Times are tough for startups. A huge slowdown in growth capital has led to layoffs, rescinded job offers, and wildly tapered scaling plans.

Some say this kind of downturn is inevitable with the amount of money injected into the economy during the COVID-19 pandemic, but the real question is not why it’s happening. Instead, it’s how smart startup leaders should respond.

In a recent BetaKit Live, Katy Yam, partner at Real Ventures and GM of Founder Fuel, Peter Fishman, co-founder and CEO of Mozart Data, and Ethan Ruby, partner of analytics at Craft Ventures all spoke about how the right data can help startup leaders make survival decisions in a downturn.

Prepare for the worst-case scenario first

Startups are always at risk of going out of business, regardless of market conditions, but the current downturn isn’t making things any easier. To help founders facing that reality, Yam built a worst-case scenario checklist for when things aren’t going to plan, to prepare for better days or wind down the company without causing irreparable damage.

The checklist includes the following elements:

1. Debt load: The sum of your debt obligations—tax liabilities, outstanding commercial or loan debt, and outstanding wages owed to employees—becomes the minimum sale price you can accept.

“How do you land the plane as a founder and not crash the plane?” Yam asked. “It’s better to walk away with an acquisition that may be for a loss, but at least you’ve kind of landed it.”

Yam said it’s especially critical to understand how much of the debt is personally secured by the founder or founding team. If you guarantee your startup’s debt personally and need to file bankruptcy, you could severely damage your ability to raise capital for a future business and harm your personal finances.

2. Business value: This is your intellectual property, talent, and other elements of your business (like a client list) that could add value to a potential acquirer.

Particularly in worst-case scenarios, Yam said too many founders look to an acquirer to name a price. However, doing your own analysis of the valuable pieces of your company—even if the company itself isn’t going to make it—is a necessary step.

“Nobody knows your business like you know your business,” said Yam.

3. Possible avenues for cash: Revenue might be low or fundraising impossible, but there are other avenues you can look at. Yam said in Canada it’s often possible to get an advance on government credits like IRAP or SR&ED, which can either extend your runway or become a valuable source of cash to aid in an acquisition process.

The four stages of “OK”

Ruby said startups should be conscious of the fact that “almost anyone could fundraise” in 2020 and 2021. However, 2022—and potentially for the next couple of years—will be a fight for capital. To make it through, startups don’t necessarily need to thrive. They just need to be “OK,” something Craft Ventures describes as four possible scenarios.

The first stage is “cash-flow positivity,” meaning that the company has gross profits to keep itself in business. The second is “default alive,” which means that with cash on hand and the company’s current growth rate, it will be able to get to cash flow positive. The third stage is “default investable,” which is the ideal stage everyone likes. In this stage, growth metrics are solid despite a down economy, meaning you will likely be able to access capital even if there’s less of it to go around.

“How do you land the plane as a founder and not crash the plane?”

For startups that can’t swing the first three stages, the fourth is to go into super lean or “cockroach” mode. The goal here is to minimize burn rate as much as possible to buy yourself time to figure out product-market fit and get into one of the previous three stages.

“There are some startups that were pretty high flying a couple of years ago, but now are in no man’s land where they’re not on the path to being cash flow positive,” said Ruby. “They don’t have ideal metrics. So what should they be doing? They need to cut back.”

From hyper-growth to efficient growth

In what Ruby calls a “massive dislocation in the economy,” governments globally pumped trillions of dollars of stimulus into the economy during the pandemic. This kept the good times going for two years longer than arguably they should have, and now companies are feeling the pinch via inflation, higher interest rates, and stock price dips.

The problem is not necessarily that stocks went down, said Ruby, but what that caused in turn. Stock values dropping pushed big public market investors to slow down, which reduced the capital available to growth stage private companies. Investors in earlier stage private companies took their cues from growth stage investors, which meant they also slowed investing.

