New York-based Kasisto, creators of the KAI FinTech platform, and Manulife Bank have announced the launch of MAI, a conversational AI solution targeted towards Manulife’s Canadian millennial clients, as part of its All-In Banking Package.

“We’re thrilled that Manulife chose Kasisto’s platform to power its millennial-focused digital product suite.”

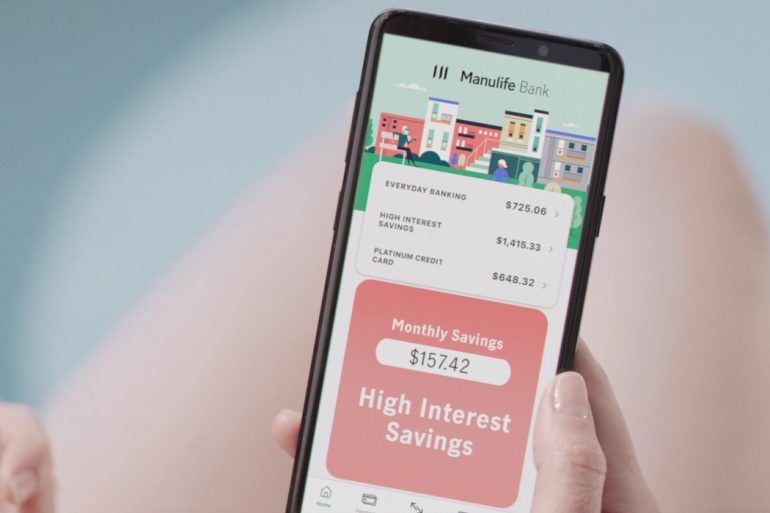

Powered by KAI, MAI shares insights into customer spending habits, tracks account balances, locates nearby ATMs, and answers personal finance questions. Manulife is hoping Kasisto’s chatbots can increase digital engagement, brand loyalty, and customer lifetime value through its insights.

“Canadians are looking for clarity, simplicity, and value from their bank. This applies equally to the technology they use to bank,” said Rick Lunny, president and CEO of Manulife Bank. “We sought the input of Canadians, user tested, prototyped and reimagined the customer banking experience to offer something you can’t get anywhere else: a complete digital banking package infused with artificial intelligence that works together to help you understand and maximize your money.”

Manulife’s new banking package offers a savings account, everyday no-fee chequing account, cash-back credit card, and trip insurance. The bank says customers can sign up for the package in under four minutes.

RELATED: HSBC opens Toronto data lab, will partner with FinTech, AI startups

Manulife is not the first bank to work with Kasisto. In January, TD Bank unveiled TD Clari, its own AI-powered chatbot also built with Kasisto. DBS Bank in Singapore, and Standard Chartered Bank in the UK, also use KAI.

Financial institutions and startups have been exploring conversational AI offerings for some time in Canada. Last year, Vancouver-based Finn AI announced a strategic collaboration with Visa Canada to use the Visa Developer platform within its own conversational chatbot platform. Borrowell recently made its free credit monitoring app, which includes an AI-powered credit coach, widely available on iOS and Android.

“Manulife Bank’s commitment to helping customers manage their money and save more matched perfectly with Kasisto’s vision to enable customers to make better financial decisions through human-like Conversational AI,” said Zor Gorelov, CEO and co-founder of Kasisto. “We’re thrilled that Manulife chose KAI, Kasisto’s state-of-the-art conversational AI platform, to power its millennial-focused digital product suite.”

Image courtesy Manulife Bank