One might think that the best kind of client to land might be an venture capital firm. It looks like Toronto’s HockeyStick did even better this week, signing the Network of Angel Organizations – Ontario (NAO-O) to a three year deal where the startup will provide reporting tools to more than two dozen Angel groups and clubs representing over 800 Angel investors in the province.

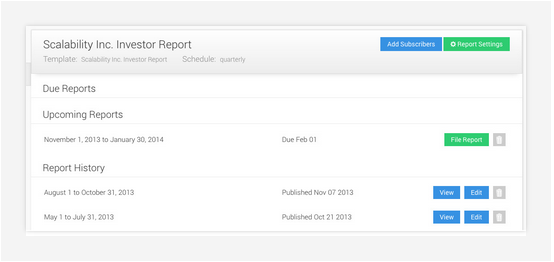

Hockeystick helps private companies share performance metrics and regular business updates with investors. The tool is used by thousands of startups, investors and funds around the world and promotes better communication with shareholders. “For the first time, people who support and invest in Ontario entrepreneurs will have a common platform to track their investments and improve their investment practices,” said founder Raymond Luk.

In a release the startup said that Ontario investors including BDC Venture Capital, the MaRS Investment Accelerator Fund, Communitech Hyperdrive and Extreme Startups all use Hockeystick to gather metrics from portfolio companies.

“A shared goal among NAO Ontario and Hockeystick is to put in place best practices for how companies report metrics to investors. This will lead to better company governance and better data for future industry research,” wrote the startup. “Accredited Angel investors who belong to a recognized Angel group or club will have free access to Hockeystick starting summer 2014.”

With over $250 million in investment activity over the last 7 years, the NAO-O supports the formation of Angel investment groups in order to boost the availability of capital and mentorship available to entrepreneurs.

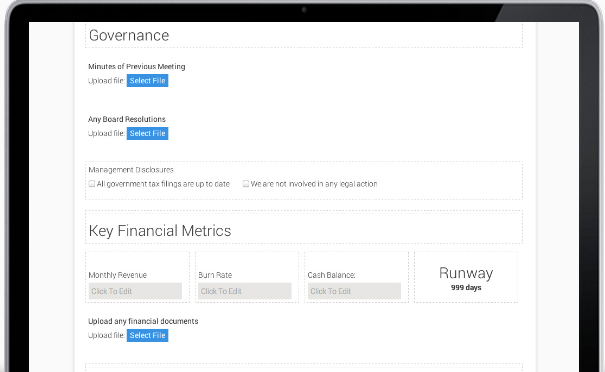

On its website, HockeyStick says it makes it easy for private companies to report key metrics and information to their investors, advisors, and stakeholders. Investors can define their own reports and automatically gather information from their portfolio, while CEOs can access simple and straightforward reporting that takes minutes a quarter. “You control who receives your information. Great for investor updates, Board meetings, and Advisory boards.”