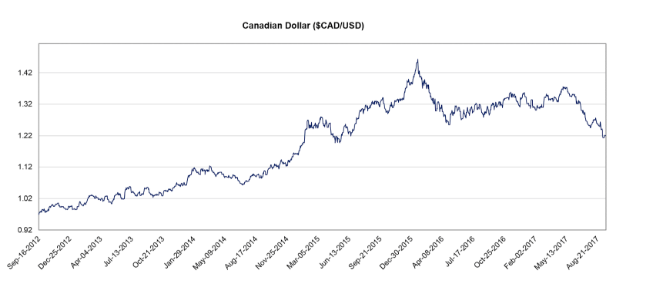

Over the last few years, Canadian SaaS businesses have had a significant benefit from the weak Canadian dollar.

This is because many SaaS businesses in Canada price their products in US dollars and sell to the US and internationally. As such, not only are they benefiting from stronger Canadian dollar revenues than if the exchange rate was closer to parity, but they have also been more profitable because in general, most of their expenses (especially labour costs) are in Canadian dollars. Over the last few years, this benefit has meant an additional 25 to 35 percent uplift in Canadian dollar revenues than compared to the 2013 period.

In the last few weeks we have seen this trend begin to reverse, with the Canadian dollar strengthening from its low point of $1.37 CAD per $1 CUSD over the summer, to its current position of $1.22 CAD. If the Bank of Canada continues to raise interest rates at a faster pace than the Federal Reserve in the US, then the Canadian Dollar will likely continue to rise. So what impact does this have on the average Canadian SaaS business over the next couple of years, and what can they do to protect against it?

The most obvious impact on Canadian SaaS businesses is that their Canadian dollar revenues will decline. As a result, the “burn-rate” or how quickly companies burn through their cash and previous funding will be accelerated to the tune of 10%+ currently, and potentially worse if the Canadian dollar continues to strengthen — especially since many businesses have tied their operating expenses to how much they expect to earn in revenues.

SaaS companies should actively track what’s happening with the exchange rate.

As such, we recommend that companies run several different budgets or forecasts at different exchange rates to see how much runway they have in a base case (we would recommend at $1.2 CAD per US dollar) and a downside case (which could be as low as $1.1 CAD per US dollar).

Given the acceleration of burn, we also recommend re-evaluating hiring plans to ensure the anticipated spend is in-line with the lower expected revenues. By delaying a hire by a month, you save nearly the same in salary (1/12) as the amount of the recent exchange rate decline. But obviously, this only has an impact on year one.

Lastly, there are a whole range of different hedging strategies that you can discuss with your bank that protect you against future price movements. The banks will likely try to push you to the more “exotic” structures where they charge you fees up front and make more money. As a rule, we prefer structures like the “Participating Upside” where you are guaranteed a set minimum exchange rate if the US dollar continues to weaken but participate in the upside should the US dollar strengthen again. These can typically be put in place for no upfront fee. But given the complexity on these hedging matters, we recommend you discuss with your bank and get expert advice.

So, we recommend that SaaS companies begin actively tracking what is happening with the exchange rate, have a plan in place to accommodate future changes, and potentially use hedging strategies to offset some of the risk.

Photo via Unsplash

Sampford Advisors is not an expert in currency hedging and we recommend you discuss any of the strategies outlined above with an expert before proceeding with any currency hedging.