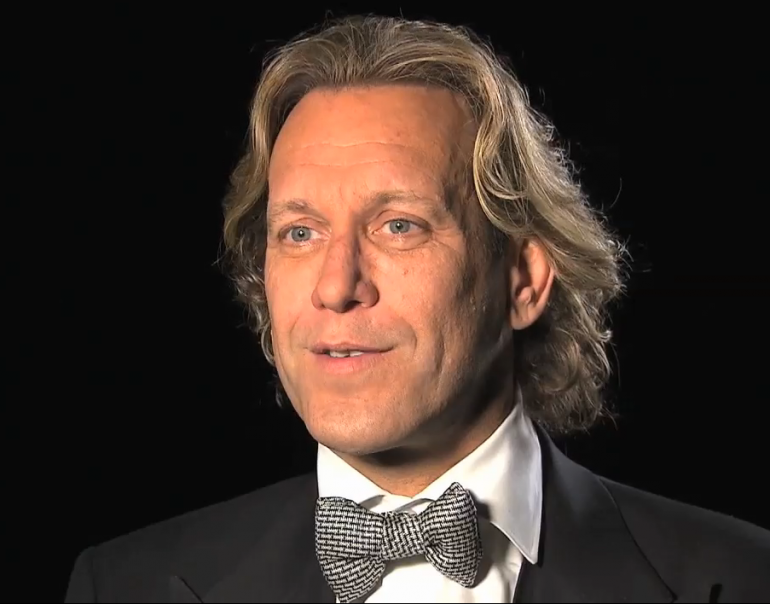

One of the two newest members to CBC’s Dragons’ Den has a multitude of tattoos (about “38 to 42”) and a multitude of investment interests. In fact, it doesn’t matter what an entrepreneur pitches to the longtime finance man, who most recently headed up the merchant banking firm Difference Capital.

“I don’t characterize anything as a favourite, my whole modus operandi is ‘can I make money,’ or ‘can I make a deal with somebody,'” said Wekerle. “What I look or is ownership at the level of the entrepreneur. I think there needs to be some sort of barrier to entry and again, passion is very important.”

CBC recently released a few inspiring videos that detail who the two new dragons are, and you can check out our take on Wekerle’s fellow newcomer, Vikram Vij, here.

While Vij came to Canada by way of Austria and his home country of India, Wekerle is a born-and-raised Toronto boy (and he sure sounds like one too).

Described as “Mick Jagger meets Warren Buffett,” Wekerle’s story is just as cool as Vij’s: his first job was as a paper boy for the Toronto Star where he had to “add up the Toronto Star tickets that you used to have and you had to do it very quick or you wouldn’t get paid.”

From there he moved on to “the glamorous life as a busboy at an all-night restaurant,” at 12 years old, working all-night shifts from 7PM to 7AM. Moving up to the position of host and eventually waiter at 18 years old, career lasted two days after he spilled several plates all over a table.

But to his “fortuitious nature” he was hired on the floor at the Toronto Stock Exchange. “”I was an overnight success, it just took me 32 years,” joked Wekerle. He said his co-workers were all ten years older and that gave him the edge as he got older and into his early 20s as he rose within the TSX.

Difference Capital is just the third firm that he’s been with and “probably the most exciting thing I’ve done in my whole career.”

With GNP Securities, he started the company off with four partners, gained a bit of seed capital and grew it up to a billion shares in foreign market capitalization.

And how does he see success in entrepreneurship?

“Being there at the right place at the right time. I tell people, ‘you have to work hard to do well, and to do well you have to be lucky, but you have to be good to be lucky and lucky to be good.”