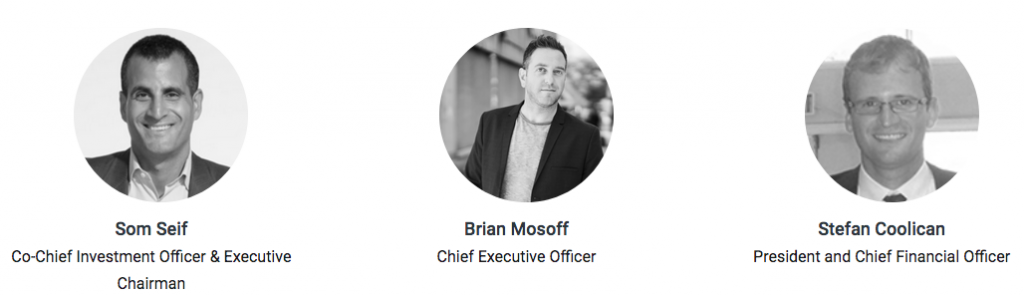

Ether Capital, a company dedicated to investing in Ethereum, announced the appointment of Brian Mosoff as its CEO and Stefan Coolican as its president and CFO.

Ether Capital said the decision to bring on Mosoff and Coolican was made in consultation with Michael Conn, who has resigned from his position as director and CEO. Conn will continue to serve as an advisor to Ether Capital for an interim period as the new executive team transitions into their new roles.

Scott Bartholomew has also resigned as the company’s CFO, but will remain for a period in the transition process. Bartholomew is part of the team at Purpose Investments; its CEO, Som Seif, is a founding member and sits on the board of Ether Capital.

The firm will also be insourcing many of the functions previously provided under a services agreement with Purpose, including oversight of financial reporting, insurance and risk management matters, certain organization compliance, and administrative services.

“There were conversations with Michael [Conn] for a while about what was needed to take the company one step further, and there was no animosity, there was no ‘hey we want you to go,’ and he doesn’t want to go,” Mosoff said in an interview with BetaKit about the executive change. “Everyone understands what this means is to go to the next phase with full-time people who have relationships with the developers, who have relationships with the tech community and have insights into those projects and pass off the torch.”

“What I care about is developers and following those developers, and as long as they’re adding, building, getting excited by the technologies and protocols, then I want this as part of my portfolio.”

– Brian Mosoff, CEO of Ether Capital

Mosoff is an entrepreneur and angel investor in blockchain and cryptocurrency technologies. Since 2013, he has invested in early-stage projects such as Ethereum’s 2014 crowdfunding. As Ether Capital’s CEO, Mosoff will be responsible for sourcing and evaluating investment opportunities, alongside engaging with the Ethereum community and growing Ether Capital’s presence.

“Ninety-nine point five percent of what’s out there is junk and is going to go to zero, and we have to be very diligent about the things we do decide to deploy capital in, and if we believe that Ether is going to do a five to 10x in the next 18 months to five years, our next question is: what projects will outpace that growth; how do you find and get access to the projects we think could do 100x? Those are tough to find,” Mosoff said of the challenge of investing in the space.

“It requires a team with strong technical expertise to vet through the junk…[and] fund developers dedicated to the ideas and projects that they want to build, that they will see through and not abandon after raising a lot of money.”

With volatile pricing and an uncertain regulatory environment, there is a perception that cryptocurrency is not a trustworthy investment; Canada’s own crypto exchange Coinsquare, for example, is highly focused on educating beyond the tech community to get more people interested in cryptocurrency investing. Mosoff, however, said that he wasn’t concerned with the unpredictable pricing.

“What I care about is developers and following those developers, and as long as they’re adding, building, getting excited by the technologies and protocols, then I want this as part of my portfolio,” he said. “I believe every investor should have a small portion, whether it’s half a percent or one percent. They need exposure to these technologies. It’s more than just a currency.”

Coolican was previously a director at investment banking group Cormark Securities, where he specialized in corporate finance and merger and acquisition advisory for various sectors including cleantech, industrial, and media. Coolican has also been an active investor in bitcoin, ether, and cryptocurrency projects.

“We have an exciting opportunity to become the central business and investment hub for the Ethereum ecosystem.”

As president and CFO, Coolican will also be responsible for sourcing and evaluating Ether Capital’s investment opportunities, as well as overseeing the firm’s finance, operations, and investor relations. Ether Capital said with Coolican’s appointment, the company will also begin to insource functions such as financial reporting, insurance and risk management matters, and certain organization compliance and administrative tasks.

“I’m eager to engage with current and prospective shareholders to raise awareness of Ether Capital,” said Coolican. “I have been involved in capital markets for my entire career and believe that Ether Capital presents investors with a unique and compelling opportunity to gain exposure to a whole new market through the Ethereum ecosystem.”

Ether Capital said Mosoff and Coolican will also join the company’s board of directors. Ether Capital was launched by several Canadian VC firms and technologies in January. At its launch, Ether Capital said it would launch a private placement co-led by CIBC Capital Markets and Cannacord with plans to raise $50 million. The firm’s strategy is to acquire Ether and make strategic acquisitions of controlling staes in Ethereum-based businesses.

“We’re thrilled to welcome Brian and Stefan to Ether Capital. We have an exciting opportunity to become the central business and investment hub for the Ethereum ecosystem, and their leadership, expertise, and experience will bolster the active management of the company to drive this vision,” said Seif, who is co-chief investment officer of Ether Capital. “Brian and Stefan bring proven expertise in both technology and capital markets to the Ether Capital team, and will complement the deep talent at the Board of Directors level.”

With files from Jessica Galang.

Photo via Ethereum Price.