“We started with the assumption that banking is broken.”

I’m speaking with Daniel Eberhard, co-founder and CEO of Koho, a new Vancouver-based startup that has been operating in stealth mode for the last eight months. Daniel is trying to convince me that he’s about to disrupt the Canadian banking system, and I’m starting to believe him.

Daniel continues, explaining the current disconnect facing Canadians across the country: last year, Canada’s five largest banks made $29 billion in profit; meanwhile, Canadians on average pay $185 a year in banking fees, one of the highest amounts globally. In Canada, the Net Promoter Score, which measures the likelihood a customer would promote a brand or service to their immediate network, of our financial institutions consistently rank at the bottom, beat out only our telecom companies.

“The majority of people pay bank fees,” Eberhard says, “yet most people don’t know what they are for, they don’t know where they go, and it should be very simple. If you think about it, it’s the only brand relationship where you have a vague idea of why you’re paying fees, but that’s it.”

Koho’s solution? Decouple the consumer experience of banking from the bank itself.

The disconnect is more dire for millennials, who, having been raised in a digital age, see no reason to continue with business as usual. A recent in-house study from Viacom found that 73% of millennials are more excited about the prospect of financial services from companies like Google and Apple than their nationwide bank, while nearly half are expecting startups to overhaul the way banks work.

Koho’s solution? Decouple the consumer experience of banking from the bank itself. Koho has partnered with a (currently undisclosed) Canadian credit union in a unique way: Koho owns the entire customer experience, from design and development to customer experience, while the credit union handles all traditional fiduciary responsibilities.

“Credit unions and banks are very good at holding money,” Eberhard says. “But the more you ask the bank or the credit union to do, the more opportunities for inefficiencies. What we’re trying to do is give customers the modern experience they’d expect from a technology company.”

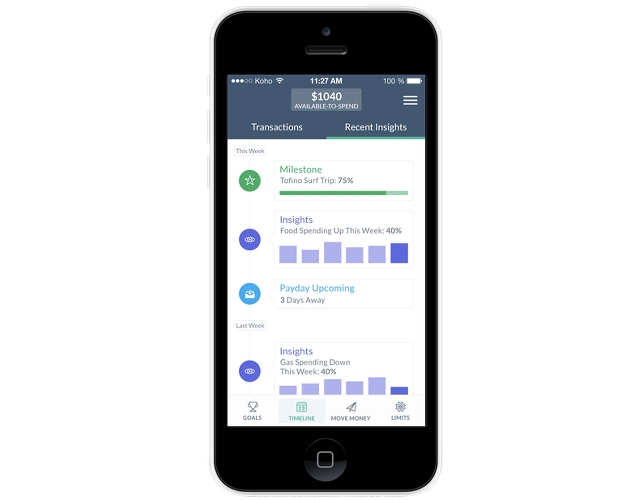

So what will that modern experience look like? For the most part, streamlined web and mobile interfaces that focus on simplicity, intelligible UI, and a feature set targeted to a new generation of bankers. Koho will support social payments, goal-based savings, budget tracking, and insights like an ‘available to spend’ indicator. If that sounds like a cross between RBC and Mint, well, that’s kind of the point.

Of course, Koho still has to get its service out the door before the disruption can begin. The company expects to launch in beta by Q2 of 2015 (interested customers can sign up now on Koho’s website to participate in the beta), and is hoping strong word of mouth will fuel growth. That’s a far cry from the giveaways and deals most Canadian financial institutions employ to acquire new customers, but if Koho can provide the customer experience its pitching, perhaps the company won’t have to cajole users into signing up.

“We’re doing some things that frankly haven’t been done before.”

At the very least, customers should be piqued by Koho’s business model, which relies upon merchant-side Interchange fees. These fees are typical to any current card-based payment transaction, but crucially Koho thinks it can prosper without applying any of those aforementioned mysterious fees onto customers.

The company also has funding, although its yet unwilling to disclose just how much, and an impressive founding team, which includes Strangeloop co-founders Josh and Jon Bixby, the former now the Entrepreneur in Residence at UBC, and the latter a co-founder of the HIGHLINE accelerator (disclosure: BetaKit’s office is located in the co-working space of HIGHLINE’s Toronto campus).

If anything, Koho will be a welcome breath of fresh air to an industry that has (mostly) digitized, yet failed to adopt the tenets of the digital age. But Eberhard obviously has his sights set on a larger prize than consolation.

“We’re doing some things that frankly haven’t been done before.”