In the past, CareGuide has excelled at securing funding using unconventional methods. For example, raising funding from the largest seed investor group in Canada, or securing $1 million in debt-financing from RBC to gobble up competitor CanadianNanny. However, not even founder John Philip Green could expect the next round would come via co-op, Ali Dinani.

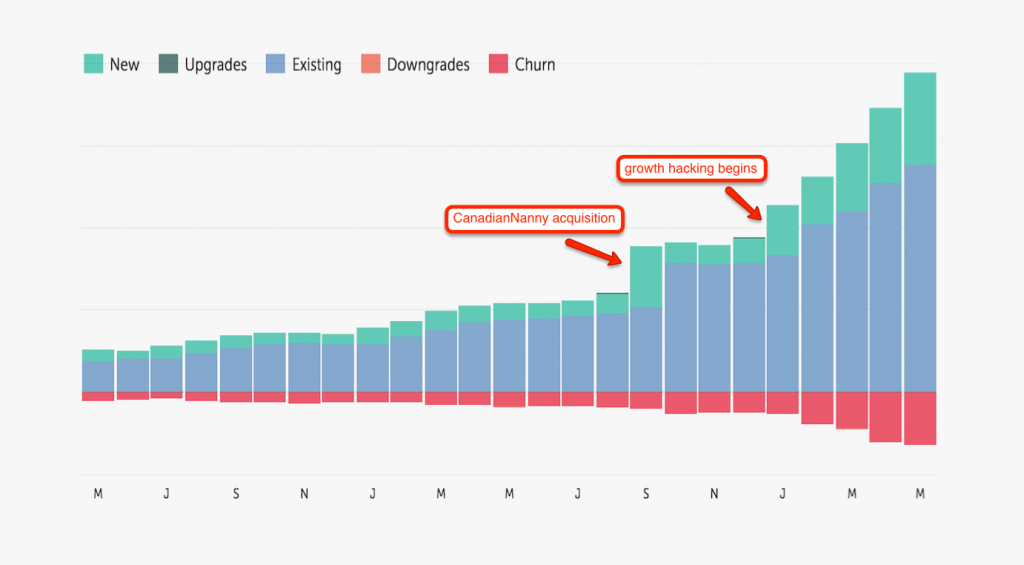

Dinani’s role at CareGuide is to run growth hacking experiments. Around December of last year, he approached Green with a few ideas to optimize the company’s customer funnel. The impact was immediate, and CareGuide began allocating additional resources. The results? 12% average MoM top line revenue growth over the last 6 months and a new round of funding.

“I sent out a graph that looked like the one [shown below] to our investors – I sent out a quarterly update – and 500 Startups in San Francisco, one of our existing investors, perked up their eyebrows,” Green told BetaKit.

Those eyebrows quickly turned into funding from 500 Startups’ DistroFund, which invests $100,000-$250,000 in post-seed/pre-Series A startups. CareGuide raised the maximum amount on favourable terms.

“They’ve already doubled-down on us once,” Green noted, explaining that 500 Startups had committed $75,000 in CareGuide’s initial seed round, then $250,000 in its follow-on round. “I think it’s quite a vote of confidence. I think having watched us operate in the last few years it’s obvious that we’re one of the tall poppies.”

Dominic Coryell, a Distro Partner at 500 Startups, agrees. “CareGuide’s advanced implementation of growth distribution techniques is impressive. The company is on a great trajectory.”

“I was expecting this. Every single thing we do at CareGuide is by design.”

Dinani explained that CareGuide prioritized its growth projects using Sean Ellis’ ICE Score, which ranks hypotheses by Impact, Confidence, and Effort. CareGuide’s projects ranged from simple signup form and POS optimizations to tweaks more particular to the company’s platform.

“Families love it when they get many candidates on their first day on our site,” Dinani said. “To make this happen, we text every applicable candidate when there are new jobs in their area.”

“It’s actually been a new gravitational pull within the company,” Green said. “Before, we may have been focused on launching features or building more traditional marketing channels. But man, what looks like a small optimization – if you get a 5% lift here and a 4% lift there, if you put those things together, all of a sudden, it has a huge trickle down effect on all of your other numbers.”

While Green freely admitted surprise over the cumulative impact of such optimizations, Dinani was fully confident in the results.

“I was expecting this,” Dinani said. “Every single thing we do at CareGuide is by design. I distinctly remember a conversation I had with [Green] back in December. I asked him about what his growth goals are. His response: triple revenue every year. To do that, we needed to think big, we needed to figure out a smart, sustainable way to grow our revenue by 10% every single month.”

Beyond the newfound revenue and investment, the success story carries additional personal weight for CareGuide. Dinani began CareGuide’s growth hacking operation at the end of his second co-op run; the first was beside Green’s side as he was starting the company. Dinani was sincere about his reasons for returning to the company following a school stint.

“CareGuide has an environment where we take people early in their careers and figure out their strengths,” he said. “I started off as a marketing intern. 4 months later I was a junior software engineer. And soon after that, I combined marketing and programming. Each transition has been a play towards my strengths. Now, it’s all about scaling our growth and taking CareGuide to the next level.”

Dinani is now a full-time CareGuide employee.