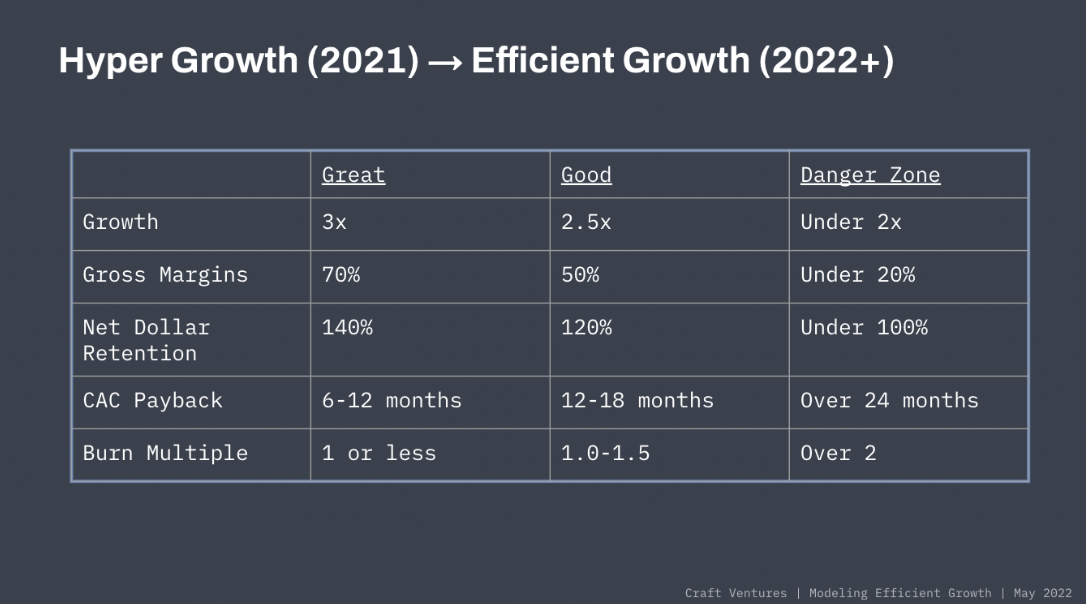

The net effect for startups is a slow period that shifts the focus from hyper-growth at all costs to efficient growth. And measuring efficient growth requires different metrics.

“If last year was about growth at all costs, this year is all about growth efficiency,” said Ruby.

Yam noted that a focus on growth efficiency also requires a change in the speed at which founders operate. From both an operator and investor perspective, Yam feels horizon planning needs to change. Instead of looking for the highest possible customer growth, she said businesses should look to “traditional” metrics, like retention, margins, and burn.

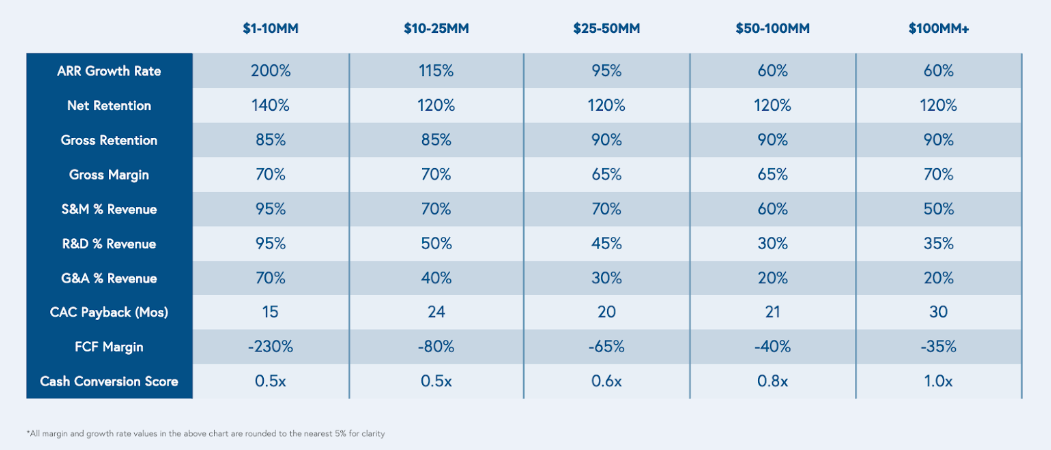

Thankfully for founders in 2022 and beyond, Bessemer Venture Partners studied hundreds of venture-scale startups to identify key metric milestones on the road to $100 million in revenue. Referencing those milestones, Yam noted that if your startup has below $10 million in revenue, you should be aiming for a 200 percent ARR growth rate. But if you’re at $50 million in revenue, a 95 percent ARR growth rate would still be top tier.

For Fishman, the real challenge isn’t identifying the metrics to track, but ensuring the data is honest. The data behind growth efficiency metrics like CAC / LTV are often stored in different places and require semi-complex calculations. Collecting and collating data is something Fishman knows well through his company, Mozart Data: the SaaS platform helps companies centralize all their data—from CRMs, marketing software, data warehouses, and more—then deduplicate and analyze information quickly.

From a survival perspective, correctly identifying these metrics serves two very important purposes: cautious investors won’t dole out capital without seeing them, but they also give a very clear window into your business operations, which means you get insights you can use to survive a downturn—or even grow through it.

“These metrics aren’t there just to appease funders,” said Fishman. “These are metrics that help guide how you should operate. They’re there because it signals to funders you’ve got a great business.”