Vancouver-based Finn AI announced a strategic collaboration with Visa Canada, which will see the FinTech leveraging the Visa Developer platform within Finn AI’s conversational chatbot platform.

Launched in February 2016, the Visa Developer platform gives developers access to Visa’s suite of payment products and services, APIs, and software development kits that work with Visa payment products and capabilities.

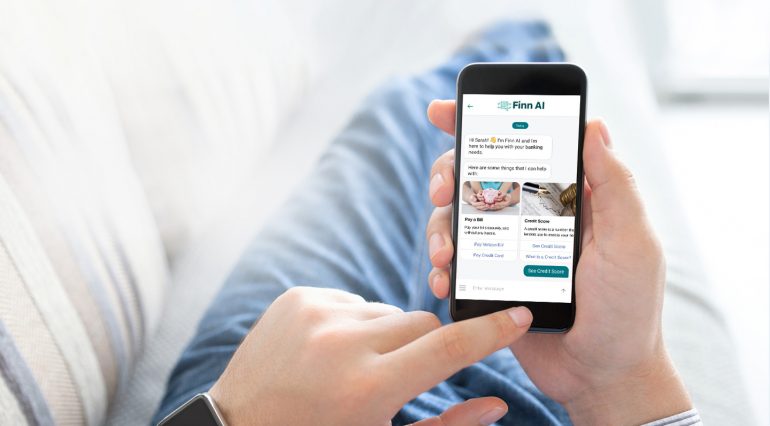

Finn AI said it will use Visa Developer’s APIs to enhance its conversational banking chatbots, and allow banks to create more personalized experiences for their customers. For example, a customer might chat with a virtual banking assistant and follow a process to ensure their cards know when they’re travelling to enable travel notifications, receive foreign exchange rates, and locate nearby ATMs. Customers can also use interact with the chatbot to disable a misplaced card, and receive access to a card through a digital wallet while waiting for a physical replacement.

“The Visa Developer platform is designed to provide open access to Visa’s technology for our partners to build more dynamic and seamless digitally enabled experiences for consumers,” said Derek Colfer, head of digital product at Visa Canada. “We are proud to work with Finn AI and collaborate in the rapidly evolving AI and chatbot space. For consumers, this will mean a more relevant and personalized digital experience.”

Finn AI and Visa’s collaboration announcement comes just over two months after Finn.AI partnered with BMO to launch AI assistants. Finn AI closed a $3 million bridge round led by Yaletown Partners in October 2017.