For FinTech startup Nuula, it’s all about the partners. Nuula has joined forces with two Canadian startups, Caary and OneVest, to launch what it calls its super app in Canada.

While the financial services app for small businesses has previously been available in the United States (US), the Canadian version is beefed up with integrations from Nuula’s two partners.

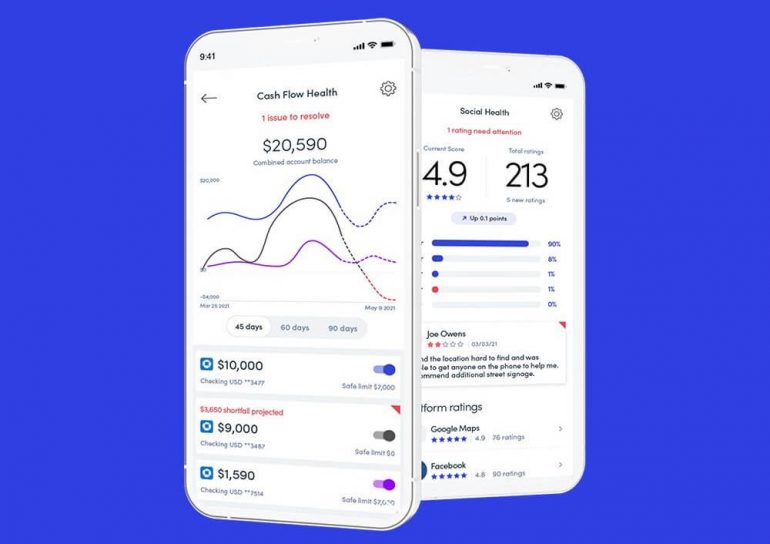

Nuula claims its new app helps small business owners track their cash flow in real time, aids them in monitoring financial and commercial metrics, and allows them to track customer sentiment, including online ratings and reviews.

Caary’s corporate credit card is offered in the Nuula app to Canadian customers, while OneVest is providing personalized investment portfolios within the app.

Nuula first launched its app in the US in 2021 after rebranding from BFS Capital, which operated for 20 years offering small business loans. Based out of the US, BFS Capital began its transformation to a company with a real-time data and analytics app in 2019, when it opened a Toronto engineering hub.

At the time of the US launch, Nuula CEO Mark Ruddock spoke about building a broader partner ecosystem through which Nuula hopes to offer a number of financial services to its customers. That now seems to be coming to fruition.

In an interview with BetaKit, Ruddock said he sees the rise of embedded FinTech partnerships coming to the forefront. “An example of this is the next generation of exciting new FinTechs that are being built and which are designed to be embedded in a range of third-party platforms,” Ruddock said.

In Nuula’s case, that means catering to small businesses globally by partnering with FinTechs locally, market by market. “Much of financial services requires local competency, and an understanding of each jurisdiction’s rules and regulations,” Ruddock said. “That is what makes partnerships so attractive — it’s easier to partner with local, best-in-class FinTechs than it is to build something from scratch that serves all needs in all markets.”

Ruddock noted that every partnership is slightly different. Some use a revenue-sharing model, while others are paid for with the onboarding of new customers. Still others are paid through a lifetime revenue share, or per transaction. “We work with a lot of different partners, and allow small businesses to access the Nuula app for free, so we are very flexible when it comes to putting the right model in place,” he said.

He also pointed out that Nuula’s partners gain access to what he said is a rapidly growing pool of small business customers, along with insights into the health of each business.

“As an app that tracks financial performance, we’re able to pre-qualify customers and find signals of financial health,” Ruddock said. “We are also able to monitor the performance of these companies over time and provide ongoing signals of health to our partners. These are insights that many FinTechs would not be able to gather on their own.”

RELATED: OneVest secures $5 million to help companies like Neo Financial launch wealth management products

While partnerships among FinTechs isn’t a new trend – Wealthsimple and Borrowell joined forces in 2016 – more such partnerships are popping up as of late. More recently, such partnerships have included FinTech startup Brim Financial teaming up with Canadian Western Bank (CWB) to give CWB clients access to Brim’s “platform-as-a-service” technology; and FinTech startup Mogo announcing a three-year lending partnership with alternative financing provider goeasy.

In fact, one of Nuula’s partners, OneVest, is no slouch when it comes to partnerships itself. OneVest teamed up with Neo in April to create Neo Invest, a digital investing platform managed by professional money managers.

OneVest’s model is that it offers a turn-key “wealth-as-a-service” platform to a range of different customers, including consumer FinTech companies, credit unions, traditional banks, and wealth management firms. It partners with companies and operates as the back-end for various FinTech services in order to help companies launch those products easier and quicker.

Nuula’s other partner, Caary, was founded in 2020 and offers a corporate card and payments platform to Canadian small and medium-sized enterprises. The startup claims it has developed a model for assessing and offering credit to SMEs based on cash-flow and assets instead of credit history, which it refers to as “a novel approach.” Caary secured $4.1 million in funding last year.

Nuula currently has around 60 employees, with most based in Canada. While Ruddock is pleased with the Canadian launch, he noted the lag when it comes to open banking as a missing component to operating in Canada. He said countries that have built strong open banking platforms, alongside a solid regulatory infrastructure, have seen the rise of a vibrant FinTech and banking ecosystem.

“Unfortunately, Canada lags behind in this area compared to the rest of the world,” Ruddock noted. “Countries where open banking is strong are reaping the benefits, allowing a new generation of FinTechs to thrive. The result is more financial inclusion, more access to capital, and more innovation.”

Canada only announced its open banking lead, PwC Canada digital banking director Abraham Tachjian, in March. The appointment comes more than three years after the federal government launched its Advisory Committee on Open Banking, and almost a year to the day since their report recommended a lead designing the “early phase of the [open banking] system.” Canada’s long and drawn-out path to open banking has often been criticized by Canadian FinTech companies for what they consider its glacial pace.

For Nuula’s part, Ruddock said that in coming weeks the startup will announce more partnerships that “lean into the needs” of both small businesses and entrepreneurs. “For example, you’ll soon hear us announce partnerships that flesh out the broader needs of small businesses, whether that’s term life insurance or cyber protection,” he said.

Over the next few quarters, Nuula plans to launch into additional countries globally. “The United Kingdom is next on our road map,” Ruddock said.